- Joined

- Aug 14, 2012

- Messages

- 35,070

- Reaction score

- 26,905

- Gender

- Male

- Political Leaning

- Libertarian - Left

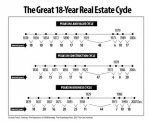

2019 and 2026 is being predicted by the men who predicted 2008's crash in 1997. Despite what mainstream economists would have you believe, recessions are fairly predictable as they generally follow an 18-year-cycle. Most economists are blind to this pattern since they are educated through the neo-classical school of thought which downplays the role of land in the economy. Don't let the government make you think the problems of 2007/8 have been resolved. Expect more of the same so long as banks get to speculate on the Earth.