- Joined

- Feb 22, 2019

- Messages

- 37,166

- Reaction score

- 24,122

- Location

- The Bay

- Gender

- Male

- Political Leaning

- Progressive

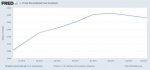

Source: (CNBC) Fed cuts rates by half a percentage point to combat coronavirus slowdown

What is not easily conveyed by this breaking news article, is that at this morning's G7 meeting no concrete course of action was agreed upon, thereby giving the appearance the meeting was a substantive failure. In response it would seem, the Fed moved unilaterally and unexpectedly immediately after.

If anything, it looks like Fed is taking the economic effect of COVID-19 quite seriously. The markets had an immediate slight positive blip, but now minutes later they are moderately back in the red. I suspect the markets are sill trying to digest the news.

I haven't seen the Fed statement yet, but the Fed Chair has a press conference scheduled for 11:00A. Apparently the statement declares the coronavirus economic risks are, "greater than expected".

The Fed uses rate cuts to promote growth. What possible growth will result from a rate cut that says it addresses the seriousness of the covid-19 virus? This rate cut means that when the recession comes, the Fed will have 1/2 a point less to actually deal with growth problems.