Enacting a policy of permanent fiscal stimulus would surely boost economic output. With little means of obstruction in his path, combined with some powerful bargaining chips (the SCOTUS nomination comes first to mind), U.S. GDP can very will see a massive upswing during the initial phase of his presidency. However, given that labor market slack is minimal, how beneficial will persistent deficits that flirt with $1 trillion annually be for long term economic growth? If fiscal policy isn't cut back during periods of heavy economic growth, it has great potential to crowd out private investment, and severely reduce economic efficiency in the medium to long term.

I've said several times on the board we can indeed Pump growth higher with stimulus.

We can also be on steroids for a year and feel better (or hit 70 Home Runs), but it doesn't mean that's a good idea either.

With boomers dropping out of the workforce, and Europe and Japan dead in the water growth-wise and demographically, how does high growth work exactly?

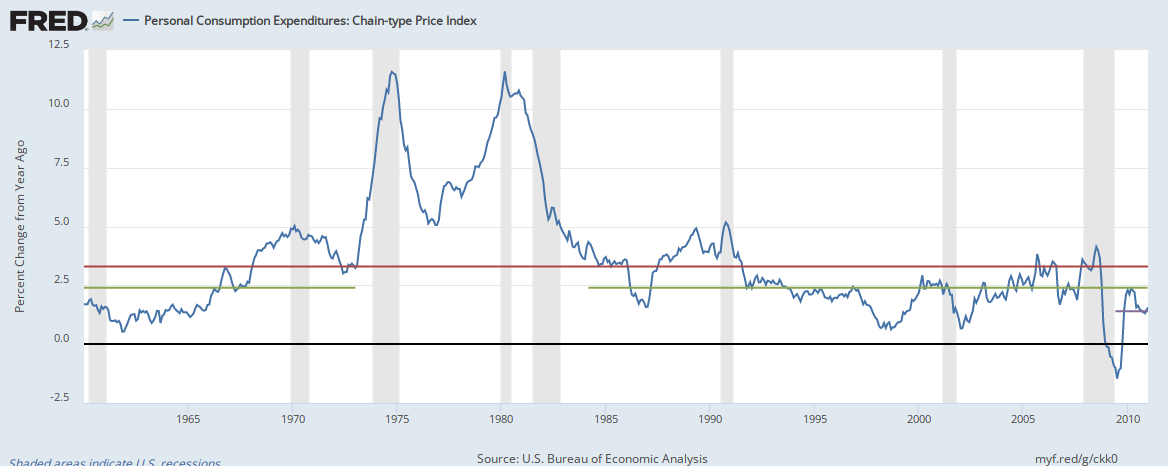

4% growth would probably produce wild inflation, and an eventual crash as the yearly stimulus is gradually overcome by the accumulating debt.

That's what happened in 1987, 7 years into Reagan's tax cut, and in 2007/8 , the same amount of time in W's tax cut.

Considering First World demographic realities, 2% growth is not that bad, and perhaps more in line with what's achievable without eventually paying the piper/Doubling down on debt to truly dangerous levels.

But I do believe there is some positive 'stimulus' possible, but not by Across the board or top down Tax cuts.

I would do the opposite of Trump, raise taxes, but only at the top, with one or two 'Buffett Brackets.'

Perhaps 40% at 1 Mil, 50% at 5/10 Mil and Earmark that money for Infrastructure spending.

Kinda like Forced investment of Billions stuck in .1% T bills.

It will create jobs and velocity.

Right now there is no velocity (or reason to invest) because wealth disparity is too high, and there is no incentive to build a factory without the customers for it's goods. Unless, at the moment, it's Private (Lear) Jets.