- Joined

- Mar 29, 2016

- Messages

- 40,927

- Reaction score

- 55,000

- Location

- Houston Area, TX

- Gender

- Female

- Political Leaning

- Liberal

Hyperbole, thy name is Pelosi. Let’s finally just send her butt home. Anybody got a broom?

Hyperbole, thy name is Pelosi. Let’s finally just send her butt home. Anybody got a broom?

This is what I know.... I am in the $50-70k range I pay 25% and after deductions I end up in the 13% range. I have for the last 9 years not been able to claim my Son as hes over 18 and moved out. The most deductions I can muster usually are in the $9,000 - $10,000 range.

Trumps plan taxes me at 25% ~ Same

Trumps plan gives me a based Deduction of $12,000 ~ Which already gives me $2000 more back in my refund which is a HUGE help for my family!

If you do not itemize, have no children, pay not alimony .... the plan will likely work for you.

If you do have any of the following (the more of which, the worse): children (without child care), itemize (especially if you pay for health insurance or have medical deductions, pay a mortgage, live in a state with income taxes, have job related expenses), pay alimony and/or have kids in college, you could see a very large increase in your taxes with this bill.

I pay a Mortgage, Property Taxes, State Tax, Federal Tax, pay for my Insurance, use an FSA, my son is 27, I have only donations for deductions.

1. When Socialists hate legistaltion, you know it’s good for the country.

2. Pelosi presided over the worst legistlation in modern history. The Careless Affordable Care Act (CACA).

She dropped the all-time bad one liner for bad legistaltion too... “You have to pass the bill to find out what’s in it.” Like it’s Christmas or something. Well Nancy, it’s been passed, it’s been lived, and it’s the biggest turd of legistlation we’ve seen in our lifetimes.

Soon... it looks like it will be gutted... in the tax bill... ROTFLOL

Those of us pro-Americans love it when the Socialists of America Partei (SAPs) roll out Pelosi, Schumer or Schiff. Just the faces you want telling lies to the American people.

1. When Socialists hate legistaltion, you know it’s good for the country.

2. Pelosi presided over the worst legistlation in modern history. The Careless Affordable Care Act (CACA).

She dropped the all-time bad one liner for bad legistaltion too... “You have to pass the bill to find out what’s in it.” Like it’s Christmas or something. Well Nancy, it’s been passed, it’s been lived, and it’s the biggest turd of legistlation we’ve seen in our lifetimes.

Soon... it looks like it will be gutted... in the tax bill... ROTFLOL

Those of us pro-Americans love it when the Socialists of America Partei (SAPs) roll out Pelosi, Schumer or Schiff. Just the faces you want telling lies to the American people.

What? Surly you must be a Russian bot right? No way you could actually like the Tax plan omg...... lol

Small business owners are going to see a good decrease in taxes making it easier for them to not only operate but expand.

Getting rid of the mandatory insurance clause you can hire more people without fear of insurance costs.

What is it that you like, specifically? The reality is that this bill is far more generous to the rich, golf course owners and real estate corps, than either Reagan's or Bush's tax cuts. Do you own a golf course, a private jet or are in the real estate business?Not all of it, no. However I can't remember the last time I like the whole tax bill as it was rolled out by either party.

What is it that you like, specifically? The reality is that this bill is far more generous to the rich, golf course owners and real estate corps, than either Reagan's or Bush's tax cuts. Do you own a golf course, a private jet or are in the real estate business?

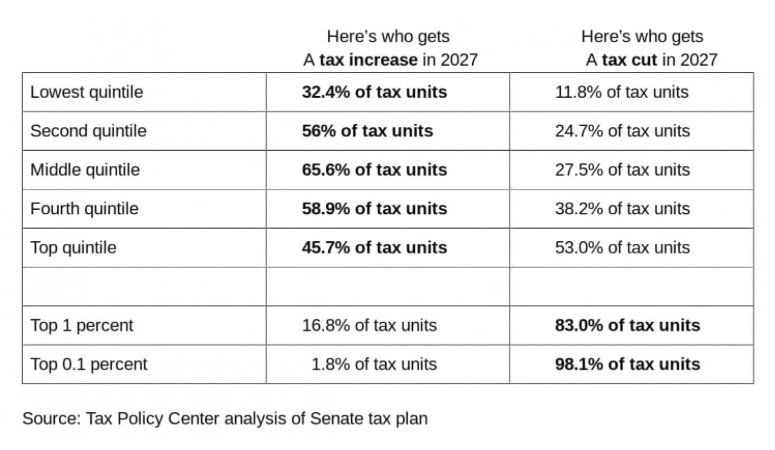

I imagine it's hard to accept that Trump, who promised he was going raise taxes on the rich, get rid of the carried interest rule that hedge fund billionaires enjoy, get rid of loophole, etc., once again was the king of the double-cross. This time, he double-crossed the voters that not only expected those changes but raised THEIR taxes too. So, the rich get a tax reduction and it's paid for by the middle-class, including those down-on-their-luck Trumpsuckersvoters and the hedge fund billionaires keep the carried interest rule.

