- Joined

- Apr 18, 2013

- Messages

- 94,313

- Reaction score

- 82,703

- Location

- Barsoom

- Gender

- Male

- Political Leaning

- Independent

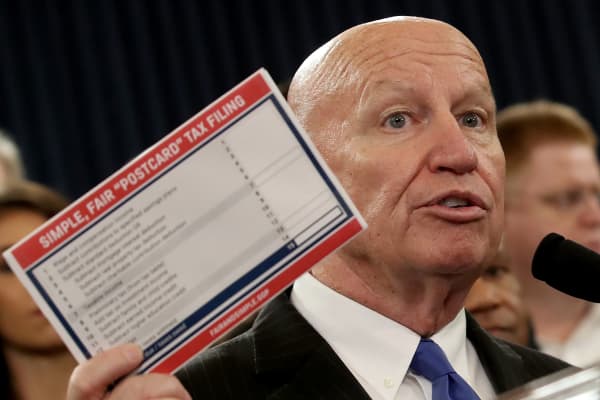

Here’s the incredibly unpopular GOP tax reform plan — in one graph

In short, the GOP is pushing to pass a tax-reform bill in 2017 that is far less popular than the Obamacare (ACA) bill when it passed in 2009.

IMHO, the GOP will pay a steep price for such arrogance and wealth-bias in 2018/2020.

By John Sides

November 18

A Republican tax plan has passed the House, but obstacles remain in the Senate. One of those obstacles: The plan appears to be not just unpopular, but also distinctively — almost historically — unpopular. My fellow George Washington University political scientist Chris Warshaw compiled public polls capturing support for major legislation dating back almost 30 years. Here’s what he found:

On average, only about 30 percent of Americans support the tax plan. This is lower than support for almost any of these legislative initiatives. The only thing that was less popular was … the Republican health-care bill that was intended to replace the Affordable Care Act. We know how that turned out. Majorities of Americas believe that the GOP tax plan will not give them a tax cut or increase economic growth, but it will benefit the rich. Of course, perhaps the GOP can thread the needle and pass a bill with a bare majority of support in the Senate. There’s nothing that says public opinion has to carry the day.

But, as with the effort to repeal the Affordable Care Act, Republicans in Congress are making it hard for themselves. After the passage of the Affordable Care Act, several other political scientists and I found that Democrats in competitive districts who supported the ACA were punished in the 2014 elections — losing almost six points of vote share compared to similar Democrats who opposed the ACA. And the ACA was actually more popular in 2009 than is the Republican tax reform plan now. Does this mean that pushing unpopular bills will lead to a similar fate for Republicans in 2018? We certainly don’t know. But we’re about to test the hypothesis that you can buck public opinion only for so long.

In short, the GOP is pushing to pass a tax-reform bill in 2017 that is far less popular than the Obamacare (ACA) bill when it passed in 2009.

IMHO, the GOP will pay a steep price for such arrogance and wealth-bias in 2018/2020.