- Joined

- Dec 13, 2015

- Messages

- 9,594

- Reaction score

- 2,072

- Location

- France

- Gender

- Male

- Political Leaning

- Centrist

Republicans are all about Capitalism and Capitalism is all about greed to the max.

Whilst I agree with much of your argument contained in the above post, I must disagree with quoted portion.

Capitalism is a mechanism which has means and a purpose. Like a hammer is employed to drive a nail in wood.

It is the USE of capitalism that is all wrong in America. And that comes from an exceptional accent/focus on the accumulation of riches.

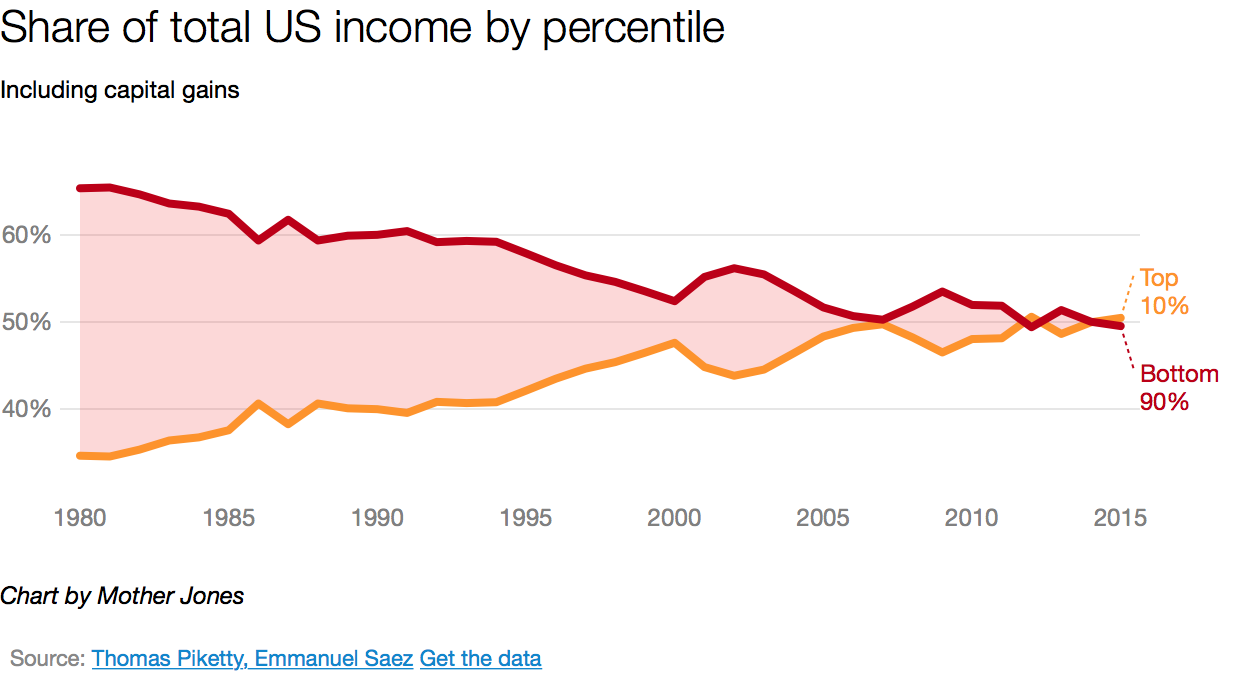

So, if we want to blame anybody, let's blame Ronald Reagan (and before him both LBJ and JFK). These are the real culprits as regards Income Disparity in America today, directly attributable to the lack of sufficient upper-income taxation. Just one look at the historic upper-income taxation rates tells the true story since the 1960s:

Each one of those dips in upper-income taxation coincides with the administration of JFK/LBJ or Reckless Ronnie!

So rather than palavering about "Who did what to whom", why not just go back to pre-1960 when our little world was just fine under the high, almost confiscatory taxation of mindlessly to high upper-incomes!!?!!