- Joined

- Mar 27, 2014

- Messages

- 63,563

- Reaction score

- 33,567

- Location

- Tennessee

- Gender

- Male

- Political Leaning

- Undisclosed

I've heard that argument before but i dont see how its true. A sales tax taxes disposable income and the rich have far more dispoable income than the poor.

Sent from my SM-G965U using Tapatalk

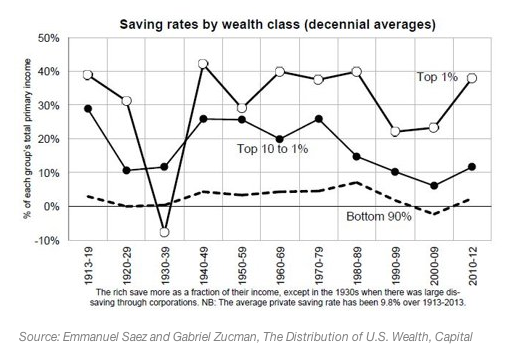

It's simple. The wealthy save a great deal of their income. Here's one calculation.

So the top 1% save 40% of their income on average. The top 1/10th of 1% might save 80-90% or higher. So do the math. If the consumption tax is 20%, and the bottom 90% spend all their income on average, they'll pay a tax equal to 20% of income. The top 1% will pay only 12% of income in taxes (60% of income is consumed X 20% = 12% of income). The top 1/10th of 1% perhaps only 2%-4% of income.