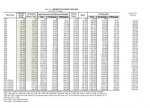

What does 911 have to do with anything? GDP continued to grow 2000 to 2001 to 2002 to 2003, etc., yet income tax revenues fell (see below). Why? Because Bush cut taxes.

Moreover, is with this "full implementation" rationalization? The real guts of the tax cuts were in 2001, and they resulted in reduction of tax revenue. The 2003 addition primarily expanded capital writeoffs and lowered cap gain/ dividend rates. It really wasn't that substantive. For all intents and purposes, the tax cuts happened in 2001, and tax revenues immediately preceded to fall 19%.

Yes, over time, the economy grew, which resulted in increasing income tax revenues, but it took six (6) years for taxes to return to their pre-tax cut levels. Tax receipts grew 5%, while GDP grew 20%. How does that work? If tax cuts were truly neutral, they would grow at or better than the rate of GDP growth (after all, income taxes are progressive, so their resulting revenue should actually grow faster than GDP). GDP growth and tax receipts are destined to climb; you want to suggest the tax cuts grew the GDP, but there is NO evidence of that (give me 3 notable economists that support this.... don't waste your time looking, there aren't any) ... there is evidence, however, that the tax cuts resulted in lower tax receipts (note relationship between GDP growth and tax receipt decline)

The Congressional Research Service has estimated the 10-year revenue loss from the Bush tax cuts of 2001 and 2003 to be in excess of $1T, and extending these cuts beyond 2010 to cost an $3.5 trillion over the next 10 years.

http://fpc.state.gov/documents/organization/148790.pdf

There... a refute to your claim that no one has ever challenged you assertion that the Bush tax cuts led to increased income tax revenue. Frankly, in making the argument that one item resulted in the other, I would say the burden of proof is really on you. Afterall, GDP and tax revenues naturally trend up. Cutting taxes usually result in less tax revenue. Both of these events clearly happened in the last decade, but there is almost zero evidence that the Bush tax actually did a thing to help the economy (yet plenty of evidence they actually hurt).