-

This is a political forum that is non-biased/non-partisan and treats every person's position on topics equally. This debate forum is not aligned to any political party. In today's politics, many ideas are split between and even within all the political parties. Often we find ourselves agreeing on one platform but some topics break our mold. We are here to discuss them in a civil political debate. If this is your first visit to our political forums, be sure to check out the RULES. Registering for debate politics is necessary before posting. Register today to participate - it's free!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Government stimulus

- Thread starter garb

- Start date

More options

Who Replied?celticwar17

DP Veteran

- Joined

- Feb 17, 2011

- Messages

- 6,540

- Reaction score

- 2,524

- Gender

- Male

- Political Leaning

- Libertarian

It hurts... and it doesn't even help the economy in the long run either. The money is so much for efficiently spent by the people, instead of feeding it to an endless money dump a.k.a. the federal government.

Harry Guerrilla

DP Veteran

- Joined

- Dec 18, 2008

- Messages

- 28,951

- Reaction score

- 12,422

- Gender

- Male

- Political Leaning

- Libertarian

Does government spending stimulate the economy or hurt it?

I think the choices are not an "either or" situation.

Government spending can stimulate the economy and hurt it at the same time.

- Joined

- Sep 25, 2008

- Messages

- 3,082

- Reaction score

- 744

- Location

- New Orleans

- Gender

- Male

- Political Leaning

- Moderate

Does government spending stimulate the economy or hurt it?

Well I was sure hoping it would help everybody keep their jobs but that didn't happen. I don't get that our politicians at all understand how important not losing a job is. It is devastating to a family. To the American dream. All that money and you all couldn't keep people working? Cleaning beaches and parks. Painting government buildings? Helping to teach kids? Coaching sports? Directing traffic? Working at a hospital. Preparing government property for sale. Patching pot holes and sidewalks, I don't know. There's a million things need to be done that don't take years of study and planning. Make some effort to help people till things get better!

Mayor Snorkum

Banned

- Joined

- Feb 20, 2011

- Messages

- 1,631

- Reaction score

- 317

- Location

- Los Angeles

- Gender

- Male

- Political Leaning

- Libertarian

The PEOPLE don't spend money they've borrowed from China, AND their debts aren't passed down to their grand children.

Clearly government spending, which today means borrowing, is far more harmful.

Clearly government spending, which today means borrowing, is far more harmful.

- Joined

- Dec 20, 2009

- Messages

- 75,621

- Reaction score

- 39,896

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

Does government spending stimulate the economy or hurt it?

let's see. we're going to take money from a small business owner through taxes, or from an investor through the sale of bonds

.....and spend it studying robot bees.

yeah, i can't see the economic inefficiency there. the business owners and investors probably would have spent that money on something foolish, like hiring new employees.

- Joined

- Dec 20, 2009

- Messages

- 75,621

- Reaction score

- 39,896

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

It hurts... and it doesn't even help the economy in the long run either. The money is so much for efficiently spent by the people, instead of feeding it to an endless money dump a.k.a. the federal government.

okay celtic, new rule. since you always say what i wish i had thought of saying before i get to say it, you're not allowed to post in an interesting thread until i have.

- Joined

- Jun 10, 2009

- Messages

- 27,254

- Reaction score

- 9,350

- Gender

- Male

- Political Leaning

- Liberal

Does government spending stimulate the economy or hurt it?

When there is a recession, or depression, and there is no money being spent in the private market, government spending can shorten the recession by getting the markets moving again. This is the course proscribed by most economists and from our own experience in how government spending for the war during the Great Depression helped bring us out of it, just as our stimulus spending prevented us from continuing on our path in 2007 to another Great depression. Instead, things have improved so much the Republicans are proposing giving the rich more tax cuts.

- Joined

- Dec 20, 2009

- Messages

- 75,621

- Reaction score

- 39,896

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

When there is a recession, or depression, and there is no money being spent in the private market, government spending can shorten the recession by getting the markets moving again.

except that, of course, the government has to raise that money by taxation or borrowing.

which means (roughly) that it is responsible for the market not spending private money - because the private money is being diverted into politicians favorite projects.

from our own experience in how government spending for the war during the Great Depression helped bring us out of it

on the contrary, the US did not recover from the Great Depression until the 1950's; we went through a growth boom when government dramatically cut spending following the succesful conclusion of WWII.

just as our stimulus spending prevented us from continuing on our path in 2007 to another Great depression

:lamo: HOW???

let's see, what is the most successful handling of such a recession in the last century of American history?

oh, i remember, it was the Harding Administration

...America’s greatest depression fighter was Warren Gamaliel Harding. An Ohio senator when he was elected president in 1920, he followed Woodrow Wilson who got America into World War I, contributed to the deaths of 116,708 Americans, built up huge federal bureaucracies, imprisoned dissenters and incurred $25 billion of debt, for which he has been much praised by historians.

Harding inherited the mess, in particular the post-World War I depression – almost as severe, from peak to trough, as the Great Contraction from 1929 to 1933, that FDR inherited and prolonged. Richard K. Vedder and Lowell E. Gallaway, in their book Out of Work (1993), noted that the magnitude of the 1920 depression "exceeded that for the Great Depression of the following decade for several quarters." The estimated gross national product plunged 24% from $91.5 billion in 1920 to $69.6 billion in 1921. The number of unemployed people jumped from 2.1 million in 1920 to 4.9 million in 1921...

