- Joined

- Dec 13, 2015

- Messages

- 9,594

- Reaction score

- 2,072

- Location

- France

- Gender

- Male

- Political Leaning

- Centrist

From here: Blue-collar wages are surging. Can it last?

Excerpt:

No doubt about it - the fix is "in". And Donald Dork can't take the credit.

The US economy began to fix itself in 2014, well after the Replicants took control of the HoR and stymied all further stimulus-spending in 2010. (So, Barack was left to steer the economic ship with no tailwind.)

Economies do that. Consumers get board with hoarding and saving, so human nature takes the lead. People go out and shop-till-they-drop.

Can it last forever? Nope, but at least another couple of years. At the end of which, growth will once again stagnate and the unemployment rate will inch upward. Not all that much, but nonetheless somewhat.

In such circumstances, the first workers to go are those most easily laid-off at the bottom rungs of the ladder. And those are NOT the ones running Artificial Intelligence machines doing the production work that humans were doing up till 2008.

Which was when the New Era (called "Information Age") finally showed its best and its worst. The latter being massive layoffs that were prompted by the Great Recession. The former being that companies had a damn good reason (recession) to lay-off workers and install massively smart-machines to do the same jobs. Those running the highly complex production configuration from a computer screen are earning damn fine salaries.

What does that mean for Joe/Jane Bloggs looking for a job? It means they'd better go get some new education-credentials rather waiting for the "old-jobs" to come back. Whyzzat?

SERVICES INDUSTRIES

The old jobs are gone for good. We are no longer a predominantly Manufacturing Country. We have become a Services Country. How's that?

Read here: DEFINITION OF THE SERVICE INDUSTRY - excerpt:

Some examples cited:

Some agricultural services (including landscaping and horticulture)

Hotels and other places of lodging

Personal services (including dry cleaning, tax preparation, and hair cutting)

Business services (including temporary agencies and business software developers)

Automotive services

Miscellaneous repairs

Motion pictures

Amusements and recreation

Etc., etc., etc.

One benefit of the change is that these jobs tend to be better paying (if one climbs the ladder) than in manufacturing. Time will tell if enough Yanks will go back to school and obtain the necessary credentials.

Or will these jobs go to "furriners" from poorer-countries who nonetheless went to post-secondary schooling to obtain the necessary diplomas because it was free, gratis and for nothing ...

Excerpt:

IF THERE was a defining economic problem for America as it recovered from the financial crisis, it was stagnant wages. In the five years following the end of the recession in June 2009 wages and salaries rose by only 8.7%, while prices increased by 9.5%. In 2014 the median worker’s inflation-adjusted earnings, by one measure, were no higher than they were in 2000. It is commonly said that wage stagnation contributed to an economic anxiety in middle America that carried Donald Trump into the White House.

