- Joined

- Aug 26, 2007

- Messages

- 50,241

- Reaction score

- 19,243

- Location

- San Antonio Texas

- Gender

- Female

- Political Leaning

- Conservative

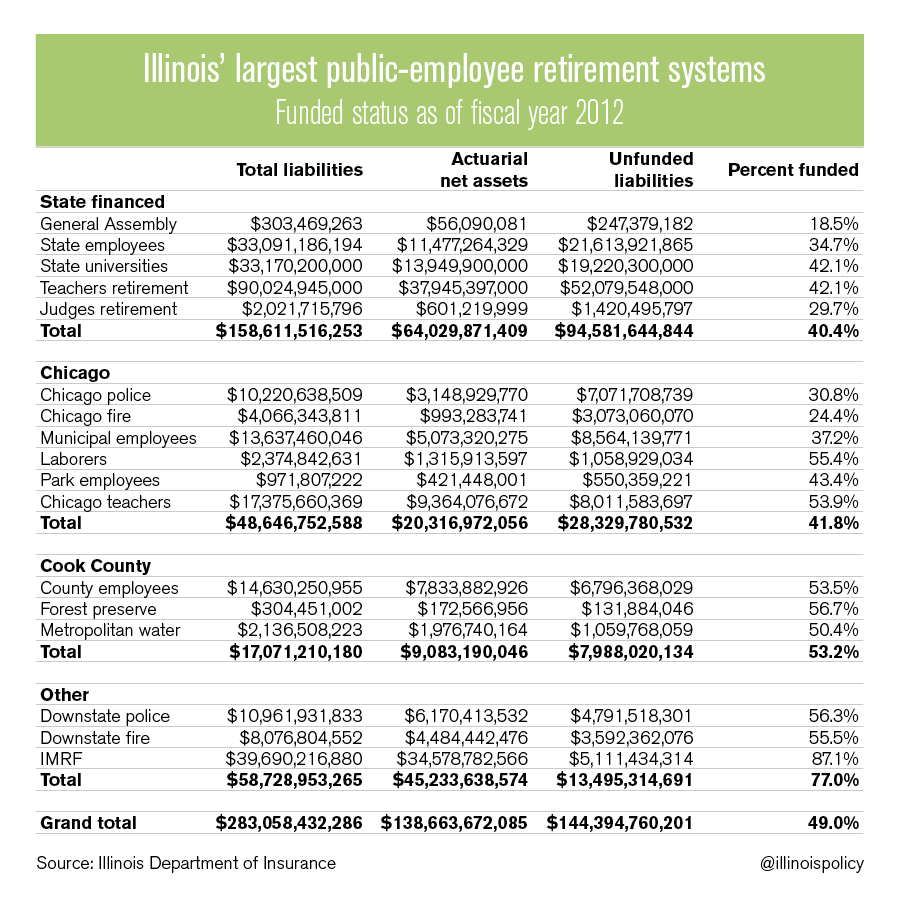

CHICAGO (CBS) — Citing the city’s underfunded pension crisis, Moody’s Investors Service downgraded Chicago’s debt to junk bond status on Tuesday.The Ba1 rating means that Chicago’s $8.1 billion in debt carries a substantial credit risk. That credit rating is also just a few levels above bonds that are in default.

“The Ba1 rating on Chicago’s debt incorporates expected growth in the city’s highly elevated unfunded pension liabilities,” Moody’s said.

The service cited the state Supreme Court’s recent decision to toss out the state’s pension reform bill as unconstitutional, along with concerns that the city will be able to meet its pension obligations in the future.

-=-

The move is not only financially embarrassing for the city, it will also increase the costs for future borrowing.

=-=

Mayor Rahm Emanuel criticized the downgrade.

“While Chicago’s financial crisis is very real and at our doorsteps, today’s irresponsible decision by Moody’s to downgrade the City’s credit by two steps goes far beyond that reality,” he said. “Their decision was driven solely by the overturning of a state pension bill that did not include Chicago’s pension reform, yet they did not downgrade the State of Illinois.”

Moody's holds the City accountable, points to the irresponsible SSC decision and Rahm whines about it. Amusing as hell.