Many? How many? How many young people?

How many young people can be landlords is irrelevant. Efficient market requires many landlords, no matter what age. As for how many ...

in the United States there are

between 10 million and 11 million individual investor landlords managing an average of two units each, many with just one unit.

Do you own any roads or freeways?

Please don't be this dumb. Transportation budgets in family expenses include things like cars that you buy, gas you buy to put in them, maintenance on them, etc.

Landlords buy properties and then maintain them and rent them out.

So tenants who do their own maintenance get to live for free, right? Nope.

There is no rent-paying tenant out there who is going to get a new roof when it leaks.

Not with the amount that they're paying.

You first ask if "tenants who do their own maintenance" get to live for free and then accept there is no such thing. I accept your surrender.

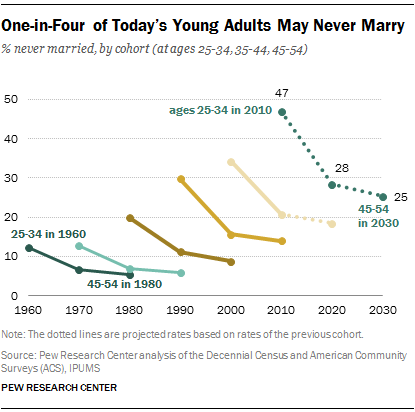

Certainly not! We have a declining household formation rate because of low pay. We have more women working because of low pay. These factors both would give an apparent rise in household income while wages are falling. Looking at household formation is misleading because of these factors.

Sorry, math and facts clearly contradict you.

First, as already stated, only 15% live with their parents. So, 85% of millennial are forming households just fine, thank you very much. Not only that, this does not differ much from prior generation (X) when 90% were forming households.

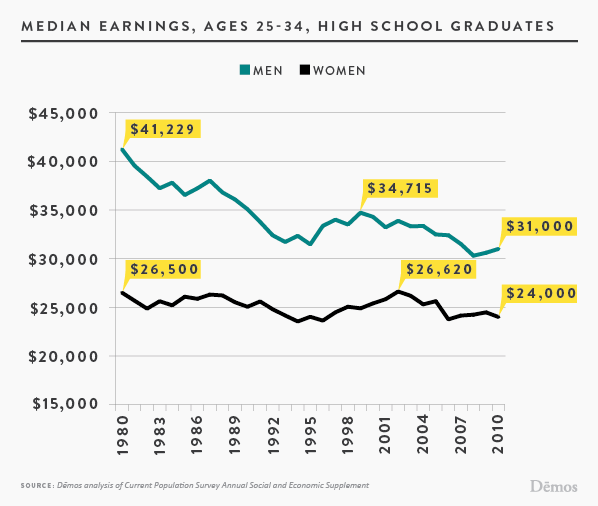

Second, your 25k number,

which you never provided any proof for is not relevant if household income is 69k. Yes, I get your point about 2 incomes now provide instead of 1.

- That's true of

44% of cases only.

More than half (56%) of the millennial households have 1 earner.

- You are implying that the fact that both adults must work in order to comfortably afford the rent is somehow terrible. Welcome to the rest of the world.

That's the case for most of the world.

- Finally, your numbers are off again. Even in 2-people households, normally 1 person earns more than another. So your 25k number is likely around 45-50k in fact for 1 of the earners. So,

the appropriate rent you should be looking for (FOR A SINGLE EARNER) would be closer to $1300, not $650 as you had claimed.

Going from 10 to 15 is a 50% rise.

Nice try. I can play the same game. Going from 90% (number of Gen X households) to 85% (number of millennial households) is only 5.6% drop in household formation from Gen X to Millennial.

... look at the article which details this record high millennial household income ...

You misrepresented what the article said in your quotes... Your first paragraph was "The gain was also “driven by increased employment, rather than increased pay."". You forgot to mention that this was referring just to 2017 gain specifically - 1 year! That's NOT what we are talking about. Sure, during that 1 year people had more jobs at roughly same pay. Who cares.

Your second paragraph is an argument AGAINST your position actually. It confirms that paychecks have

the same purchasing power it did 40 years ago. Despite the second part of the paragraph, what this ACTUALLY means is that you can afford SAME kind of stuff as before.

Having said all this, I will give you partial credit: it IS true that

in less than 44% of cases (how much less? depends on number of women working in the past), women now earn more than before but households still have same purchasing power; and so, in that sense life has become more expensive. However, housing is just one SMALL piece of it. Cost of living has risen for the poor across ALL categories. Your harping on housing specifically is meaningless. As I said before, according to

this and

this, since 1900's, percentage of income people spent on housing did not increase by all that much over the past 120 years. It used to be around 23%-27% and now around 33%.