- Joined

- Jul 7, 2015

- Messages

- 39,396

- Reaction score

- 10,076

- Location

- California

- Gender

- Male

- Political Leaning

- Liberal

What does "due" even mean in the context of enacting policy?

We've reached a point where raising taxes on the rich is required.

"Required for what ?" Would be the important question.

When the poor are priced out of the articles of production, economic growth is inhibited. This is well understood. The wealth of a nation is measured in the goods and services that it produces. When the people cannot readily acquire education and capital (when those resources are not allocated for productive purposes because they are hoarded by a small minority), economic growth wanes.

It makes sense. If we had no schools in this country, if they all disappeared overnight, that would spell certain economic doom.

Once every person has access to the means of harnessing their productive potential, the redistribution of resources from rich to poor becomes prohibitive again. This is because it does, eventually, impact the availability of capital.

This is why it's so confusing: in some circumstances, lowering taxes and services serves to increase economic growth. In other circumstances, raising taxes and services serves to increase economic growth.

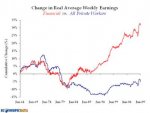

The question then becomes, under which circumstance are we currently under ? Well the answer is pretty obvious from the history. We've had four decades of tax cuts without much economic growth. In particular, President Bush 2's tax cuts didn't help the economy. We could also look at educational access for the poor. We could also look at income disparity.

Virtually every bit of evidence points in the same direction: the resource distribution in this country is inefficient because the resources are far too consolidated.