- Joined

- Dec 13, 2015

- Messages

- 9,594

- Reaction score

- 2,072

- Location

- France

- Gender

- Male

- Political Leaning

- Centrist

THE REPUBLICAN AUSTERITY DELUSION

You may be missing the point. The FED is not proactive regarding US Budget Spending, but reactive. It will sell T-Notes only when it must to provide a balanced budget for the Federal government. (Yes, it transfers the revenue from T-notes to the Treasury. The Fed is also responsible for maintaining a T-note rate at acceptable interest-rate levels.)

Obama, since, 2010 has been forced to run a tight budget by Replicant hawks in the HofR, which they controlled. Now, of course, with Obama gone they will open the purses to feed Donald Dork's giant spendthrift maw. (Like building his stoopid-Wall with Mexico.)

When politicians do what is best for "Their Party" irregardless of what is best for "The Nation", then what you can expect are such shenanigans. Any one on the Right of the spectrum, with any brains, should be ashamed of what the Replicant Party has done these past 8-years during the Great Recession.

Because their one accomplishment has been to extend it! At the great cost of those Americans remaining unemployed. Had they listened to Obama when he asked for Stimulus Spending in 2011, then those jobs might have occurred sooner. They finally did appear, but four l-o-n-g years later. See here, from the Bureau of Labor Statistics:

What Replicants offered the American voters as an excuse was "Austerity Budgeting" nonsense. (See here: "The austerity delusion", by Paul Krugman.) Excerpt:

MY POINT?

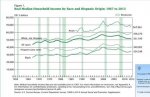

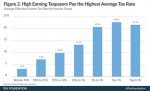

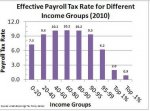

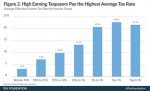

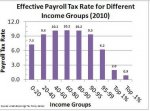

We've been lied to by a bunch of Plutocrats whose only political concern is to block any Democrat attempt at raising abjectly-low Upper-income Taxation. Ie., derailing their Revenue Stream of Income-to-Wealth caused by very low fixed-rate taxation]. See here:

They won't admit it, but maintaining the above taxation-schemes was and still is their first and foremost political objective ...

Nope! It is creating reserves for banks. Reserves are not the same as dollars.

The Fed isn't even a net purchaser of Treasuries anymore

You may be missing the point. The FED is not proactive regarding US Budget Spending, but reactive. It will sell T-Notes only when it must to provide a balanced budget for the Federal government. (Yes, it transfers the revenue from T-notes to the Treasury. The Fed is also responsible for maintaining a T-note rate at acceptable interest-rate levels.)

Obama, since, 2010 has been forced to run a tight budget by Replicant hawks in the HofR, which they controlled. Now, of course, with Obama gone they will open the purses to feed Donald Dork's giant spendthrift maw. (Like building his stoopid-Wall with Mexico.)

When politicians do what is best for "Their Party" irregardless of what is best for "The Nation", then what you can expect are such shenanigans. Any one on the Right of the spectrum, with any brains, should be ashamed of what the Replicant Party has done these past 8-years during the Great Recession.

Because their one accomplishment has been to extend it! At the great cost of those Americans remaining unemployed. Had they listened to Obama when he asked for Stimulus Spending in 2011, then those jobs might have occurred sooner. They finally did appear, but four l-o-n-g years later. See here, from the Bureau of Labor Statistics:

What Replicants offered the American voters as an excuse was "Austerity Budgeting" nonsense. (See here: "The austerity delusion", by Paul Krugman.) Excerpt:

All of the economic research that allegedly supported the austerity push has been discredited.

Since the global turn to austerity in 2010, every country that introduced significant austerity has seen its economy suffer, with the depth of the suffering closely related to the harshness of the austerity. In late 2012, the IMF’s chief economist, Olivier Blanchard, went so far as to issue what amounted to a mea culpa: although his organisation never bought into the notion that austerity would actually boost economic growth, the IMF now believes that it massively understated the damage that spending cuts inflict on a weak economy.

Meanwhile, all of the economic research that allegedly supported the austerity push has been discredited. Widely touted statistical results were, it turned out, based on highly dubious assumptions and procedures – plus a few outright mistakes – and evaporated under closer scrutiny.

MY POINT?

We've been lied to by a bunch of Plutocrats whose only political concern is to block any Democrat attempt at raising abjectly-low Upper-income Taxation. Ie., derailing their Revenue Stream of Income-to-Wealth caused by very low fixed-rate taxation]. See here:

They won't admit it, but maintaining the above taxation-schemes was and still is their first and foremost political objective ...

Last edited: