- Joined

- Mar 27, 2014

- Messages

- 63,624

- Reaction score

- 33,652

- Location

- Tennessee

- Gender

- Male

- Political Leaning

- Undisclosed

Not only is that untrue, it has become more untrue over the past few decades.

Since when have Republicans/conservatives been concerned with enforcing anti-trust rules, for example?

Regulations are what keep them big :shrug:. That's why they invest so much on purchasing the regulators.

I see this assertion all the time but have never actually read a coherent demonstration of it. Just as an example, the 'fiduciary' rules that the Trump EO apparently struck down arguably actually favor larger entities because of the regulatory burdens of complying with them. But the big banks/Wall Street firms lobbied hard for their repeal... Also, if regulatory burdens pose too heavy a burden on smaller entities, I'm not sure the answer is to ditch them but rather target the capital, etc. requirements on those entities that will require taxpayer bailouts or risk a collapse of the system.

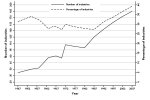

And consolidation isn't just happening with financial firms - it's a feature of the last few decades of the U.S. across at least nearly all industries if not every industry, nearly every sector. And if that is the problem - industries becoming too big and therefore able to consolidate political power - then what is the conservative response to that other than let the market work, when we see what happens when that is the regulatory approach, which is to consolidate/merge into just a few massive firms controlling the vast majority of nearly every sector of our economy.