solletica

DP Veteran

- Joined

- Feb 5, 2011

- Messages

- 6,073

- Reaction score

- 926

- Gender

- Female

- Political Leaning

- Libertarian

your blatantly dishonest posts are entertaining lots of people

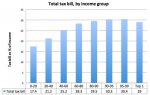

payroll taxes are different than the Federal Income Tax

Really? Explain to us the difference between the payroll tax and you're so called "federal income tax" from the perspective of the average wage-earning taxpayer.

We'd all like to hear it :rofl: