- Joined

- Jul 7, 2015

- Messages

- 39,369

- Reaction score

- 10,021

- Location

- California

- Gender

- Male

- Political Leaning

- Liberal

Brownback Tax Cuts a bust...Kansas State Legislature now fixing to repeal

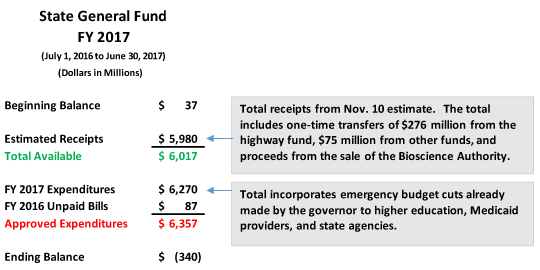

$342 million is less than 2% of Kansas government revenue?

Can you cite this number?

I am always amazed at the vitriol directed at Kansas in general and Brownback in specific. I don't get it. Thomas Frank wrote a book, What's Wrong with Kansas that attempted to explain problems at the time under Dem Governor Sibelius. I read it and did not see the problem. And now this budget issue. $342 million is less than 2% of Kansas government revenues. Currently Kansas has one of the lowest debt to revenue ratios of 37% so a slight increase won't kill them. Some states have debt to revenues ratios of more than 75%. The average for states is 51%. The federal budget operates with deficits c. 10% of revenues.

On the personal side, Kansas has average income per capita but less than average cost of living. It is better to make the average of $52K/yr in Kansas's .92 Cost of Living than to make Connecticut's $70K/yr in a 1.45 cost of living state. Adjusting for cost of living, Kansas's $56,521/yr is better than Conn's $48,505. Kansas also has better income equality than most other states. I would not want to live in Kansas for other factors but economically they seem to be doing rather well.

$342 million is less than 2% of Kansas government revenue?

Can you cite this number?