I have my own appraisal business, which for the last few years I have been forced to downsize and run out of my own home. Now with the changes coming along I may actually be able to move back into an actual building and get to having a few workers to handle more business.

I was nearly charged out of business for having only three people on my payroll and now I think I can get back to actually having my own business again.

What is it that you like, specifically? The reality is that this bill is far more generous to the rich, golf course owners and real estate corps, than either Reagan's or Bush's tax cuts. Do you own a golf course, a private jet or are in the real estate business?

I imagine it's hard to accept that Trump, who promised he was going raise taxes on the rich, get rid of the carried interest rule that hedge fund billionaires enjoy, get rid of loophole, etc., once again was the king of the double-cross. This time, he double-crossed the voters that not only expected those changes but raised THEIR taxes too. So, the rich get a tax reduction and it's paid for by the middle-class, including those down-on-their-luck Trumpsuckersvoters and the hedge fund billionaires keep the carried interest rule.

1. When Socialists hate legistaltion, you know it’s good for the country.

2. Pelosi presided over the worst legistlation in modern history. The Careless Affordable Care Act (CACA).

She dropped the all-time bad one liner for bad legistaltion too... “You have to pass the bill to find out what’s in it.” Like it’s Christmas or something. Well Nancy, it’s been passed, it’s been lived, and it’s the biggest turd of legistlation we’ve seen in our lifetimes.

Soon... it looks like it will be gutted... in the tax bill... ROTFLOL

Those of us pro-Americans love it when the Socialists of America Partei (SAPs) roll out Pelosi, Schumer or Schiff. Just the faces you want telling lies to the American people.

Fact check has proven your lies wrong why do you keep spouting them.

About 80% of middle or low income people will see a tax break.

There is only about 15% of upper middle income people that will see and increase but that was under the house bill

Not the senate.

Overall, the majority of Americans -- 62 percent -- would get a tax cut of at least $100 in 2019, according to JCT. The remaining 38 percent would either pay about the same in taxes as they do now or get a tax hike.

But by 2027, just 16 percent of Americans would get a tax cut of at least $100. The "winners" fall dramatically because the tax cuts for individuals go away in 2026 in the Senate GOP plan. Republicans argue that those tax cuts are likely to be extended by a future Congress.

https://www.washingtonpost.com/news...te-gop-plan/?tid=a_inl&utm_term=.768c884824d9

Tax reform 2017: 4 red flags in the GOP tax bills - Dec. 8, 2017I have my own appraisal business, which for the last few years I have been forced to downsize and run out of my own home. Now with the changes coming along I may actually be able to move back into an actual building and get to having a few workers to handle more business.

I was nearly charged out of business for having only three people on my payroll and now I think I can get back to actually having my own business again.

Red flag #3: Could saddle some corporations with a higher bill

The biggest unintended consequences so far, which lawmakers may try to fix in their final negotiations, are caused by the Senate bill keeping the corporate AMT.

GOP senators were trying to provide more revenue to pay for other last-minute changes. Yet in doing so, they effectively subverted the purpose of the corporate AMT, which is supposed to ensure that corporations don't take so many tax breaks that they pay no tax at all. Under the tax bill, the regular corporate rate is slashed to 20%, identical to the corporate AMT rate.

The last-minute switch also would render key tax incentives for corporations moot because they're not allowed to be taken under the AMT. One of them -- the research and development credit -- is intended to spur innovation.

The AMT change, combined with other provisions in the tax bill that curb valuable business tax breaks, means many corporations -- surprise! -- could face a tax hike. For instance, the CEO of coal company Murray Energy estimates his company would pay $60 million more a year.

Preserving the AMT also could undermine the structure of international tax reforms in the bills, according to a report by tax scholars, practitioners and analysts.

I have my own appraisal business, which for the last few years I have been forced to downsize and run out of my own home. Now with the changes coming along I may actually be able to move back into an actual building and get to having a few workers to handle more business.

I was nearly charged out of business for having only three people on my payroll and now I think I can get back to actually having my own business again.

House Minority Leader Nancy Pelosi (D-Calif.) declared unequivocally on Monday that the GOP tax overhaul is the worst legislation ever considered by Congress.

Your the kind of business we need to promote.

Guys that want to go from start up to 5-10 then 20 people.

That is what grows the economy. Corporations have saturation levels.

Great. Please tell us what specific proposed changes in tax code make that possible....

No tax code for hiring workers. I am going to have a bit more money to support having them now.

It was the rates that hurt us in the past, with barely anything to do with having workers that changed from the last plan.

Regulations brought on by the SBREFA was what tried to strangle most of us.

Not sure what "no tax code for hiring workers" means. AFAIK, nothing in the new law changes your tax or other liabilities for employees.

I'm also curious what regulations you're referring to. Something affecting appraisers or small business in general?