- Joined

- Dec 3, 2017

- Messages

- 26,290

- Reaction score

- 16,771

- Gender

- Male

- Political Leaning

- Progressive

https://www.google.com/search?rlz=1.....9.8.647.0..0j0i131k1j0i10k1.113.qx7sfgjVY8Y

Dow down 528 points.

Dow down 528 points.

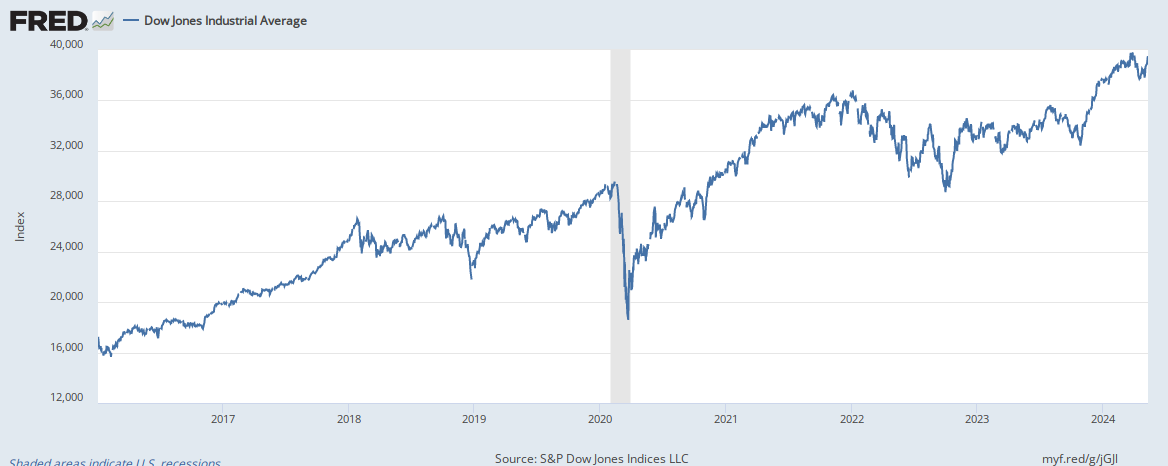

The DOW has yet to recover from its slide that began in late January. We're four months into this now.

It's up for the year!

Not a good data set. There is is a remarkably clear point in time when the DOW shifted from steady growth to variable decline. A reasonable interpretation of the data must split the data at that point.

It's up for the year!

Yea I know because it went up for the year!! Sigh.............. Let take the data set for just today and you can say it's down. :lamo

It's up for the year!

The Dow is now officially no better than if we had continued the same upward trend under Obama for the year 2016.

Are you people in the market?

Do you own equities?

Or is this just a bash thread on markets moving up and down?

If a serious thread on equities, we can talk. I can point to a number of overpriced ones to sell if you own. And underpriced o es to buy....

If not, see ya....

Nobody is required to hold a prerequisite number of shares set by you before they're allowed to participate in this thread.

I've been investigating in stocks since I was 26 and have usually beaten the S&P 500 trading in and out. I must admit, I missed the 2017 rally for my mutual funds because I couldn't see how a 2-3% gain in GDP translates into a 20-25% increase in the value of stocks. (I still held AAPL and did well.) I was wrong during that period but think this is now a seller's market. As I write this (10:25AM est 5/3/2018), the DOW is off -273.95-1.15% at, 23,651.03. I've been sounding the sell signal to friends since DOW 26,000.That isn’t what I said is it

Is this a real thread to talk about equities?

Or a bash thread

One would make an interesting conversation....the other, not interested

I've been investigating in stocks since I was 26 and have usually beaten the S&P 500 trading in and out. I must admit, I missed the 2017 rally for my mutual funds because I couldn't see how a 2-3% gain in GDP translates into a 20-25% increase in the value of stocks. (I still held AAPL and did well.) I was wrong during that period but think this is now a seller's market. As I write this (10:25AM est 5/3/2018), the DOW is off -273.95-1.15% at, 23,651.03. I've been sounding the sell signal to friends since DOW 26,000.

My view is that the combination of expected inflation; future Fed rate hikes; people in charge (see: Kevin Hassett DOW 36,000) who have no appreciation about trade or anything else) is bearish for stocks. Add to that the risk of corporate debt, which has risen to record highs.