Etallium

Member

- Joined

- Oct 25, 2019

- Messages

- 78

- Reaction score

- 33

- Gender

- Male

- Political Leaning

- Independent

While reading through the thread about Circular Flow of Income theory I saw confusion that I think could have been prevented by better understanding of stock-flow modeling. I will put some links at the bottom of this post, but will try to summarize briefly.

Firstly, as the name implies, we need to make a clear distinction between stocks and flows.

These two things impact each other, but are not the same thing.

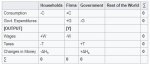

The second thing we need to consider is double entry book-keeping as used in accounting. Since macro-economics describes a closed system, all flows must net to zero between parties. That is to say, for every credit there must be a debit and vice versa. By keeping track of the flows in this manner, we can better understand the corresponding changes in the stocks. Below is an example from wikipedia that shows a simple GDP model in stock-flow consistent format with 4 sectors.

This type of models offer several advantages. From Wikipedia:

I'd like to know your thoughts on the applicability of this form of model.

Wikipedia entry on Stock-Flow consistent models

YouTube lecture on Stock Flow models by Atoine Godin (approx. 1 hour)

Firstly, as the name implies, we need to make a clear distinction between stocks and flows.

- Stocks describe an amount at a certain point in time. For example, how much money is in your bank account right now. Or, how much was in your bank account last Thursday at 3:35pm.

- Flows on the other hand describe how those stocks change over a certain period of time. If you have $1,000 right now and had $700 a week ago, then your balanced increased by $300.

These two things impact each other, but are not the same thing.

The second thing we need to consider is double entry book-keeping as used in accounting. Since macro-economics describes a closed system, all flows must net to zero between parties. That is to say, for every credit there must be a debit and vice versa. By keeping track of the flows in this manner, we can better understand the corresponding changes in the stocks. Below is an example from wikipedia that shows a simple GDP model in stock-flow consistent format with 4 sectors.

This type of models offer several advantages. From Wikipedia:

...allows for a consistent integration of the real and the financial side of the economy...

...can be used to identify unsustainable processes, for example a prolonged deficit of a sector will result in an unsustainable stock of debt...

...the consistent accounting framework prevents the modelers from leaving "black holes" i.e., unexplained parts of the model.

I'd like to know your thoughts on the applicability of this form of model.

Wikipedia entry on Stock-Flow consistent models

YouTube lecture on Stock Flow models by Atoine Godin (approx. 1 hour)