Samhain

DP Veteran

- Joined

- Sep 30, 2011

- Messages

- 4,939

- Reaction score

- 2,131

- Location

- Northern Ohio

- Gender

- Undisclosed

- Political Leaning

- Libertarian

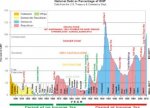

I disagree. The reason the debt is so high is that we cut taxes too much and spent too much on foreign wars and defense spending in general. If we had simply left the top effective tax rate where it was in 1986, the current debt would be quite manageable. If Bush had not cut taxes and invaded Iraq, the debt would be quite manageable. Basically what it comes down to is this: we have to realize that we can't have low taxes and a strong safety net and be the world's police man. We can do one of those, or possibly two, but not all three.

in 1990, 27% of our 1.2 trillion of spending was on defense, 41% of our 1.2 trillion of spending is on entitlements. 37% of revenue was from FICA.

in 2011, 25% of our 3.6 trillion of spending is on defense. 59% of our 3.6 trillion of spending is on entitlements. 40% of revenue was from FICA.

See the problem?

Last edited: