- Joined

- Jun 3, 2009

- Messages

- 30,870

- Reaction score

- 4,246

- Gender

- Male

- Political Leaning

- Very Conservative

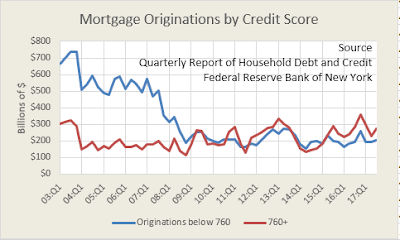

I found this chart recently and found it fascinating. It looks at mortgage originations by credit score over time:

In the past we had far more mortgages given to those with credit scores below 760. Why is this important? It means that those of modest means and modest income aren't getting mortgages. Now, you may say that's great, as there will be far fewer foreclosures. And that is true, but it leads to a problem: only the very well off can afford mortgages. And what does that do?

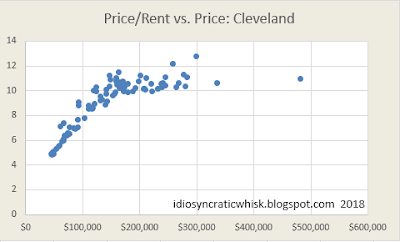

Let's look at a city that has lots of low cost properties. Take a look at the ratio of home prices to prevailing rents:

There's something funny going on there with lower priced homes. Prices are only 4-8x the rent, while they are between 10-12x the rent for higher priced properties. Given that a ratio of 4-8x means that those homes are a steal, why aren't renters simply buying the properties?

The problem is that they cannot. With Dodd-Frank regulations and the CFPB, mortgages to people who would be buying these homes (low income, low credit score) are effectively banned. Now understand that this happens for a reason, these loans are more likely to fail and those who take out the mortgages more likely to declare bankruptcy, so there is a good side to this. Additionally, funding these types of loans becomes expensive because of the income verification and other regulations that have to be complied with. But what's the downside? The only people who can buy these properties are those who qualify, those who have enough money to simply buy them. This is effectively cutting out competition for landlords. They can buy homes for cheap and rent them out for relatively high rents.

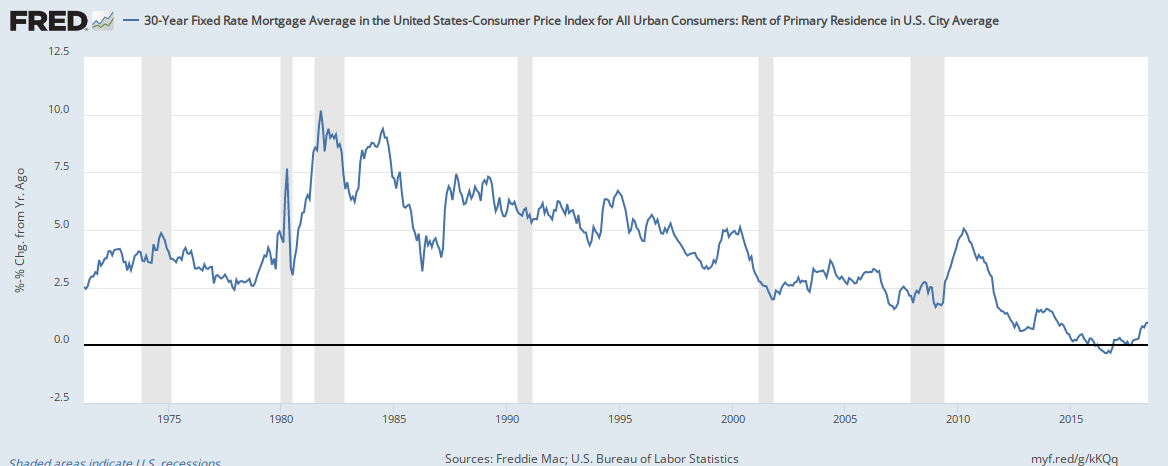

And this is really the source of much of the rental affordability problem. Look at rental affordability over time:

Something broke in 2010, and this is it. Dodd-Frank was instituted, and landlords were shielded from competition.

Now understand, I'm not necessarily against this, but there is a problem right now. Real interest rates are very cheap relative to inflation, and so landlords can essentially buy these homes for free with the way rental inflation is happening. The poor are stuck with paying these rents because they have no way of buying the properties, and so the rent/income ratios balloon.

So what is the solution? To me, I see only two possibilities: either we repeal Dodd-Frank and allow banks to again make these risky loans, or we try to get interest rates higher so that it isn't as cheap for landlords to buy up property (additionally we could eliminate things like mortgage interest deductions and landlord tax breaks). The former will make home prices rise, while the latter will make home prices decrease. I prefer the second, but is it politically possible? I'm not sure.

Either way, the current setup isn't working, and it needs a drastic change.

If you want to read a more in depth analysis from someone who thinks credit ought to be expanded, take a look here:

https://idiosyncraticwhisk.blogspot.com/2018/04/housing-part-293-how-has-dodd-frank.html

In the past we had far more mortgages given to those with credit scores below 760. Why is this important? It means that those of modest means and modest income aren't getting mortgages. Now, you may say that's great, as there will be far fewer foreclosures. And that is true, but it leads to a problem: only the very well off can afford mortgages. And what does that do?

Let's look at a city that has lots of low cost properties. Take a look at the ratio of home prices to prevailing rents:

There's something funny going on there with lower priced homes. Prices are only 4-8x the rent, while they are between 10-12x the rent for higher priced properties. Given that a ratio of 4-8x means that those homes are a steal, why aren't renters simply buying the properties?

The problem is that they cannot. With Dodd-Frank regulations and the CFPB, mortgages to people who would be buying these homes (low income, low credit score) are effectively banned. Now understand that this happens for a reason, these loans are more likely to fail and those who take out the mortgages more likely to declare bankruptcy, so there is a good side to this. Additionally, funding these types of loans becomes expensive because of the income verification and other regulations that have to be complied with. But what's the downside? The only people who can buy these properties are those who qualify, those who have enough money to simply buy them. This is effectively cutting out competition for landlords. They can buy homes for cheap and rent them out for relatively high rents.

And this is really the source of much of the rental affordability problem. Look at rental affordability over time:

Something broke in 2010, and this is it. Dodd-Frank was instituted, and landlords were shielded from competition.

Now understand, I'm not necessarily against this, but there is a problem right now. Real interest rates are very cheap relative to inflation, and so landlords can essentially buy these homes for free with the way rental inflation is happening. The poor are stuck with paying these rents because they have no way of buying the properties, and so the rent/income ratios balloon.

So what is the solution? To me, I see only two possibilities: either we repeal Dodd-Frank and allow banks to again make these risky loans, or we try to get interest rates higher so that it isn't as cheap for landlords to buy up property (additionally we could eliminate things like mortgage interest deductions and landlord tax breaks). The former will make home prices rise, while the latter will make home prices decrease. I prefer the second, but is it politically possible? I'm not sure.

Either way, the current setup isn't working, and it needs a drastic change.

If you want to read a more in depth analysis from someone who thinks credit ought to be expanded, take a look here:

https://idiosyncraticwhisk.blogspot.com/2018/04/housing-part-293-how-has-dodd-frank.html