teamosil

DP Veteran

- Joined

- Oct 17, 2009

- Messages

- 6,623

- Reaction score

- 2,226

- Location

- San Francisco

- Gender

- Male

- Political Leaning

- Liberal

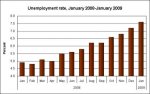

What could I possibly say to you if you sincerely believe the economy is "improving rapidly"? It would be like trying to convince you gravity exists when you insist it doesn't.

So are you claiming that the numbers I am presenting are false? Or that you think that your gut instinct is a better measure of economic success than economic indicators? Or what exactly is your position now?