It's really not all that sarcastic. If people really want all this "free" stuff and want the federal government to pay for it all then tax rates are going to need to be exorbitant.

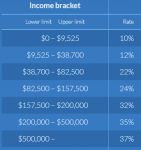

Right now the fedral government is spending roughly $4 Trillion per year. In 2017, the most recent year we have tax data for, total Adjusted Gross Income for all returns or all individuals reporting an AGI in excess of $75k was just under $8 Trillion. We'd need to take HALF of that just to cover

current spending. If we add free health care, free college, free child care, free reparations for slavery, free basic income and affordable housing for all that will tack AT LEAST another couple of Trillion dollars so you're talking about need for a 75% tax rate on every dollar of income in excess of $75k.

If you only want to hit up "the wealthy" you need to understand that aggregate AGI for all returns showing income in excess of $200k is only a little over $4 Trillion so if we took 100% of that it MIGHT cover current spending and would fall at least 50% short of proposed spending. This idea that we can do all kinds of "free" stuff and only tax the "very, very wealthy" is, to be kind, utter bull****.

Income information I used can be found here -

SOI Tax Stats - Individual Income Tax Returns Publication 1304 (Complete Report) | Internal Revenue Service