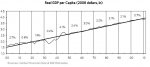

As shown below in chart 1, real per capita GDP has increased at an average rate of a shade less than 2%

over the last 100 years and didn’t vary a lot from that. This is because, over time, knowledge increases,

which in turn raises productivity and living standards. As shown in this chart, over the very long run,

there is relatively little variation from the trend line. Even the Great Depression in the 1930s looks rather

small. As a result, we can be relatively confident that, with time, the economy will get back on track.

However, up close, these variations from trend can be enormous. For example, typically in depressions

the peak-to-trough declines in real economic activity are around 20%, the destruction of financial

wealth is typically more than 50% and equity prices typically decline by around 80%. The losses in

financial wealth for those who have it at the beginning of depressions are typically greater than these

numbers suggest because there is also a tremendous shifting of who has wealth.