Harding’s Budget and Accounting Act of 1921 provided a unified federal budget for the first time in American history. The act established (1) the Bureau of the Budget with a budget director responsible to the president, and (2) the General Accounting Office to help cut wasteful spending.

In the fall of 1921, Harding’s Secretary of Commerce Herbert Hoover prompted him to call a Conference on Unemployment. Hoover wanted government intervention in the economy, which as president he was to pursue when he faced the Great Depression a decade later, but Harding would have none of it. Good thing, since Hoover’s policies were to prolong the Great Depression...

Federal spending was cut from $6.3 billion in 1920 to $5 billion in 1921 and $3.2 billion in 1922. Federal taxes were cut from $6.6 billion in 1920 to $5.5 billion in 1921 and $4 billion in 1922. Harding’s policies started a trend. The low point for federal taxes was reached in 1924. For federal spending, in 1925. The federal government paid off debt, which had been $24.2 billion in 1920, and it continued to decline until 1930...

With Harding’s tax cuts, spending cuts and relatively non-interventionist economic policy, the gross national product rebounded to $74.1 billion in 1922. The number of unemployed fell to 2.8 million – a reported 6.7% of the labor force – in 1922. So, just a year and a half after Harding became president, the Roaring 20s were underway! The unemployment rate continued to decline, reaching a low of 1.8% in 1926 – an extraordinary feat. Since then, the unemployment rate has been lower only once in wartime (1944), and never in peacetime.

"The seven years from the autumn of 1922 to the autumn of 1929," wrote Vedder and Gallaway, "were arguably the brightest period in the economic history of the United States. Virtually all the measures of economic well-being suggested that the economy had reached new heights in terms of prosperity and the achievement of improvements in human welfare. Real gross national product increased every year, consumer prices were stable (as measured by the consumer price index), real wages rose as a consequence of productivity advance, stock prices tripled. Automobile production in 1929 was almost precisely double the level of 1922. It was in the twenties that Americans bought their first car, their first radio, made their first long-distance telephone call, took their first out-of-state vacation. This was the decade when America entered ‘the age of mass consumption.’"...

Last edited:

- Joined

- Jun 10, 2009

- Messages

- 27,254

- Reaction score

- 9,350

- Gender

- Male

- Political Leaning

- Liberal

except that, of course, the government has to raise that money by taxation or borrowing.

It was raised by borrowing as the decsion was made to provide tax cuts instead of paying for it. Once the economy has fully recovered we should cut spending and raise taxes for the rich to pay down the debt, just as we did after we recovered after the Great Depression. This approach resulted in the strongest half century for the midddle class in our history!

on the contrary, the US did not recover from the Great Depression until the 1950's; we went through a growth boom when government dramatically cut spending following the succesful conclusion of WWII.

"the years of the Great Depression (1929–1939)"

Great Depression in the United States - Wikipedia, the free encyclopedia

I would agree with you that as soon as we conclude our wars we should drasicatically cut spending. Our military spending could easily be cut by 4/5 and still be the most powerful military force on the planet. And of course the tax cuts for the rich will have to end if we are to ever get serious about paying down our national debt.

:lamo: HOW???

New coastal plan NOT ready for prime time! | LaCoastPost

Bluepoint daily market view

let's see, what is the most successful handling of such a recession in the last century of American history?

oh, i remember, it was the Harding Administration

"The verdict of history has been severe on Harding. Despite Harding's landside victory, he is considered by many historians to have been the worst Ameican president. A recent biographer thinks that Harding should be related higher. He thinks the affair with Nan Britton, which he disputes, was responsible to a great extent for Harding's reputation. [Dean] HPC might put Bucannan and Hoover ahead of him. Despite the financial scandals, there is no evidence that Harding was personally involved. While Harding was undeniably a poor president, he did little actual damage -- unlike Bucannan and Hoover. Precisely where Hardingb ranks in the Pantheon of American presidents is debateable. That he ranks near the bottom most historians would agree. One historian writes, "The presidency of Warren G. Harding began in mediocrity and ended in corruption." [Fass]

Warren Harding

Last edited:

- Joined

- Dec 20, 2009

- Messages

- 75,621

- Reaction score

- 39,896

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

It was raised by borrowing as the decsion was made to provide tax cuts instead of paying for it.

it was definitely raised by borrowing. massive borrowing. borrowing on a scale never before seen.

government borrowing, of course, serves (like all government spending) to divert resources from productive uses, to unproductive ones. the act of borrowing takes money out of the economy before one puts it back in, but inevitably government puts it back in less where it will produce economic growth, and more where politicians want to spend money.

Once the economy has fully recovered we should cut spending

see, that's the problem. as long as we keep spending like this, the economy will never fully recover.

because it's the spending that's the problem

and raise taxes to pay down the debt

except of course that raising taxes won't raise revenue, it will just depress growth which will impede revenue.

just as we did after we recovered after the Great Depression. This approach resulted in the strongest half century for the midddle class in our history

:lol: the 1970's were that awesome? i seem to remember reading about stagflation, gas lines, shortages, price controls.... yeah, everything was peachy.

"the years of the Great Depression (1929–1939)

the American economy did not reach the level that it was at in 1929 until 1953. Thanks to FDR's Stupid Policies.

even Keynes though the guy was a loony fool. the man used to set the price of gold based off of what felt lucky.

Henry Morgenthau said:"We have tried spending money. We are spending more than we have ever spent before and it does not work. And I have just one interest, and if I am wrong ... somebody else can have my job. I want to see this country prosperous. I want to see people get a job. I want to see people get enough to eat. We have never made good on our promises ... I say after eight years of this Administration we have just as much unemployment as when we started ... And an enormous debt to boot!"

gosh. that doesn't sound familiar... :roll:

I would agree with you that as soon as we conclude our wars we should drasicatically cut spending. Our military spending could easily be cut by 4/5 and still be the most powerful military force on the planet. And of course the tax cuts for the rich will have to end if we are to ever get serious about paying down our national debt.

cutting the military spending by 4/5ths produces an instable world that wrecks trade and destroys our economy. Gates has identified $178 Billion in spending we don't need, which is more than 1/5th of the DOD budget; the Republicans have taken him at his word and cut that spending in their 2012 House Budget. repealing tax cuts for the wealthy - scored statically, which is to say, idiotically optimistically - would net us $80 Bn a year. nowhere near enough. I've shown you the chart enough that you know you're not going to be able to get away with pretending that we can significantly increase revenues through tax hikes.

the entitlements are the ones driving the debt crises. now, and more and more as we look into the next 15 years. they are ultimately what must be trimmed.

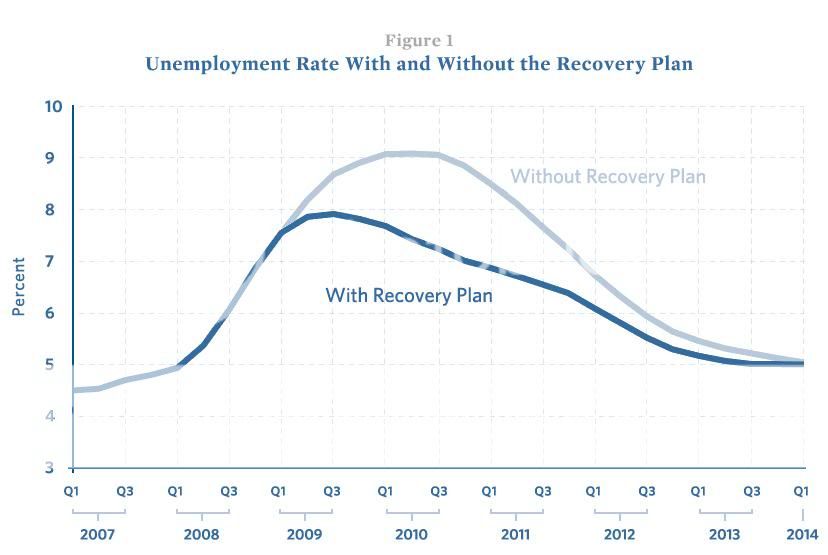

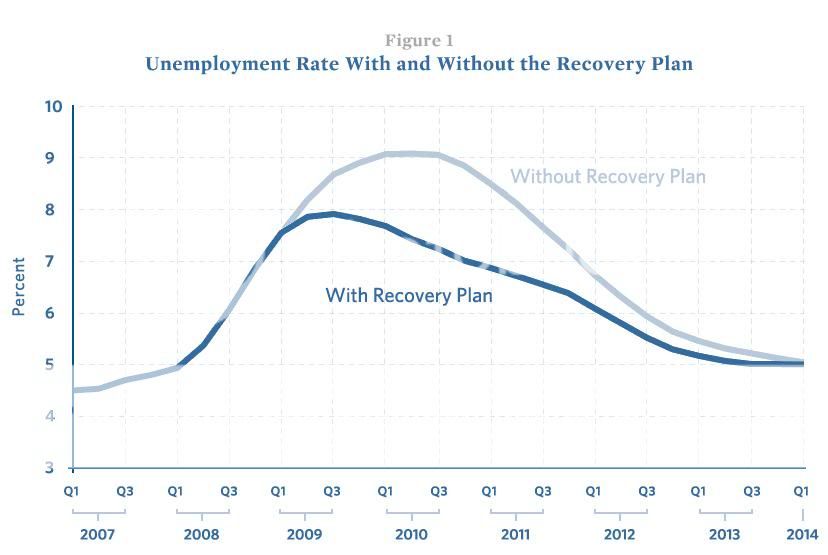

a good chart. but it seems to decieve, and suggest that unemployment was somehow decreasing under Obama. Instead, every month of Obama's Presidency has seen higher unemployment than every month of Bush's. which isn't saying much, that increase in the loss of jobs you note was occuring when BUSH"s "stimulus" plan was busy "priming the pump" and "keeping us out of recession". Then Obama came in, continued Bush's policies, and generally got Bush's results - the economy continued to suffer, unemployment got higher and remained that way. More people are unemployed, more people are underemployed, the main dip (if what we have seen from a "conveniently seasonally adjusted" 9.7 to today's 8.8 can be called "main") to the "unemployment" numbers thus far appears to be people falling off the rolls by stopping their search, and those who find jobs are doing so after longer and longer periods out of work.

to paraphrase Morgenthau; we've spent more money than anyone 10 years ago ever would have thought possible, and we haven't done a damn thing for unemployment; we are left with a suffering economy and a existential threat of a debt to boot.

[/quote]"The verdict of history has been severe on Harding. Despite Harding's landside victory, he is considered by many historians to have been the worst Ameican president. A recent biographer thinks that Harding should be related higher. He thinks the affair with Nan Britton, which he disputes, was responsible to a great extent for Harding's reputation. [Dean] HPC might put Bucannan and Hoover ahead of him. Despite the financial scandals, there is no evidence that Harding was personally involved. While Harding was undeniably a poor president, he did little actual damage -- unlike Bucannan and Hoover. Precisely where Hardingb ranks in the Pantheon of American presidents is debateable. That he ranks near the bottom most historians would agree. One historian writes, "The presidency of Warren G. Harding began in mediocrity and ended in corruption." [Fass]

Warren Harding

hilarious. I post you his numbers and you respond with the Teapot Dome scandal. because your argument can't sustain itself on the numbers. cut taxes, cut spending, pay down debt = watch the economy boom. raise taxes, raise spending, increase debt = watch the economy suffer. that's the lesson of history.

- Joined

- Jun 10, 2009

- Messages

- 27,254

- Reaction score

- 9,350

- Gender

- Male

- Political Leaning

- Liberal

it was definitely raised by borrowing. massive borrowing. borrowing on a scale never before seen.

It doesn't even come close to the amount we've borrowed to pay for the tax cuts and wars for the rich and it wouldn't have even been necessary if the last administration hadn't screwed up the economy so badly.

government borrowing, of course, serves (like all government spending) to divert resources from productive uses, to unproductive ones. the act of borrowing takes money out of the economy before one puts it back in, but inevitably government puts it back in less where it will produce economic growth, and more where politicians want to spend money.

Tell me about it, we went through the same thing for two terms of the last president. Once our economy has fully recovered, we need to drastically cut spending and eliminate the tax cuts for the rich.

see, that's the problem. as long as we keep spending like this, the economy will never fully recover.

I've never heard economists say that spending money hurts the economy in a recession. If you are worried about the debt, eliminate the tax cuts to the rich.

because it's the spending that's the problem

Its both spending and reducing our income that created the problem and the problem won't be fixed by addressing one without the other.

except of course that raising taxes won't raise revenue, it will just depress growth which will impede revenue.

Our history shows just the opposite.

:lol: the 1970's were that awesome? i seem to remember reading about stagflation, gas lines, shortages, price controls.... yeah, everything was peachy.

You have forgotten about the useless war and the oil embargo that that brought that on?

the American economy did not reach the level that it was at in 1929 until 1953. Thanks to FDR's Stupid Policies.

even Keynes though the guy was a loony fool. the man used to set the price of gold based off of what felt lucky.

Economists agree: Stimulus created nearly 3 million jobs

cutting the military spending by 4/5ths produces an instable world that wrecks trade and destroys our economy.

No, it still leaves us with the most powerful military on the planet.

the entitlements are the ones driving the debt crises. now, and more and more as we look into the next 15 years. they are ultimately what must be trimmed.

I don't see it that way:

United States Military Spending

a good chart. but it seems to decieve, and suggest that unemployment was somehow decreasing under Obama.

Thanks for your opinion. I'll go with the facts.

cut taxes, cut spending, pay down debt = watch the economy boom.

Trickle down theory. Been there, done that for the last 30 years and it just made things worse. No thanks! You cut the spending for the optional wars and the imperial size military and pay down the national debt and then we'll talk about tax cuts for the rich. :sun

Last edited:

Troubadour

Banned

- Joined

- Oct 12, 2010

- Messages

- 464

- Reaction score

- 181

- Gender

- Male

- Political Leaning

- Liberal

Does government spending stimulate the economy or hurt it?

Obviously it depends on the particulars. I think asking the question in such simplistic terms hurts the debate, because it reduces the matter to dueling ideologies rather than a rational examination of policy priorities. If I go out and spend my money on strippers, that's not going to improve my personal finances; but if I just live like a survivalist in a bunker and don't spend money at all, I won't realize any kind of benefit from my discipline. Education, healthcare, science, transportation, and communications are all more or less intrinsically beneficial investments (with standard caveats - e.g., due diligence against corruption and inefficiency).

samsmart

DP Veteran

- Joined

- Dec 7, 2009

- Messages

- 10,315

- Reaction score

- 6,470

- Gender

- Male

- Political Leaning

- Other

Does government spending stimulate the economy or hurt it?

The answer isn't black and white.

When we have a good economy, we should lower government borrowing but we should keep tax levels where they are at. Which means we shouldn't cut taxes but shouldn't raise them either. Because in a good economy more private entities are able to pursue necessary functions.

When we have a bad economy, we should increase government borrowing and lower government fees. By this, I mean we should reduce the fees for business licenses and so forth on a temporary basis. This way we can keep tax levels where they are at but decrease economic disincentives. This combination will help spur the economy again.

Our current problem right now is that during the Bush years (which is likely just as much the fault of Congress as it is the fault of GWB - I'm just saying "Bush years" for a timeline) is that taxes were lowered at the same time government borrowing increased. This was done to pay for the wars in Iraq, Afghanistan, and against Global Terror.

But what this means is that the U.S. didn't have the capability to be ready against the current Great Recession. So we are now in the crisis that because we borrowed money to pay for the wars without raising tax revenues, we are also in a bad economy because of the collapse of 1) the credit market, 2) the housing market, and 3) the mortgage market.

Personally, I really think we should do some kind of constitutional amendment that forces the government to use taxes to pay for the wars that our federal government decides to put us in. Perhaps a constitutional amendment that says should the President deploy the armed soldiers in any conflict for over 90 days (which the President is allowed to do according to the War Powers Act) then an immediate national sales tax is applied to all purchases in the United States.

This has the benefit of both paying for any conflicts even when Congress doesn't declare war and it makes people feel the wars the government decides to go forth on, which many critics, both in the military and out, feel should happen for the good of America.

samsmart

DP Veteran

- Joined

- Dec 7, 2009

- Messages

- 10,315

- Reaction score

- 6,470

- Gender

- Male

- Political Leaning

- Other

The PEOPLE don't spend money they've borrowed from China, AND their debts aren't passed down to their grand children.

Clearly government spending, which today means borrowing, is far more harmful.

Government spending isn't in itself harmful.

Rather a number of things that the government chooses to spend tax money on is.

- Joined

- Dec 20, 2009

- Messages

- 75,621

- Reaction score

- 39,896

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

It doesn't even come close to the amount we've borrowed to pay for the tax cuts and wars for the rich and it wouldn't have even been necessary if the last administration hadn't screwed up the economy so badly.

8 years of war in Iraq cost less than the Stimulus

and that's just the stimulus, that's not counting the massive federal deficits of this year or last; both of whom were larger than the "stimulus" bill. don't get me wrong, the wars were expensive; but they weren't as big as the expansions under Obama

Tell me about it, we went through the same thing for two terms of the last president.

on a smaller scale, ergo, as it was doing less damage.

Once our economy has fully recovered, we need to drastically cut spending and eliminate the tax cuts for the rich.

ah. so once we are up in the air we will see if we can take off from the ground? so long as spending remains as large a % of the economy as it is, we won't fully recover. look elsewhere in the world - where government spending is the % of GDP that ours is, unemployment is high and growth is low. that is not a coincidence.

I've never heard economists say that spending money hurts the economy in a recession.

then very likely you have only been paying attention to keyensians, who live and breathe by the broken window fallacy.

If you are worried about the debt, eliminate the tax cuts to the rich.

eliminating the tax cuts to the rich won't bring in much (if any) extra revenue.

what is needed is to strip out all the tax incentives in the code, all the allocations and loopholes etc and use that to lower rates while maintaining revenue - just like the Bi-Partisan Bowles-Simpson Commission suggested. that way you keep a solid flow of income, while also boosting growth. you get the positive economic benefit of a tax cut for free.

Its both spending and reducing our income that created the problem and the problem won't be fixed by addressing one without the other.

if you repeal the bush tax cuts for the rich that will (again, statically, which is to say hopelessly optimistically, scoring) get you $80Bn a year. our deficit is $1.6 Trillion a year. you could literally confiscate 100% of every dollar earned by those making $100K and above and it wouldn't be enough to cover our current spending, much less the entitlements explosion.

Our history shows just the opposite.

on the contrary; recessions that were met by increased government spending and intervention tend to take longer to recover. those that are met by decreaed government spending and intervention (or nothing) recover quicker. for ease, compare the market crashes of 1920 and 1929, and the market crashes of 1987 and 2008. doing nothing or (better) cutting spending and taxes gets us out of recession; spending keeps us in.

You have forgotten about the useless war and the oil embargo that that brought that on?

inflation was a deliberate policy - no war brought on price controls, and unemployment was higher than it is today. tell me more about this "strongest time in our history" that gave rise to the "misery index"

1. i think it's hilarious that you answer points about FDR's failures by claiming success for Obama's Stimulus

2. Obama's stimulus didn't create 3 million jobs, the "counter" "Sheriff Joe" Biden failed miserably - jobs were "created" in districts that didnt' exist - jobs that recieved raises were counted as "created"; one guy managed to "create" something like 10 jobs on a $40,000 grant... the "jobs saved or created" metric was so ridiculous (and ridiculed) that even the administration has dropped it, and seeks desperately to keep the phrase "stimulus" from being added to any new spending legislation. what growth we did get was in productivity increase - which is supply side, not demand. the assumption that "the stimulus created 3 million jobs" is built on a simple multiplier which is itself useless because it does not consider where the money came from.

3. in the meantime, labor force participation is at the lowest point since the takeoff of the Reagan Boom, and people are dropping out of the labor force, not coming in. two years after he passed the dang thing, unemployment has never dropped below what Obama promised us would be the highest it could ever get under his brilliant "plan".

No, it still leaves us with the most powerful military on the planet.

which is immaterial. the question isn't whether or not we are the most powerful, the question is whether we are a defacto hegemon. loss of that centralizing and stabilizing world force is what i'm talking about, not invasion.

I don't see it that way:

well, that's probably because your chart is of discretionary spending, and doesn't have entitlements on it.

but by 2020, entitlement spending will absorb 100% of our tax dollars. that means no Department of Education, no Department of Agriculture, no Department of Defense, no Department of Homeland Security, no Department of Housing and Urban Development, no FBI, no Department of Justice, no federal prisons, no Coast Guard, no Post Office....

but that is a joke, of course; because A) we will try to keep those things and B) we will have to pay interest on the national debt, which is also slated to rise dramatically. Mandatory spending is the majority of our budget today, and that percentage is only going to grow.

why do we have to cut the entitlemenets? because together they will cost more than our entire budget. so we can either reform them now, in a manner that we choose, or our creditors will do it in a manner that they choose in about 6 years or so; and we will be Greece. How much do you trust China to have our citizens' best interest at heart when that day comes?

Thanks for your opinion. I'll go with the facts.

then you will be persuaded by my post above that the notion that we can just raise taxes on the wealthy and not cut the entitlements is unfounded.

Last edited:

- Joined

- Apr 15, 2011

- Messages

- 5,302

- Reaction score

- 5,084

- Location

- New York

- Gender

- Male

- Political Leaning

- Undisclosed

FDR tried to spend his way out of the great depression, and failed. WW2 ended up bailing us out. Anytime legislation interferes with the forces of the market recovery tends to be delayed. The invisible hand does work, sometimes less regulation works better, especially during recessions. Is the law of supply and demand perfect, no. However, spending does not work. You can't dig yourself out of a hole.

Badmutha

Banned

- Joined

- Jan 27, 2011

- Messages

- 1,951

- Reaction score

- 395

- Gender

- Undisclosed

- Political Leaning

- Undisclosed

When there is a recession, or depression, and there is no money being spent in the private market, government spending can shorten the recession by getting the markets moving again. This is the course proscribed by most economists and from our own experience in how government spending for the war during the Great Depression helped bring us out of it, just as our stimulus spending prevented us from continuing on our path in 2007 to another Great depression. Instead, things have improved so much the Republicans are proposing giving the rich more tax cuts.

Perhaps there would be truth to your statement.......if all evidence didnt prove it was an outright lie........

Unemployment Rate Since Obama's "Stimulus/Jobs Bill"

......and yet there are those that still believe in the fantasy of Government Stimulus via massive government spending.......

.

.

.

.

- Joined

- Dec 20, 2009

- Messages

- 75,621

- Reaction score

- 39,896

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

FDR tried to spend his way out of the great depression, and failed. WW2 ended up bailing us out

see, I've never been able to understand why everyone thinks that. WWII "solved" unemployment via the draft, but the US populace suffered more economically during the war than they had during the Depression. Whereas before things were expensive, now they simply couldn't be bought. we were rationing tires, gasoline, eggs, ladies nylons. buying a car was out of the question unless you were a doctor, or could demonstrate some other kind of extreme need. FDR ceased waging war on Big Business, and so the effort of propaganda shifted, but by objective measures American citizens were worse off during the war than prior to it.

immediately after the war, we cut spending dramatically. again, all of Catawaba's Keynsian economists swore up and down that we would be throwing the country back into the Great Depression, just as today they swear up and down that reducing government spending will destroy the "recovery". instead we got a readjustment of resources that created the the post-war "boom"

...THE DEPRESSION OF 1946

Historically minded readers may be saying, "There was a Depression in 1946? I never heard about that." You never heard of it because it never happened. However, the "Depression of 1946" may be one of the most widely predicted events that never happened in American history. As the war was winding down, leading Keynesian economists of the day argued, as Alvin Hansen did, that "the government cannot just disband the Army, close down munitions factories, stop building ships, and remove all economic controls." After all, the belief was that the only thing that finally ended the Great Depression of the 1930s was the dramatic increase in government involvement in the economy. In fact, Hansen's advice went unheeded. Government canceled war contracts, and its spending fell from $84 billion in 1945 to under $30 billion in 1946. By 1947, the government was paying back its massive wartime debts by running a budget surplus of close to 6 percent of GDP. The military released around 10 million Americans back into civilian life. Most economic controls were lifted, and all were gone less than a year after V-J Day. In short, the economy underwent what the historian Jack Stokes Ballard refers to as the "shock of peace." From the economy's perspective, it was the "shock of de-stimulus."

If the wartime government stimulus had ended the Great Depression, its winding down would certainly lead to its return. At least that was the consensus of almost every economic forecaster, government and private. In August 1945, the Office of War Mobilization and Reconversion forecast that 8 million would be unemployed by the spring of 1946, which would have amounted to a 12 percent unemployment rate. In September 1945, Business Week predicted unemployment would peak at 9 million, or around 14 percent. And these were the optimistic predictions. Leo Cherne of the Research Institute of America and Boris Shishkin, an economist for the American Federation of Labor, forecast 19 and 20 million unemployed respectively — rates that would have been in excess of 35 percent!

What happened? Labor markets adjusted quickly and efficiently once they were finally unfettered — neither the Hoover nor the Roosevelt administration gave labor markets a chance to adjust to economic shocks during the 1930s when dramatic labor market interventions (e.g., the National Industrial Recovery Act, the National Labor Relations Act, the Fair Labor Standards Act, among others) were pursued. Most economists today acknowledge that these interventionist polices extended the length and depth of the Great Depression. After the Second World War, unemployment rates, artificially low because of wartime conscription, rose a bit, but remained under 4.5 percent in the first three postwar years — below the long-run average rate of unemployment during the 20th century. Some workers voluntarily withdrew from the labor force, choosing to go to school or return to prewar duties as housewives.

But, more importantly to the purpose here, many who lost government-supported jobs in the military or in munitions plants found employment as civilian industries expanded production — in fact civilian employment grew, on net, by over 4 million between 1945 and 1947 when so many pundits were predicting economic Armageddon.

Household consumption, business investment, and net exports all boomed as government spending receded. The postwar era provides a classic illustration of how government spending "crowds out" private sector spending and how the economy can thrive when the government's shadow is dramatically reduced....

Anytime legislation interferes with the forces of the market recovery tends to be delayed. The invisible hand does work, sometimes less regulation works better, especially during recessions. Is the law of supply and demand perfect, no. However, spending does not work. You can't dig yourself out of a hole.

Truth. I once had a math teacher who told me that 1+1 could = 3, for sufficiently large enough values of "1". which is perhaps a neat trick on paper; but I wouldn't build an aircraft based on that math. somtimes, it takes smart people to make boneheaded mistakes, and the "we can spend our way out of trouble" crowd is following them.

- Joined

- Jun 10, 2009

- Messages

- 27,254

- Reaction score

- 9,350

- Gender

- Male

- Political Leaning

- Liberal

8 years of war in Iraq cost less than the Stimulus

and that's just the stimulus, that's not counting the massive federal deficits of this year or last; both of whom were larger than the "stimulus" bill. don't get me wrong, the wars were expensive; but they weren't as big as the expansions under Obama

The three trillion dollar war

The cost of the Iraq and Afghanistan conflicts have grown to staggering proportions

"Because there are so many costs that the Administration does not count, the total cost of the war is higher than the official number. For example, government officials frequently talk about the lives of our soldiers as priceless. But from a cost perspective, these “priceless” lives show up on the Pentagon ledger simply as $500,000 - the amount paid out to survivors in death benefits and life insurance. After the war began, these were increased from $12,240 to $100,000 (death benefit) and from $250,000 to $400,000 (life insurance). Even these increased amounts are a fraction of what the survivors might have received had these individuals lost their lives in a senseless automobile accident. In areas such as health and safety regulation, the US Government values a life of a young man at the peak of his future earnings capacity in excess of

$7 million - far greater than the amount that the military pays in death benefits. Using this figure, the cost of the nearly 4,000 American troops killed in Iraq adds up to some $28 billion.

The costs to society are obviously far larger than the numbers that show up on the government's budget. Another example of hidden costs is the understating of US military casualties. The Defence Department's casualty statistics focus on casualties that result from hostile (combat) action - as determined by the military. Yet if a soldier is injured or dies in a night-time vehicle accident, this is officially dubbed “non combat related” - even though it may be too unsafe for soldiers to travel during daytime.

In fact, the Pentagon keeps two sets of books. The first is the official casualty list posted on the DOD website. The second, hard-to-find, set of data is available only on a different website and can be obtained under the Freedom of Information Act. This data shows that the total number of soldiers who have been wounded, injured, or suffered from disease is double the number wounded in combat. Some will argue that a percentage of these non-combat injuries might have happened even if the soldiers were not in Iraq. Our new research shows that the majority of these injuries and illnesses can be tied directly to service in the war.

From the unhealthy brew of emergency funding, multiple sets of books, and chronic underestimates of the resources required to prosecute the war, we have attempted to identify how much we have been spending - and how much we will, in the end, likely have to spend. The figure we arrive at is more than $3 trillion. Our calculations are based on conservative assumptions. They are conceptually simple, even if occasionally technically complicated. A $3 trillion figure for the total cost strikes us as judicious, and probably errs on the low side. Needless to say, this number represents the cost only to the United States. It does not reflect the enormous cost to the rest of the world, or to Iraq."

ah. so once we are up in the air we will see if we can take off from the ground? so long as spending remains as large a % of the economy as it is, we won't fully recover.

Cutting taxes for the rich without cutting spending is what got us into this trouble to begin with. It all began in 1981 under the Reagan Administration. Spending has to be cut before we reduce revenues or we just end up with more debt. We have 30 years of experience to show is this is true. When they decide to cut the spending for our optional wars and the rich start paying their fair share again, then we will know they are serious about deficit spending.

eliminating the tax cuts to the rich won't bring in much (if any) extra revenue.

It did increase revenue when they were raised under Clinton. We went from a budget deficit to a budget surplus.

I agree we need to eliminate tax loopholes, then we need to look at targeted tax cuts to those that actually produce jobs and not to continue to give money to someone just because they are rich.

if you repeal the bush tax cuts for the rich that will (again, statically, which is to say hopelessly optimistically, scoring) get you $80Bn a year.

Now combine that with drastic cuts in our spending on optional wars and our imperialistic sized military spending and you are talking some real money.

our deficit is $1.6 Trillion a year. you could literally confiscate 100% of every dollar earned by those making $100K and above and it wouldn't be enough to cover our current spending, much less the entitlements explosion.

Most of that is due to health care costs. Eventually we will have to go to National health care like the rest of the first world nations to address that problem. We have the most expensive health care system in the world and it is completely unaffordable. SS is an easy fix. Just lock the funds and raise the Cap.

on the contrary; recessions that were met by increased government spending and intervention tend to take longer to recover. those that are met by decreaed government spending and intervention (or nothing) recover quicker. for ease, compare the market crashes of 1920 and 1929, and the market crashes of 1987 and 2008. doing nothing or (better) cutting spending and taxes gets us out of recession; spending keeps us in.

I'll go with the economist's assessment thanks.

inflation was a deliberate policy - no war brought on price controls, and unemployment was higher than it is today. tell me more about this "strongest time in our history" that gave rise to the "misery index"

The bygone middle-class golden era

“Dubbed ‘median wage stagnation’ by economists, the annual incomes of the bottom 90 per cent of US families have been essentially flat since 1973 – having risen by only 10 per cent in real terms over the past 37 years. [...] In the last expansion, which started in January 2002 and ended in December 2007, the median US household income dropped by $2,000 – the first ever instance where most Americans were worse off at the end of a cycle than at the start. Worse is that the long era of stagnating incomes has been accompanied by something profoundly un-American: declining income mobility…

“…Nowadays in America, you have a smaller chance of swapping your lower income bracket for a higher one than in almost any other developed economy – even Britain on some measures. To invert the classic Horatio Alger stories, in today’s America if you are born in rags, you are likelier to stay in rags than in almost any corner of old Europe. Combine those two deep-seated trends with a third – steeply rising inequality – and you get the slow-burning crisis of American capitalism. It is one thing to suffer grinding income stagnation. It is another to realise that you have a diminishing likelihood of escaping it…

“…[renowned Harvard economist Larry Katz] offers the most compelling analogy. ‘Think of the American economy as a large apartment block,’ says the softly spoken professor. ‘A century ago – even 30 years ago – it was the object of envy. But in the last generation its character has changed. The penthouses at the top keep getting larger and larger. The apartments in the middle are feeling more and more squeezed and the basement has flooded. To round it off, the elevator is no longer working. That broken elevator is what gets people down the most.’”

