Stock are a terrible measure of the health of the economy.

GDP isn't so hot either.

I do agree that stocks aren't a good measure of the economy. However, it is very clear that the market has completely shrugged off this news, because they fully understand that it is not an indicator that we're headed for another recession, and that many other indicators are looking up.

I always have to shake my head at the cycle in Economic reporting....

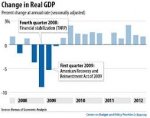

Erm, okay.... You do realize that claiming "the recovery is over" because GDP fell 1% in Q1 is, basically, an extremely primitive form of economic reporting?

Now, I will agree that there are often issues with economic reporting, especially in the middle of a bubble. That doesn't affect the validity of the claims in reference to consumer confidence, home sales rates, inventory rates and so forth.

We haven't fixed anything that was wrong with the 2007 economy.

If you mean that Congress failed to institute sufficient regulation and to reinstate the separation between commercial banks and speculators, or that it has failed to regulate obscure financial products like derivatives and CDS's and CDO's, or that it hasn't forced banks to hold enough reserves, I'd agree. That also doesn't change the fact that the economy does seem to be on a gradual upward path, rather than heading for another recession.

There are also many challenges that are very hard to fix. For example, the population is aging, which is going to put a strain on the economy. The only viable bandage is to allow more (and younger) immigrants, who can in turn work in the US, buy stuff in the US and thus increase tax revenues and economic activity. Some politicians on both sides of the aisle are waking up to this, but I'm not currently optimistic that immigration will be tackled any time soon.

In fact, the only improvement over 2007 is that companies are now stockpiling more cash....

Actually, it is

not great that companies are hoarding cash, because that means employees are getting their wages squeezed, and that capital is not being reinvested into the economy. While it is eminently rational for individual corporations to pursue those courses of actions, it is actually very bad for the economy as a whole, since that capital is locked up and not actually doing anything.

Similarly, many companies do everything they can to reduce their tax burdens. Good for the individual companies, bad for the country as a whole.

this administration is hell bent on taking that stockpile under the pretense of economic equality.

Unless they aren't.

The only thing the Obama administration has done is slightly increase the top marginal tax rate and some capital gains taxes, which has no effect whatsoever on corporate cash holdings. There are no plans to tax corporate cash holdings or similar assets.