- Joined

- Dec 13, 2015

- Messages

- 9,594

- Reaction score

- 2,072

- Location

- France

- Gender

- Male

- Political Leaning

- Centrist

ECONOMIC FAIRNESS

The single most common thread throughout the history of mankind is its evolution in terms of societal “fairness”. But neither are you or I a Roman slave, nor a medieval serf, nor an indentured servant in the 16th/17th century, nor a black slave in the 18th/19th century America.

We are (supposedly) “free”. But are we? Perhaps in name only?

What has happened recently in the US (called the Great Recession) is a repeat of the Roaring Twenties and the subsequent stock-market crash. Why’s that?

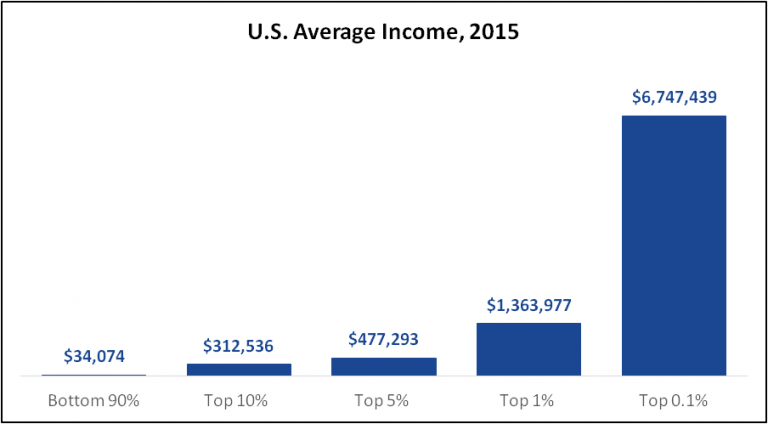

Because there was/is too much money in the hands of too few people. The 1Percenters as a class have a net worth of close to 2 trillion dollars. Which indicates that something is dangerously wrong with our system of taxation that so much should be concentrated and owned by so few.

There's an “horrendous” amount of money, that trickles upwards to become Wealth; and then back down dynastically to inheritors who did not earn a penny of it. The result is the perpetuation of Income Disparity.

A HISTORY OF INCOME-TAX UNFAIRNESS IN AMERICA

Taxation history is the obvious culprit:

*Historical info-graphic of US tax-rates:

Moreover:

*Note how taxation was uniformly very high except in two periods, one that coincides with the Stock Market crash in 1929 and the other more recently in the 1980s. Who was PotUS in the 1980s? (Reckless Ronnie)

*LBJ (of all people) in the early 1960s brought upper-income tax rates down for the level of income at which excessive revenues accumulate to select groups. Reckless Ronnie (in the 1980s) and Replicant Donald Dork have completed the hatchet-job bringing them down to the ridiculous level of 20/25%.

*This reduction in upper-level taxation is the single most factor producing the Trickle-Up Economy in which Americans now live. It leads directly to the fact that there has been a massive redistribution of income upwards; but also, since income becomes wealth, also a great redistribution of riches.

*The Paris School of Economics at their web-site (here: World Income Database) shows the evolution of Income Share by householder percentile. If you reduce the numbers, the decade-by-decade evolution of the US “10Percenter Class” looks like this:

1960 – 33.8%

1970 – 31.5%

1980 – 32.9%

1990 – 38.8%

2000 – 43.1%

2010 – 46.3%

2015 – 50.5%

(Note how the percentage changes from 1980 onwards. Who was PotUS during the 1980s? Reckless Ronnie!)

MY POINT?

*Our seemingly consummate desire for get-rich-quick Wealth is a corrosive sociological factor eating away at the moral fabric of the country. It leads to the sort of economic catastrophe such as the Toxic Waste Mess and the subsequent Great Recession – created by a mindless frenzy to earn a lot of money quickly by fraudulent means.

*Which has done great harm to ordinary people - and from which we have yet to see the light at the end of the tunnel. Because the unfortunate consequence is to incarcerate 15% of the American households below the Poverty Threshold. That’s nearly 50 million American men, women and children …

Q E D.?

The single most common thread throughout the history of mankind is its evolution in terms of societal “fairness”. But neither are you or I a Roman slave, nor a medieval serf, nor an indentured servant in the 16th/17th century, nor a black slave in the 18th/19th century America.

We are (supposedly) “free”. But are we? Perhaps in name only?

What has happened recently in the US (called the Great Recession) is a repeat of the Roaring Twenties and the subsequent stock-market crash. Why’s that?

Because there was/is too much money in the hands of too few people. The 1Percenters as a class have a net worth of close to 2 trillion dollars. Which indicates that something is dangerously wrong with our system of taxation that so much should be concentrated and owned by so few.

There's an “horrendous” amount of money, that trickles upwards to become Wealth; and then back down dynastically to inheritors who did not earn a penny of it. The result is the perpetuation of Income Disparity.

A HISTORY OF INCOME-TAX UNFAIRNESS IN AMERICA

Taxation history is the obvious culprit:

*Historical info-graphic of US tax-rates:

Moreover:

*Note how taxation was uniformly very high except in two periods, one that coincides with the Stock Market crash in 1929 and the other more recently in the 1980s. Who was PotUS in the 1980s? (Reckless Ronnie)

*LBJ (of all people) in the early 1960s brought upper-income tax rates down for the level of income at which excessive revenues accumulate to select groups. Reckless Ronnie (in the 1980s) and Replicant Donald Dork have completed the hatchet-job bringing them down to the ridiculous level of 20/25%.

*This reduction in upper-level taxation is the single most factor producing the Trickle-Up Economy in which Americans now live. It leads directly to the fact that there has been a massive redistribution of income upwards; but also, since income becomes wealth, also a great redistribution of riches.

*The Paris School of Economics at their web-site (here: World Income Database) shows the evolution of Income Share by householder percentile. If you reduce the numbers, the decade-by-decade evolution of the US “10Percenter Class” looks like this:

1960 – 33.8%

1970 – 31.5%

1980 – 32.9%

1990 – 38.8%

2000 – 43.1%

2010 – 46.3%

2015 – 50.5%

(Note how the percentage changes from 1980 onwards. Who was PotUS during the 1980s? Reckless Ronnie!)

MY POINT?

*Our seemingly consummate desire for get-rich-quick Wealth is a corrosive sociological factor eating away at the moral fabric of the country. It leads to the sort of economic catastrophe such as the Toxic Waste Mess and the subsequent Great Recession – created by a mindless frenzy to earn a lot of money quickly by fraudulent means.

*Which has done great harm to ordinary people - and from which we have yet to see the light at the end of the tunnel. Because the unfortunate consequence is to incarcerate 15% of the American households below the Poverty Threshold. That’s nearly 50 million American men, women and children …

Q E D.?