https://en.wikipedia.org/wiki/Circular_flow_of_income

GDP = demand. In a $17 trillion economy, the production is $17 trillion, and the national income is $17 trillion. That is our base income, which is

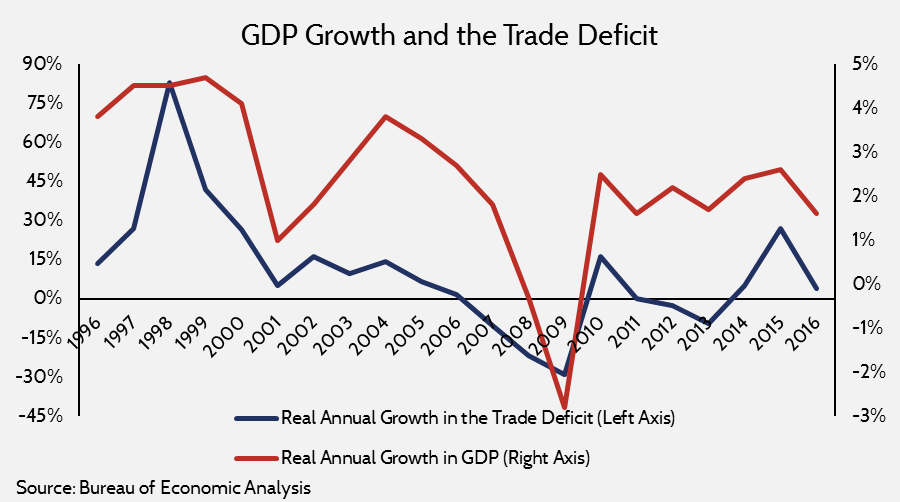

potential demand. From that, you have demand leakages and injections. Trade deficits and savings are demand leakages. Deficit spending and increased credit are injections. If injections > leakages, demand grows. So for the next year, you not only have $17 trillion of income, you also have an increase in income due to increased credit, increased investment (which pays labor), and deficit spending. For example, those additions might give you a national income of $19 trillion in the next year; minus savings of $1 trillion, minus a trade deficit of $0.5 trillion, which gives you a GDP of $17.5 trillion in that year, for a bit of growth.

So C can (and does) rise with increased credit. I can (and does) rise with increased credit. G obviously changes from year to year, but is almost always an addition to demand. And NX is almost always negative. But they are largely independent of each other. NX is not determinative of C or I or G.