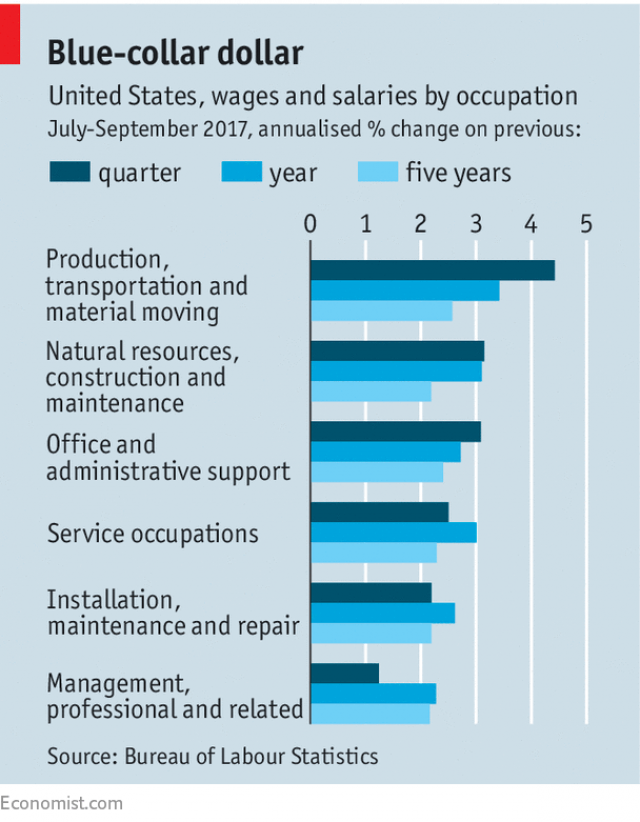

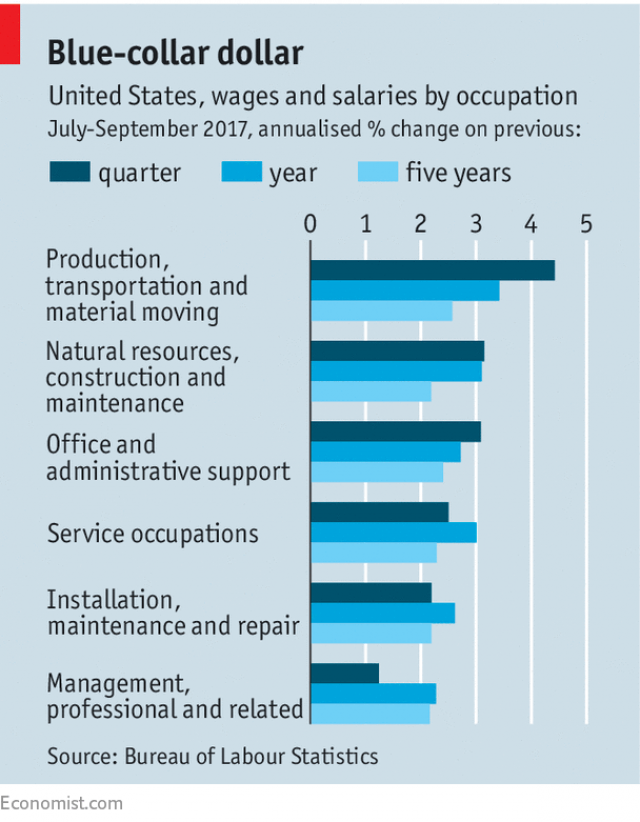

Yet Mr Trump’s rise seems to have coincided with a turnaround in fortunes for the middle class. In 2015 median household income, adjusted for inflation, rose by 5.2%; in 2016 it was up by another 3.2%. During those two years, poorer households gained more, on average, than richer ones. The latest development—one that will be of particular interest to Mr Trump—is that blue-collar wages have begun to rocket. In the year to the third quarter, wage and salary growth for the likes of factory workers, builders and drivers easily outstripped that for professionals and managers. In some cases, blue-collar pay growth now exceeds 4% (see chart).

No doubt about it - the fix is "in". And Donald Dork can't take the credit.

The US economy began to fix itself in 2014, well after the Replicants took control of the HoR and stymied all further stimulus-spending in 2010. (So, Barack was left to steer the economic ship with no tailwind.)

Economies do that. Consumers get board with hoarding and saving, so human nature takes the lead. People go out and shop-till-they-drop.

Can it last forever? Nope, but at least another couple of years. At the end of which, growth will once again stagnate and the unemployment rate will inch upward. Not all that much, but nonetheless somewhat.

In such circumstances, the first workers to go are those most easily laid-off at the bottom rungs of the ladder. And those are NOT the ones running Artificial Intelligence machines doing the production work that humans were doing up till 2008.

Which was when the New Era (called "Information Age") finally showed its best and its worst. The latter being massive layoffs that were prompted by the Great Recession. The former being that companies had a damn good reason (recession) to lay-off workers and install massively smart-machines to do the same jobs. Those running the highly complex production configuration from a computer screen are earning damn fine salaries.

What does that mean for Joe/Jane Bloggs looking for a job? It means they'd better go get some new education-credentials rather waiting for the "old-jobs" to come back. Whyzzat?

SERVICES INDUSTRIES

The old jobs are gone for good. We are no longer a predominantly Manufacturing Country. We have become a Services Country. How's that?

Read here: DEFINITION OF THE SERVICE INDUSTRY - excerpt:

The goods-producing sector includes agriculture, forestry, and fishing; mining; construction; and manufacturing. The service-producing sector includes the divisions of (1) transportation, communications, and utilities; (2)wholesale trade; (3) retail trade; (4) finance, insurance, and real estate; (5) public administration; and (6) services. This sixth group—the services division—includes a number of industries

Some examples cited:

Some agricultural services (including landscaping and horticulture)

Hotels and other places of lodging

Personal services (including dry cleaning, tax preparation, and hair cutting)

Business services (including temporary agencies and business software developers)

Automotive services

Miscellaneous repairs

Motion pictures

Amusements and recreation

Etc., etc., etc.

One benefit of the change is that these jobs tend to be better paying (if one climbs the ladder) than in manufacturing. Time will tell if enough Yanks will go back to school and obtain the necessary credentials.

Or will these jobs go to "furriners" from poorer-countries who nonetheless went to post-secondary schooling to obtain the necessary diplomas because it was free, gratis and for nothing ...

Last edited: