I’m having trouble with the bolded above. Say the annual GDP is $16t and a GOOD annual growth rate is 5%. This would equate into an annual GDP increase of $800b. Historic taxation rates have run around 18.5% REGARDLESS of the rates/deductions thus this ‘growth’ would equate to an annual revenue increase of $148b…our annual DEFICIT has been running north of $1t…this wouldn’t cover the latter Bush years when the DEFICIT was running around $400b.

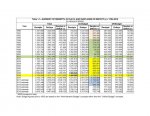

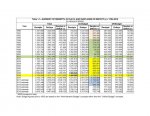

Well, again you are missing a foundational point. Revenues are not fixed to GDP as we do not have a flat tax but a progressive tax. Change in tax revenue is not a linear function of GDP change. In fact, tax revenue to GDP ratio is quite volatile... varying by 5% points in short-order. With GDP at about $16T, a 5% swing is $800B (on an annual basis). That is huge vis-a-vis the deficit. Given our income tax base is about $1.8T, then you can easily see a ...

As the economy more people are in the tax base and more people pay taxes in higher brackets. Hence revenues actually increase much faster than the rate of GDP growth. A perfect example of this was that the ___ GDP drop from 2008 to 2009 created a 16% drop in tax revenues (from $2.5T to $2.1T) and more importantly, a 22% drop in income tax revenue ($1.865T to $1.450T). That fall off in revenue is the single biggest component of the current deficits.

This FOX/Republican induced cliche that the deficit is a result of a spending problem if fundamentally a lie. Yes, there has been spending growth, but not a $1T worth. We have had a massive revenue falloff caused byt a combination of early century tax cuts and a radical recession. That, in and of itself, is NOT my argument for tax increases. Instead, I am trying to point out that a large part of the deficit will fix itself just with an improving economy; if we don't screw it up.

The other huge fallacies being passed around is the idea that 1) you can fix the deficit by cutting expenditures and 2) a dollar of spending cuts means a dollar deficit reduction.

First, there isn't enough spending that can be cut in the short-run. The total of all discretionary spending is $1.3T, with 60% of that defense spending. You could completely shut down the US government, I suppose, but short of that, there are not enough immediate savings. Any savings you get from social programs will be achieved over a very long period of time as these savings can only come from restructuring. Moveover, the idea the if you scrapped any of the social programs than all of the expense would go away is fundamentally unintellectual thinking. Social programs address very real problems (poverty, infirmary, old-age, mental illiness)... those things do not go away simply because there is no social safety... instead the problems go under the rug to resurface in the form of additional stresses on local government as crime, emergency room care and vagrancy.

Second, the notion that a dollar of expenditure cuts is a dollar of deficit reduction is another false notion held the those uneducated in economics. What seems to be lost on people is that government spending goes into the economy, creating jobs and tax revenue. When a government spends a dollar it buys goods and services, which leads to employment, which leads to employees and business owners paying taxes back to the government. Those employees and business owners also buy goods and services, leading to taxes paid those business owners and employees, etc. (there is a multiplier effect). Conversely, cutting expenditures will reverse the process, leading to some reduction in tax receipts for every dollar of expenditure cut.

Given the lion's share of the current deficit is the economic slowdown of 2008 with meager recovery; the lion's share of the solution should be in the recovery... and we should do everything we can to protect the recovery. Screwing around with taxes and debt ceilings and sequester are each threats to the recovery. This is NOT time for political hardball; at least for those that love this country.