Demand for labor is decreasing. That is a bigger issue than regulations.

While I'm not positive that is correct in net terms, the two are interconnected - regulatory costs decrease demand for labor.

Labor is emotional, so take it out and apply it to a different service, that you purchase: haircuts. You get your hair cut every two weeks, because you like to look sharp, and it's only $10 a pop at your local place. A regulatory burden on the industry then forces everyone to raise their prices, and now it is $20 a pop. You decide that you can get your hair cut every three weeks instead (a 33% reduction in demand), and perhaps look a little raggety at the end, but not enough to really make it an issue.

Would it make any sense whatsoever to say "well, it's not the regulation, it's the decrease in demand!". Of course not - the regulation is causing the decrease in demand by increasing costs.

That is the basic law of economics. The rational goal of business is inherently to maximize profit while minimizing overhead. It is a common saying that businesses aren't charities. Is it not?

Businesses aren't charities - that is correct. Their purpose is to deliver goods and services in such a way that allows them to create profit. But you are missing what I'm telling you: human capital includes knowledge, knowledge which has to be built over time and effort, and which is valuable to employers because it improves quantity and quality of production. If a business therefore wants to competitively sell goods and services in such a way as to make a profit in a marketplace where other entities are seeking to take their market share, then it wants to attract the best possible human capital.

They stay because they don't know any better.

:lol: on the contrary - masters' degrees are common, and we know exactly what we could get elsewhere, and where we could go. People accept slower promotion (or even no-promotion) and slower wage-growth because they want to stay here.

Automation has grown apace even when regulations and wages were rock bottom.

Automation is an alternative to labor, but it's often expensive. Automation therefore becomes more profitable the more you increase the cost of labor relative to it.

To put it simply:

Let's say I can hire 10 workers at a total labor cost of $1,000,000 a year to run my small business. I could purchase 2 machines, which would allow me to get rid of my 4 lowest income workers (total cost: 225,000), but the machines cost $1 million a piece, and are good for 8 years (annualized costs, $250,000). It would be stupid to invest in machines, because they are more expensive than labor. My demand is (10) workers and (0) machines.

Then, regulatory burdens increase my cost of labor. Now those 4 low income workers cost $275,000/year. Machines are now cheaper than labor, whereas before they were not. Now my demand is for (6) workers and (2) machines.

during the Gilded Age there were no regulations. Wages were also rock bottom. This is a fact of history.

:lol: Wages during the Industrial Age shot up, as did GDP per capita, in ways never before seen in human history. You are making the fallacy of comparing wages in the Industrial Era to

today, instead of comparing them to

subsistence farming, which was the previous experience for most of the population.

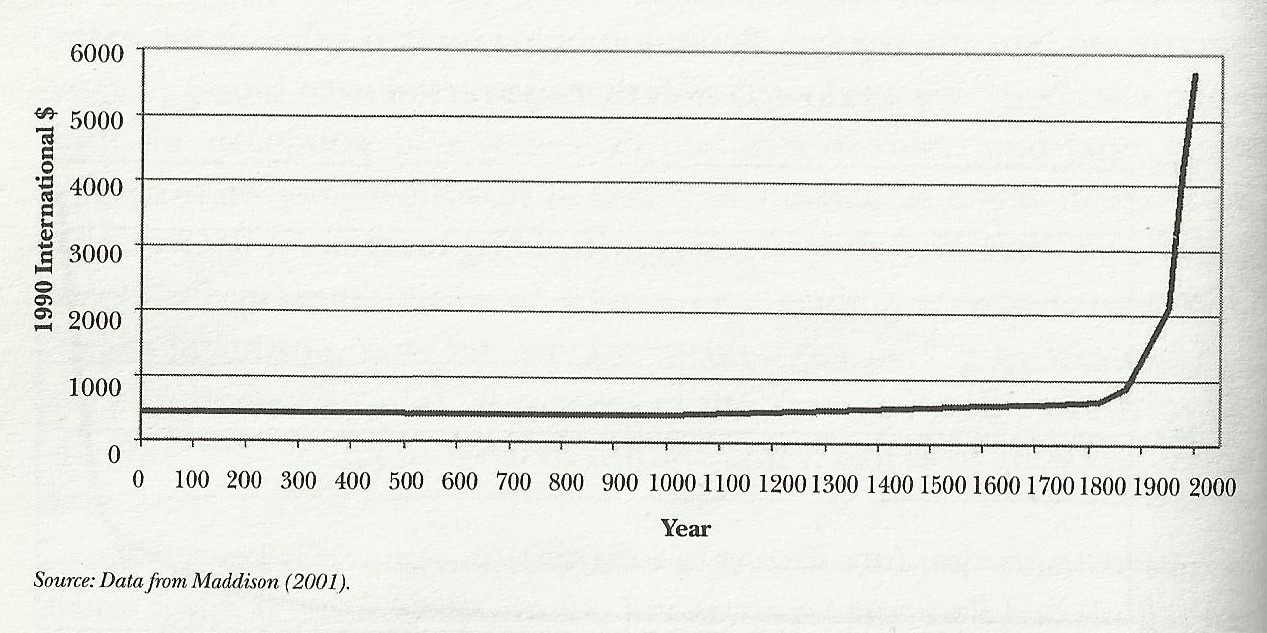

Global Average Per Capita Income:

Ye Olde

Wikipedia:

...The Gilded Age was an era of rapid economic growth, especially in the North and West. As American wages were much higher than those in Europe, especially for skilled workers, the period saw an influx of millions of European immigrants. The rapid expansion of industrialization led to real wage growth of 60% between 1860 and 1890..

There's good reason why people left the farms to move to the factories in America in the early 20th Century, and in China today. It's because it's a better life for them.

Automation was a big thing back then - which is why the Luddites happened.

Yeah, and they, and all the Malthusians who followed since have been demonstrated to be repeatedly wrong.

Perhaps you don't understand what a "straw man" means?

It's when someone attempts to project an argument onto you that you did not make, and proceeds to attack that argument. For example, I never argued we should have no regulations, only that regulatory burdens can increase the price of labor, which reduces demand for labor, but you then started spouting off about there being "no regulation" in the Gilded Age

They use the term "household income" to cover that.

On the contrary, household income is precisely what I am talking about - the article you cited stuck with wages, which are individual workers.