- Joined

- Nov 28, 2011

- Messages

- 23,282

- Reaction score

- 18,292

- Gender

- Undisclosed

- Political Leaning

- Other

What is ridiculous is attributing the state's unemployment rate to its tax policies.Wow, I didn't know all those red states were doing so well...cool! Concerning Kansas though, people are working and it's ridiculous to admonish a state's unemployment number when it's 4.2%.

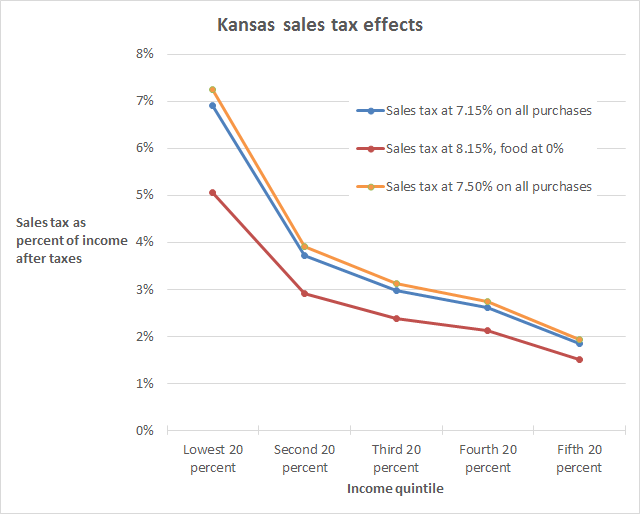

The reality is that Kansas has not added more jobs or more businesses than its neighbors, who did not enact the same policies. What it has done is cause tax shortfalls to the tune of around $800 million per year, plus increased regressive sales taxes.

It has not achieved one of Brownback's primary goals -- to stop people leaving Kansas... a problem shared by none of its immediate neighbors.

Instead of companies moving to Kansas, existing companies reorganized as LLCs / LLPs to take advantage of the new tax break.

Meanwhile, they are slashing education programs and raiding highway funding programs. Kansas' government was pretty thin to begin with, so there is no fat to cut -- mostly just muscle. This does not make the state more attractive to businesses.

Or, it's "spiking" because they increased sales taxes.As I've pointed out earlier concerning tax cuts helping an economy, their sales tax revenue has been spiking as one would expect when the consumers get to keep more of their own money.

The average worker is not, in fact, seeing most of the benefits of the tax cuts. Those personal income tax cuts were immediately offset by the increases in sales taxes.

Yeah, not so much.You're slowly seeing the sales tax revenue take the place of the income tax revenue and if you look at their total revenue, they're pretty close to being on track to have their best year ever in 2017.

Brownback is now talking about adding taxes on tobacco and alcohol, as well as raid the highway fund again, in an attempt to avoid another shortfall. He wants to cancel a 0.1% tax cut for the lowest tax brackets. He wants to tax rents and royalties. He wants to sell off the future proceeds from tobacco settlements -- funding normally used for Head Start. He wants to put all public schools on the same health plan -- which could save a bit of money, but means removing local control over teacher compensation, as well as unraveling nearly 290 existing agreements.

In order to meet this year's shortfall, he wants to liquidate the state's long-term investment fund, raid the highway fund, and underfund pension programs. He claims the long-term fund will be paid back over 7 years, but based on... what, exactly? How will 7 more years of a fiscal crisis suddenly make revenues increase?

Even after all those changes, the state is projected to have a $869 million shortfall over 18 months.

Kansas Gov. Sam. Brownback proposes tax increases to help fix the state's budget problems | The Kansas City Star

Brownback's plans are an unmitigated disaster. They aren't sparking growth. They aren't encouraging businesses to move to Kansas. They aren't encouraging residents to stay. It's an unmitigated failure.