fra93

New member

- Joined

- May 1, 2020

- Messages

- 6

- Reaction score

- 0

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

Interest on a debt is considered a tariff on the risk assessment that the debt would not be paid back. This concept would make sense if the interest on that debt is given back after it is repaid.

Inflation on currencies justifies the interest on debt, since the lender would always loose money. Interest on debt is the cause of money inflation. A chicken and egg paradox.

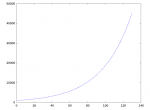

Central banks, the institutions in charge of money creation, give loans to banks that give loans to every other institutions. In this debt cycle, money inflation is exponential by design, if the inflation rate is low and constant, for example at 1% per year, than the next year would be at 1.1% with respect the original amount. Whatever small percentage is therefore theoretically and practically unsustainable, since economic growth can not be exponential forever.

To avoid the circle of debt refinanced by more debt, which leads to unsustainable money inflation, interest on debt should be illegal. Prices on goods are inflated and they will natural adjust if fewer institutions lend money.

There are banks that operate without interests on the debt ( Dubai Islamic Bank , Al-Rajhi Bank etc ).

On the topic of lending, if one person ( Alice ) needs money for a good investment, lets say a house that will probably go up in price, than institutions can pay for it, and Alice pays the rent until the price of the house is reached.

The property would stay in the hand of the financing institution, but managed by the Alice for an agreed upon time period. Furthermore, the contract could specify a buy-back option for Alice “a super discount on the property”, which allows her to get ownership of the property after the mandatory rental period, like an optional interest on the debt, with the difference that at that for Alice already repaid the property at that time, so she has no debt when this option is valid.

The proposed lending model pushes financing institutions to be responsible, and to evaluate more carefully the investments, which will lead to a slower and more sustainable growth.

Inflation on currencies justifies the interest on debt, since the lender would always loose money. Interest on debt is the cause of money inflation. A chicken and egg paradox.

Central banks, the institutions in charge of money creation, give loans to banks that give loans to every other institutions. In this debt cycle, money inflation is exponential by design, if the inflation rate is low and constant, for example at 1% per year, than the next year would be at 1.1% with respect the original amount. Whatever small percentage is therefore theoretically and practically unsustainable, since economic growth can not be exponential forever.

To avoid the circle of debt refinanced by more debt, which leads to unsustainable money inflation, interest on debt should be illegal. Prices on goods are inflated and they will natural adjust if fewer institutions lend money.

There are banks that operate without interests on the debt ( Dubai Islamic Bank , Al-Rajhi Bank etc ).

On the topic of lending, if one person ( Alice ) needs money for a good investment, lets say a house that will probably go up in price, than institutions can pay for it, and Alice pays the rent until the price of the house is reached.

The property would stay in the hand of the financing institution, but managed by the Alice for an agreed upon time period. Furthermore, the contract could specify a buy-back option for Alice “a super discount on the property”, which allows her to get ownership of the property after the mandatory rental period, like an optional interest on the debt, with the difference that at that for Alice already repaid the property at that time, so she has no debt when this option is valid.

The proposed lending model pushes financing institutions to be responsible, and to evaluate more carefully the investments, which will lead to a slower and more sustainable growth.