This is bull ****.

The oil market goes up and down and this is based on plenty of factors. This "too much oil" situation is also a temporary thing. This is clearly based on the consequences of the virus locking people in their homes, following a Saudi/Russian game of competition to provide a lower cost. It will not last. Go fill up your tanks.

China and India, because of their populations and their modernization programs, are exponentially thirsty for oil. Key to China's Middle East foreign policy is to increase geoeconomic and political influence. They are currently doing this through Iran, which was pushed closer to China's orbit thanks to our brutal and unnecessary economic sanctions. Iran doesn't even like China, but China will (and does) trade with them. Along with this is the influence that China is developing in Iran-supported Iraq. And also in Iran-supported Syria, thanks to our abrupt retrograde. The greatest prize, of course, is Saudi Arabia, which is why the very idea that "we should get out of the Middle East" is shallow and dumb. As Saudi Arabia bends to China's political needs, so will our allies who would rely on China's program to create and maintain stability in our absence. <----Isn't that what Bush, Obama, and Trump preach?

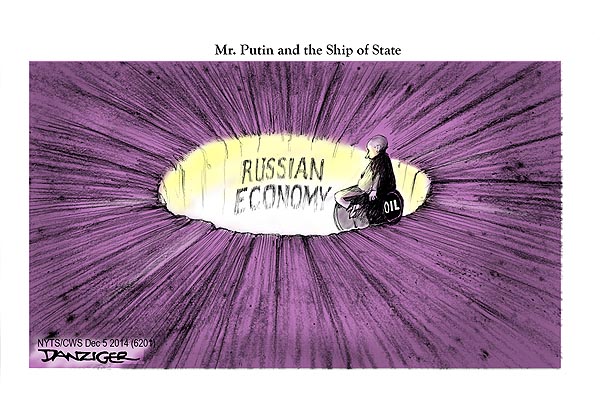

Russia, also, is playing a geoeconomic long-game while we slumber and build new tanks. While we tabled TTIP for an entire year, just to teach those Europeans who's boss, Russia was free to practice pipeline diplomacy to countries in need of oil and natural gas. In the absence of TTIP, which should have been used to increase American energy imports, Russia extended pipelines as far as France. Of course, this also includes political influence into the governments of our allies. Russia is also a long time supporter of Assad in Syria. Our unilateral and abrupt retrograde from the territory, abandoning our Kurdish allies, not only handed the region over to Russian and Iranian influence, but also forced our Kurds to make deals with those who wipe their asses with our interests. Unlike China who needs oil, Russia is a producer looking for greater global control. Again, like China, all Russia ever hears from our leaders is how we "need to get out of the Middle East." What Obama stupidly started, Trump is stupidly finishing.

Case in point: There is a history of friction between Turkey and Syria that goes back decades. It involves the control of fresh water through almost the center of Syria. Syria relies on an inflow of large amounts of fresh water from Turkey. The U.S. has had to get involved in incidences where Turkey has used their damns as leverage, cutting off the fresh water, during trade disputes. This has escalated at times to military threats on the border. One can translate this control of water into the oil, the other natural resource of great regional importance. Chinese and Russian control of Middle Eastern oil would not be pretty for those governments who wish to remain under our umbrella.

Thus, "there's too much oil" is just a short-term distraction that hides what is going on underneath.