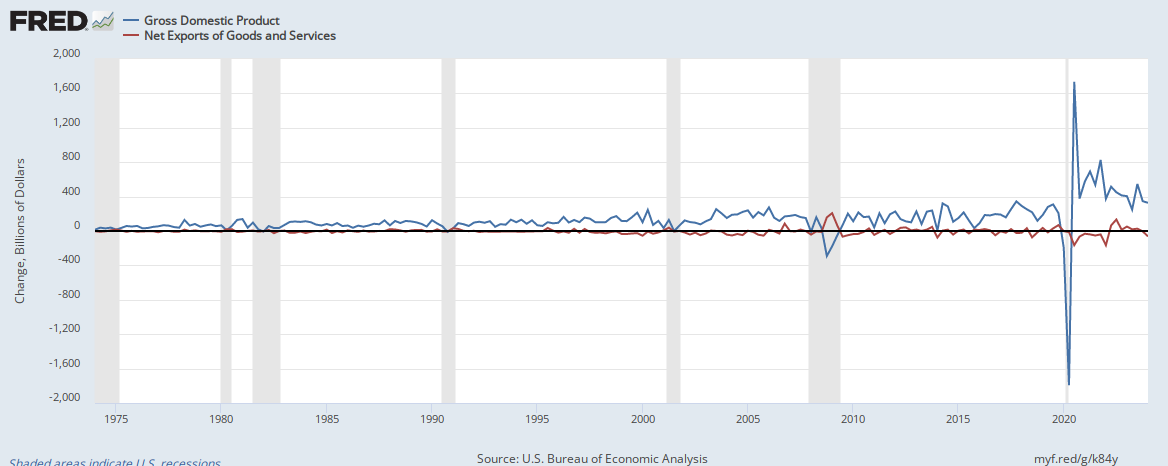

Xelor, balance of trade is a direct factor within the expenditure method for calculating at GDP formula. Trade surpluses contribute, and trade deficits reduce the resulting calculated GDP amount. That's in recognition

of trade balances' effects upon their nation's GDP.

The expenditure method is the conventional method employed world-wide. Any other method to calculate GDP, would need to directly or indirectly reflect the nation's balance of trade in a similar fashion.

I direct your attention to these words of your linked reference to “Trade Deficits: Causes and Consequences”,

https://www.dallasfed.org/~/media/documents/research/er/1996/er9604b.pdf

“… Certainly, anyone can create a theory about trade deficits and speculate about how they may, or may not, be related to a nation’s economic performance. The paramount question is not whether one can create a theory, but whether it is logically consistent and stands up to empirical observation. …”.

////////

It is logically inconsistent or the Federal Reserve Bank of Dallas to publish a paper questioning the trade balances effects upon GDP they accept as true and derived from a formula that reflects those trade balances' effects.

Respectfully, Supposn