- Joined

- Aug 14, 2012

- Messages

- 35,070

- Reaction score

- 26,905

- Gender

- Male

- Political Leaning

- Libertarian - Left

Kansas also has the 5th lowest GDP growth in the US, at 1.9%.Kansas Sate & Local debt projection for 2017 per capita is $8,827 while the national average is $9,523 (source)... but it's nice to see you guys caring about government debt for once, even if it is for irrational and highly partisan reasons.

Except that the cost of living is not equal among states in the region nor is the tax burden. Colorado is the highest is per-capita income and has a state tax burden that is still 33% lower than Kansas (CO=9.41% versus KS=12.28%) and the average state tax burden in dollars between KS and CO is nearly identical ($5854 vs $5853) (source)

It would seem that those who are huge fans of big government and big taxes are only interested in superficial comparisons of surrounding states and the direction of the tax adjustments... maybe Kansas' primary problem is they need to cut the tax burden enough to compete with Colorado...

Oh so now we dont compare states to their region when it comes to compare and contrast analysis when it comes to tax cuts? :lamo Oh its doing "great" when it comes to how most states unemployments rates are at the same rate or below the KS unemployment rate. KS was promises an"explosion in job growth".. I mean ****, Brownback promised 100,00 new private sector jobs because of these amazing tax cuts.... | The Wichita EagleWow, I didn't know all those red states were doing so well...cool! Concerning Kansas though, people are working and it's ridiculous to admonish a state's unemployment number when it's 4.2%. Even if they aren't doing as well as the states around them, they're doing good for Kansas and good nationally.

As I've pointed out earlier concerning tax cuts helping an economy, their sales tax revenue has been spiking

:lamoYou're slowly seeing the sales tax revenue take the place of the income tax revenue and if you look at their total revenue, they're pretty close to being on track to have their best year ever in 2017.

Read it again. Revenues fell in 2014, and are stagnant for 2015 and 2016. They've had to slash spending madly every year.

My bad :doh

But, I wasn't wrong.

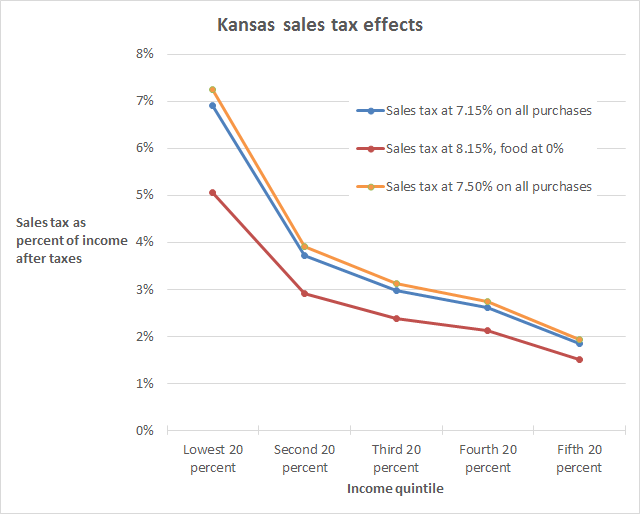

Kansas sales taxes are highly regressive:

2015 figures for who pays Kansas taxes (Kansas | The Institute on Taxation and Economic Policy (ITEP))

The tax cuts were also regressive

Kansas isn't the most regressive state for taxation, but it's in the bottom 10.

I did use combined use and sales tax. Page 34. The numbers I typed were from the 3rd column, which is sales + use taxes combined.

According to what link?

Spending per student:

2014 = $9,972

2013 = $9,987

2012 = $10,051

2011 = $9,996

2010 = $10,547

Education Spending Per Student by State

Assuming you are correct, Kansas spends more of its budget on education, because they spend less on everything else. Kansas is already very lean in its state spending, which is why they are cutting education in order to make ends meet.

Read up on it. It's a freaking disaster, built on a poor interpretation of comparative data about states and wishful thinking about tax cuts.

Cost of living has nothing to do with this.

The states in better shape around Kansas still have a lower tax burden than Kansas which screws up the narrative of you big government types.

False. https://wallethub.com/edu/states-with-highest-lowest-tax-burden/20494/

When it comes to income tax just compare the surrounding states with KS and all state except South Dakota have a more progressive and higher state income tax. KS also recently had to raise their sales tax because of the loss of revenue from the 2012 tax cuts. KS now has one of the highest sales taxes in the nation and is one of only a select few states that still tax groceries. KS reliance on the sales tax to bring in the needed revenue for the state government to operate is not doing too well... They have missed projection after projection until recently when they actually lowered those projections.

Revenues are close to what they were in 2012.

The tax cuts didn't take effect January 1, 2013. They started in mid-year, and as soon as they took effect, tax revenues plunged by 11%.Revenues are close to what they were in 2012. Why do you suppose there was a huge spike in 2013, the first year of the tax cuts if the tax cuts were such a disaster?

