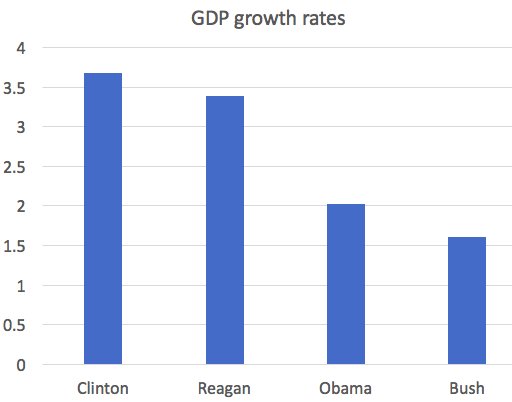

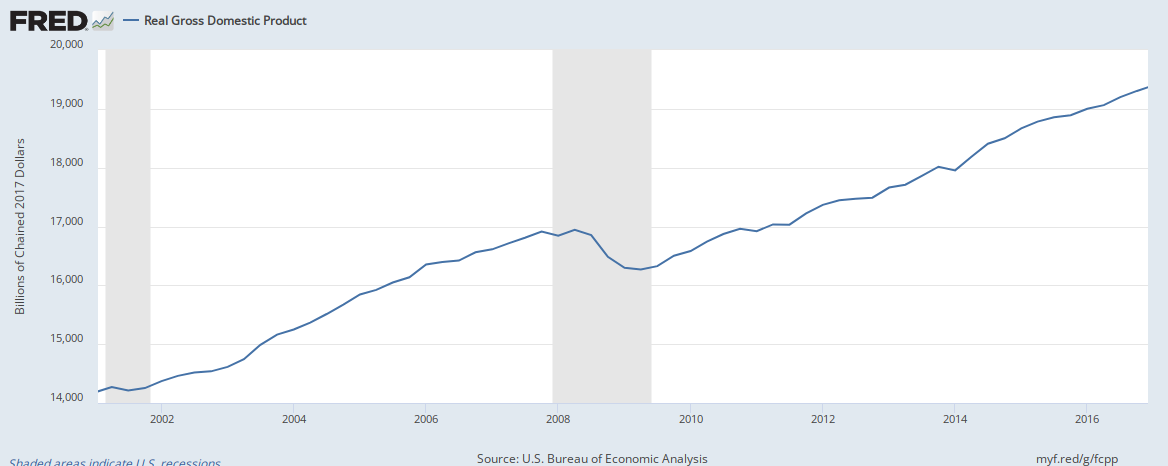

In 1990, President George H. W. Bush raised taxes, and GDP growth increased over the next five years. In 1993, President Bill Clinton raised the top marginal tax rate, and GDP growth increased over the next five years. In 2001 and 2003, President Bush cut taxes, and we faced a disappointing expansion followed by a Great Recession.

Does this story prove that raising taxes

helps GDP? No. Does it prove that cutting taxes

hurts GDP? No.

But it does suggest that there is a lot more to an economy than taxes, and that slashing taxes is not a guaranteed way to accelerate economic growth.

That ... was precisely the finding of a new study from the Congressional Research Service,

"Taxes and the Economy: An Economic Analysis of the Top Tax Rates Since 1945."

Analysis of six decades of data found that top tax rates "have had little association with saving, investment, or productivity growth."

However, the study found that reductions of capital gains taxes and top marginal rate taxes have led to greater income inequality. Past studies cited in the report have suggested that a broad-based tax rate reduction can have "a small to modest, positive effect on economic growth" or "no effect on economic growth."

Well into the 1950s, the top marginal tax rate was above 90%. Today it's 35%. But both real GDP and real per capita GDP were growing more than twice as fast in the 1950s as in the 2000s.

At the same time, the average tax rate paid by the top tenth of a percent fell from about 50% to 25% in the last 60 years, while their share of income increased from 4.2% in 1945 to 12.3% before the recession.