- Joined

- Jan 28, 2012

- Messages

- 16,386

- Reaction score

- 7,793

- Location

- Where I am now

- Gender

- Male

- Political Leaning

- Independent

This is from Janet Yellen - Head of the Federal Reserve - said today.

And remember, she knows a heck of a lot more about this stuff than any Keynesian/Krugmanite on this board.

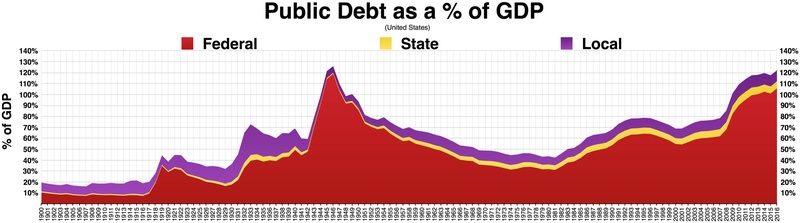

'She said lawmakers need to work toward achieving "sustainability of this debt path over time," ...

"Let me state in the strongest possible terms that I agree" the U.S. federal debt trend is unsustainable, may hurt productivity, and living standards of Americans.'

Fed Chair Janet Yellen Warns Congress: US Debt Trajectory Is Unsustainable | Zero Hedge

Can you read that?

Stick that in your pipes you mega debt/'no debt is too big' ignoramuses and smoke it.

Only an economic moron of epic proportions actually is SOOOO ignorant to believe that federal debt is no problem...no matter how big it is ('duh...just print more money').

Have a nice day

And remember, she knows a heck of a lot more about this stuff than any Keynesian/Krugmanite on this board.

'She said lawmakers need to work toward achieving "sustainability of this debt path over time," ...

"Let me state in the strongest possible terms that I agree" the U.S. federal debt trend is unsustainable, may hurt productivity, and living standards of Americans.'

Fed Chair Janet Yellen Warns Congress: US Debt Trajectory Is Unsustainable | Zero Hedge

Can you read that?

Stick that in your pipes you mega debt/'no debt is too big' ignoramuses and smoke it.

Only an economic moron of epic proportions actually is SOOOO ignorant to believe that federal debt is no problem...no matter how big it is ('duh...just print more money').

Have a nice day

Last edited: