HumblePi

DP Veteran

- Joined

- Sep 3, 2018

- Messages

- 26,311

- Reaction score

- 18,835

- Gender

- Undisclosed

- Political Leaning

- Liberal

I thought Joe Biden gave a wonderful speech yesterday. At least it was a plan, a vision for where he wants to take this country after taking office. He's focusing on bringing back American manufacturing which will help bring back our economy. He spoke of reducing our reliance on foreign manufacturing and creating five million new jobs right here in the US. He talked about raising the minimum wage to $15 an hour across the board.

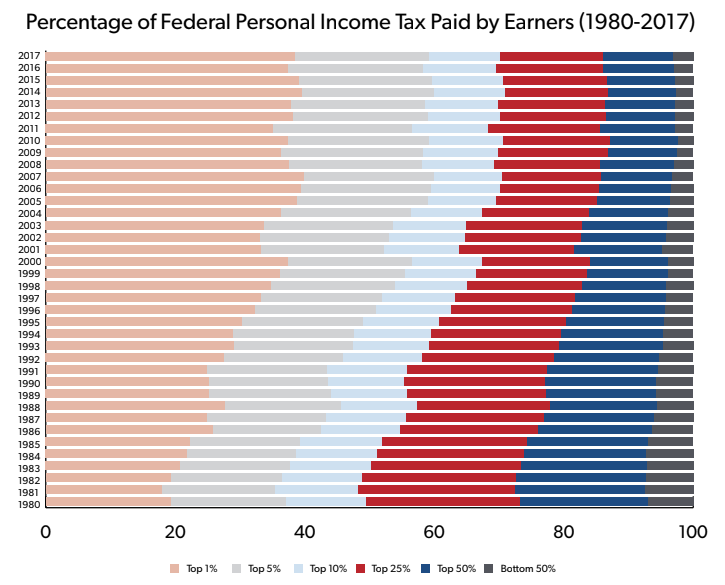

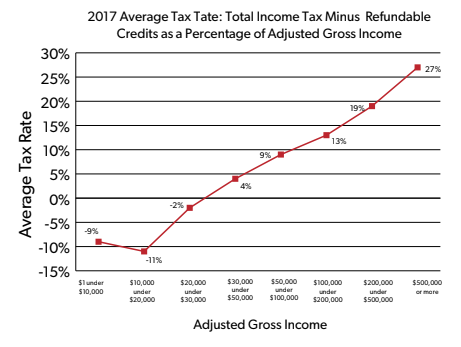

Joe Biden talked about investing in our crumbling infrastructure, which is decrepit, collapsing and in desperate need of reconstruction. And the most significant thing to me is that he will reverse the deep tax breaks that Trump gave to the super rich. That's a big deal.

Yes, Joe Biden said everything that I wanted to hear and it wasn't divisive rhetoric, it wasn't threats and it he did not promise unrealistic goals. Everything he talked of, is possible and within reach.

Joe Biden talked about investing in our crumbling infrastructure, which is decrepit, collapsing and in desperate need of reconstruction. And the most significant thing to me is that he will reverse the deep tax breaks that Trump gave to the super rich. That's a big deal.

Yes, Joe Biden said everything that I wanted to hear and it wasn't divisive rhetoric, it wasn't threats and it he did not promise unrealistic goals. Everything he talked of, is possible and within reach.