- Joined

- Jan 2, 2006

- Messages

- 28,173

- Reaction score

- 14,269

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

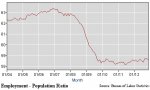

Since you all just love charts so much...

View attachment 67140395

As you can see, there has been virtually no change in the percent of eligible working Americans that have jobs since the recession ended in 2009.

That's 3 years of nothing, nada, zilch, zero, zip...

We can refer to that as a structural shift in the U.S. labor market. Namely the retiring of boomers and a glut of low-skilled/low-wage labor that tends to dominate Anglo-Saxon economies.