- Joined

- Feb 24, 2013

- Messages

- 34,892

- Reaction score

- 19,377

- Gender

- Undisclosed

- Political Leaning

- Conservative

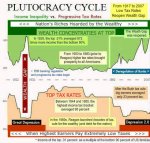

Ehh...the Dow in 1927 (to show a 2 year rally) went from around 150 to 381. Over double the value.

The current rally for the past 2 years goes 13,000 ish to a high of 16,577.

2 years isn't a big deal for inflation (comparing 2012-14 or 1927-29) but using an inflation adjusted DOW for other years we're not very far from the high's in 96 or even the 2006 peak.

Adjusted for inflation the 1929 Dow Jones wasn't hit again after the Great Depression until the late 1960's to just give you some perspective on how inflated that market was. Even the majority of the 50's was spent with a market only half as high as the 1929 pre crash market.

But this isn't actually arguing causation, only correlation. So, for instance, if the correlation were to continue the end result would be the DOW losing all of its gains of the last 2 years and falling to 13,500 this year. That wouldn't be happy times.