The primary focus of the bill is to cut taxes on corp taxes which we despirately need. They have to let the cuts expire to get it through procedures since I doubt any Dems would be rational enough to support the bill and keep it in filibuster purgatory.

I actually support corporate tax reform, but there is a fundamental dishonesty IMO in going about it this way. First of all, the House includes a $40 billion/year estate tax giveaway to the ultra wealthy, the literal top 0.2% of the country. That bill repeals the estate tax entirely AND allows heirs to write up basis to FMV at decedent's death. There's no way to defend that other than to describe it as what it is - the United States House of Representatives acting as errand boys for the plutocrats and oligarchs that fund the party.

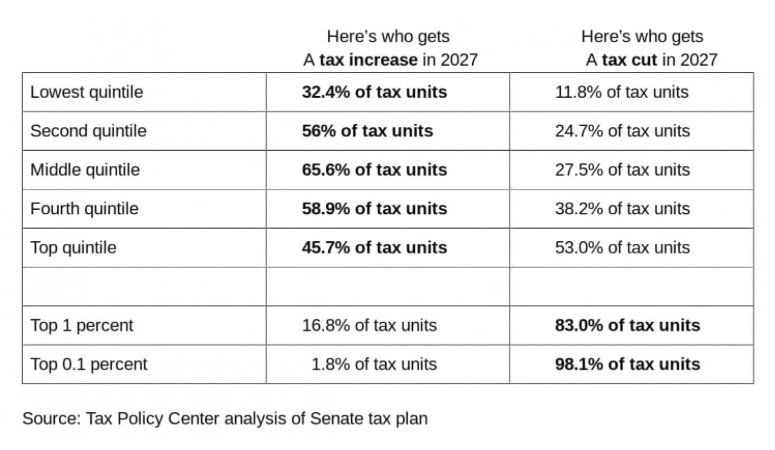

For me it completely obliterates the notion that we should award the House with anything like a good faith belief that their plan will benefit the bottom 90% or so because we all KNOW, with 100% certainty that this year during the national debt negotiations or next year, those same people will tell us that the $12 TRILLION projected deficits for the next decade will destroy the country and so the only option available is to make deep cuts to Medicare, SS and Medicaid, plus the rest of the safety nets (food stamps, disability, etc.). I'd bet my house on it. So we know the estate tax provisions will be paid for with cuts to old people, and the middle class and poor, and is a way to use the tax code to shift wealthy from the poor and old to the already rich. That's how the math works.

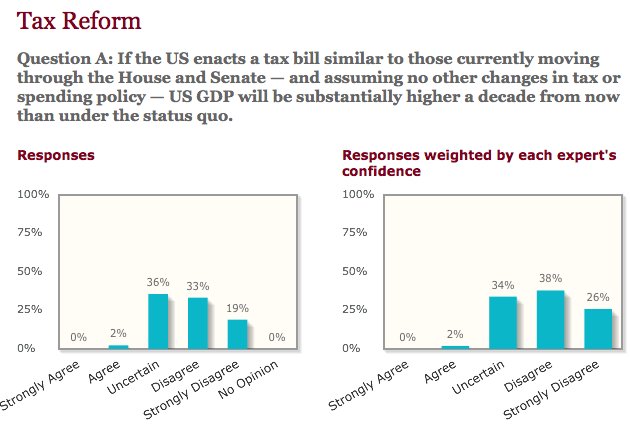

Bringing it back to corporate taxes, the big problem with our system is there are massive built in tax loopholes, in part because our tax rates ARE out of whack with competitor economies. There's a good reason to get our rates in line with the rest of the world, but if it's not going to be a complete giveaway (i.e. reduce the rates but close no loopholes), then there has to be actual reform that close those loopholes. Those kinds of "reforms" would remove much of the incentives to do business abroad but also more or less be revenue neutral to the big multinationals who right now pay EXTREMELY low income tax rates on their income. They don't need a tax cut at all. What MIGHT help is lowering our rates to remove the tax incentive to invest abroad. But if you don't close the loopholes, you don't change the incentives to do business abroad, you just lower rates.

Point is I am ignorant about the details of international taxation and so have to trust the House to do the right thing. But to trust them to do the right thing would be stupid as hell, IMO. What I trust they'll do, given the estate provisions, is shovel money hand over fist to the people they SERVE, which are the plutocrats and oligarchs, because that's who they tell us throughout the bill who they really care about.