- Joined

- Dec 13, 2015

- Messages

- 9,594

- Reaction score

- 2,072

- Location

- France

- Gender

- Male

- Political Leaning

- Centrist

The Economist, "For richer, for poorer" (Nov., 2016)

Excerpt:

Not so? Tell me (and The Economist) how ...

Excerpt:

AMERICANS are not known for their love of income redistribution. Asked to rank, on a scale of one to ten, how important it is for democracies to reduce inequality, they say only six; Europeans say eight. Yet the country is hardly indifferent to who gets which slice of the economic pie. Three in five Americans say that income and wealth should be spread around more. The most potent charge laid against the unpopular Republican tax plan making its way through Congress is that it is a giveaway to the rich and to corporations—groups that voters, by large margins, think should pay more tax, not less.

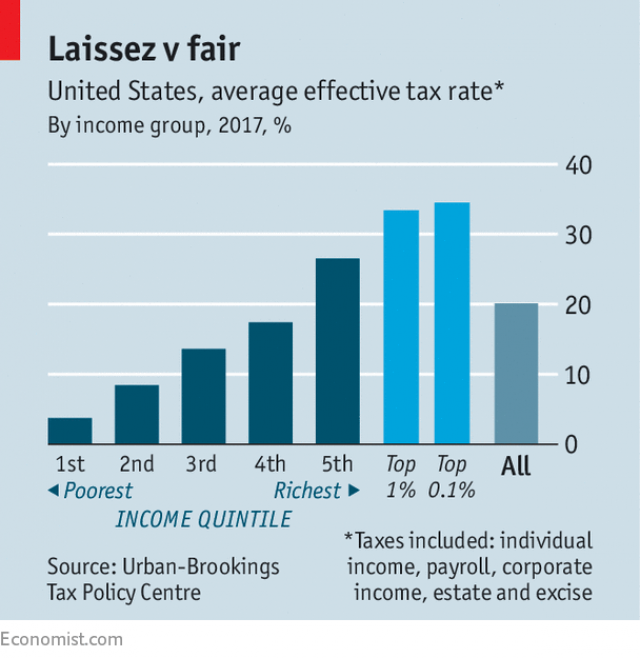

This strange amalgam of views manifests itself in fiscal policy. The federal government has no qualms about making the rich pay the country’s bills; it has perhaps the most progressive tax system in the rich world, according to one study from 2009. But it pulls off only half of Robin Hood’s trick, because it funnels very little of the money it raises towards the poor. In combination, its reluctance to redistribute is the stronger force. America’s government reduces inequality by much less than those of other rich countries:

America’s levies rise with income, but not to particularly great heights. In 2016 the top rate of income tax averaged about 46% once state taxes were included, less than France’s 55% or Sweden’s 57%. So what makes its taxes so progressive? The answer is twofold.

First, America has no value-added tax, a levy on consumption. Because VATs are flat taxes, they are regressive. In any given year VATs cost the poor a higher fraction of their income than the rich, because high earners tend to save more. The average rate of VAT in the OECD, a club of mostly rich countries, is about 19%. Many American states levy sales taxes, which are similar to VATs, but are on average less than 10%.

Second, America’s generous deductions and credits, or “tax expenditures” in the jargon, are good for the working poor. Chief among them is the earned-income tax credit (EITC), a wage top-up for low earners. The child tax credit, a refund for parents, is another. In dollar terms the rich do best from tax expenditures, because of breaks for mortgage interest and employer-provided health insurance. Yet as a percentage of income, the poor benefit most. In 2013 tax expenditures boosted the incomes of the poorest fifth of households by almost 12%, according to the Congressional Budget Office. A single mother with two children earning two-thirds of the average income pays overall taxes of just 13% in America according to the OECD. In egalitarian Sweden the charge is almost 34%.

Not so? Tell me (and The Economist) how ...