Re-read my post. I provided 4 links to articles about education cuts, AND showed you how spending per student dropped after the tax cuts. And again, merely saying "we spend more of the state budget on K-12" is because the state government is already very lean, and education is a big part of their budget.And slash spending madly? On what? Didn't you say education earlier? Well I looked it up and turns out Kansas K-12 is 2nd in the nation in percentage of education spending in budget.

Sorry, but this is nonsense. State colleges cannot summon funds out of thin air, and most of their funding is from -- wait for it -- the state. If they cut, then the money has to come from somewhere.So he cut some money to universities, who cares, for what they charge they can fend for themselves.

I used that because we were specifically discussing sales and use taxes. The chart on p18 includes corporate taxes, gas taxes, vehicle taxes etcYou're right, you did add sales and use tax. But why just show what's going into the general fund rather than the gross sales/use? This is what I initially used and it's on page 18 of each years report and it shows a much more substantial increase: http://www.ksrevenue.org/pdf/ar14a.pdf

sighYour links to education cuts all worked for me except the third one, which I couldn't read because it requires me to sign in. Of all of the rest of them, the only actual cuts that I can tell that Brownback's administration has made were 3% cuts across 6 universities.

sighKansas spent 5.5% less on students from 2010-2014. According to the same list, it's better than the border states of Colorado (-6.5%), Missouri (-5.6%), and Oklahoma (-8.7%). And 5.5% less adjusted for inflation isn't going to tank the school system. Beside, this article seems to make the case that there's more spending after 2014

It's about this:So the tax cuts didn't take effect until mid-2013? Hmm, I wonder what this was about?

Seriously? Did you not read your own link?!? The very next sentence reads: "In fact, the tax cut failed to boost the Kansas economy.""In May 2013, only a few months after the plan was implemented, Laffer and Moore claimed it was already having a measurable positive impact on the state’s economy"

And again, I refer you to the reductions in per-capita spending, how spending has not kept up with inflation and population growth, the tax cuts that have taken place, and how they're now talking about cutting K-12 by $80 to $200 million.And to the epic education cuts you referred to, once again this link that you must have missed the first time:

https://kansaspolicy.org/state-school-funding-ranks-high-in-kansas/

So they're not cutting... but there were cuts... and they cut useless funding? Wha...?Now, if the cuts were that drastic, and K-12 funding is in that great of shape, it means they were getting too much previously, don't you think?

Brownback must have forgotten that the state has been getting sued for insufficient education funding for well over half a decade.Also, Brownback's reasoning from another article:

“The dramatic increase in state education funding that has occurred over the last four years is unsustainable,” Brownback said in a statement. “School districts are estimated to have approximately $381m in reserve fund balances to help them offset the smaller than expected increase in state funding. The Kansas Department of Education should work with school districts to help them with any cash flow challenges that may arise.”

It's about this:

Why is Kansas in such horrible fiscal shape? It’s still the tax cuts, stupid.

▪ In the 2012 fiscal year, before any of Brownback’s income tax cuts kicked in, the Sunflower state raked in $2.908 billion in individual income taxes.

▪ In the 2013 fiscal year, the figure rose to $2.931 billion.

▪ But after the reductions were in place, that source of funds plummeted to $2.218 billion in the 2014 fiscal year, was $2.278 billion in the 2015 fiscal year and — again — reached just $2.249 billion in the 2016 fiscal year.

In latest Kansas revenue fiasco, it’s still the tax cuts, stupid | The Kansas City Star

Seriously? Did you not read your own link?!? The very next sentence reads: "In fact, the tax cut failed to boost the Kansas economy."

That article then points out:

• Unemployment rose less in KS than nationally

• Kansas' economy grew at half the rate of the national economy

• New businesses have declined, whereas nationally they've grown

• Personal income taxes were $700 million lower for FY2016 than for FY2013

• Kansas' growth only accounted for $30 million more in tax receipts for 2014, 2015 and 2016

• General Fund (Kansas' "rainy day" fund) is down by $570 million since 2013, and is now just $40 million

• Kansas' bond rating is down

And again, I refer you to the reductions in per-capita spending, how spending has not kept up with inflation and population growth, the tax cuts that have taken place, and how they're now talking about cutting K-12 by $80 to $200 million.

By the way, KPI is funded by the Koch Brothers, ALEC, Donors Trust.... Not exactly neutral.

So they're not cutting... but there were cuts... and they cut useless funding? Wha...?

Brownback must have forgotten that the state has been getting sued for insufficient education funding for well over half a decade.

That $381 million? Turns out, yeah, that's kind of bull****. It's all the local reserves, which cities and counties were already spending down. It included funds to pay teachers for the next few months; summer school funds; the follow year's special education and textbook budget; and contingency funds to keep schools running for a week or two, if there's some kind of disruption in the normal payment schedule.

| The Wichita Eagle

And again, are you reading your own links?!? The article discusses a mid-year $50 million K-12 cut that forced schools to end the school year early, due to an $800 million shortfall for FY2015.

Seriously, dude, you should just stop now. Even your own evidence proves you wrong, over and over.

The Kansas tax cuts are a disaster. Total, unmitigated disaster. It's hurting Kansas, it's hurting Kansans.