The picture painted is that of a triple threat to the middle-class engine of the US economy: stagnating wages for most, diminished opportunity for upward income mobility, and rising income inequality. According to the FT, a substantial majority of polled Americans “expect their children to be worse off than they are,” and with that the “golden era of the American middle class” remains on the decline."

The bygone middle-class golden era - CSMonitor.com

1. i think it's hilarious that you answer points about FDR's failures by claiming success for Obama's Stimulus

Have you noticed the what the thread topic happens to be?

2. Obama's stimulus didn't create 3 million jobs

Thanks for your opinion.

which is immaterial. the question isn't whether or not we are the most powerful, the question is whether we are a defacto hegemon. loss of that centralizing and stabilizing world force is what i'm talking about, not invasion.

Please reference our responsibility to control the world through hegemony in the Constitution. There is no such thing. We are only charged with providing for the common defense.

"1de·fense

noun

\di-ˈfen(t)s; as antonym of “offense,” often ˈdē-ˌ\

Definition of DEFENSE

1

a : the act or action of defending <the defense of our country> <speak out in defense of justice> b : a defendant's denial, answer, or plea

2

a : capability of resisting attack b : defensive play or ability <a player known for good defense>

3

a : means or method of defending or protecting oneself, one's team, or another; also : a defensive structure b : an argument in support or justification c : the collected facts and method adopted by a defendant to protect and defend against a plaintiff's action d : a sequence of moves available in chess to the second player in the opening

4

a : a defending party or group (as in a court of law) <the defense rests> b : a defensive team

5

: the military and industrial aggregate that authorizes and supervises arms production <appropriations for defense> <defense contract> "

Defense - Definition and More from the Free Merriam-Webster Dictionary

I don't see any mention of hegemony in the definition of defense, or in the Constitution.

- Joined

- Jun 10, 2009

- Messages

- 27,254

- Reaction score

- 9,350

- Gender

- Male

- Political Leaning

- Liberal

WW2 ended up bailing us out.

Right, spending on WW2 helped bail us out just as spending helped bail us out of this recession.

- Joined

- Jun 10, 2009

- Messages

- 27,254

- Reaction score

- 9,350

- Gender

- Male

- Political Leaning

- Liberal

Perhaps there would be truth to your statement.......if all evidence didnt prove it was an outright lie........

Unemployment Rate Since Obama's "Stimulus/Jobs Bill"

......and yet there are those that still believe in the fantasy of Government Stimulus via massive government spending.......

.

.

.

.

Unreferenced graphs prove nothing.

- Joined

- Dec 20, 2009

- Messages

- 75,621

- Reaction score

- 39,896

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

The three trillion dollar war

The cost of the Iraq and Afghanistan conflicts have grown to staggering proportions

"Because there are so many costs that the Administration does not count, the total cost of the war is higher than the official number. For example, government officials frequently talk about the lives of our soldiers as priceless. But from a cost perspective, these “priceless” lives show up on the Pentagon ledger simply as $500,000 - the amount paid out to survivors in death benefits and life insurance. After the war began, these were increased from $12,240 to $100,000 (death benefit) and from $250,000 to $400,000 (life insurance). Even these increased amounts are a fraction of what the survivors might have received had these individuals lost their lives in a senseless automobile accident. In areas such as health and safety regulation, the US Government values a life of a young man at the peak of his future earnings capacity in excess of $7 million - far greater than the amount that the military pays in death benefits. Using this figure, the cost of the nearly 4,000 American troops killed in Iraq adds up to some $28 billion....

...From the unhealthy brew of emergency funding, multiple sets of books, and chronic underestimates of the resources required to prosecute the war, we have attempted to identify how much we have been spending - and how much we will, in the end, likely have to spend. The figure we arrive at is more than $3 trillion... A $3 trillion figure for the total cost strikes us as judicious, and probably errs on the low side. Needless to say, this number represents the cost only to the United States. It does not reflect the enormous cost to the rest of the world, or to Iraq."

hilarious. even if you seek out every possible way to stretch expanding the cost of the wars as far as you can (accounting for the future productivity of casualties? really? even though this doesnt' increase the cost to the government one red cent?) and engage in mathematical shenanigans that are beyond the ridiculous (that last bolded bit tells the story - they are looking for something that "feels" right, not something reflected in the math), and then if you just extend these projections into the future, you still can't get their combined costs over a decade to come to more than our deficit spending for the past two years alone.

look man, i know that you hate them, but the fact is that the wars are winding down, and they just plain aren't the long-term drivers of our debt. they contributed to the deficit,to be sure; so did boosting spending on education. but up until the Bush Administration decided to engage in keynesian "stimulus" (which you ought to be in favor of - i find it intriguing that you attack the cost of the wars, when your own economic strategy says that they were boosting the economy) the deficits were problematic, but relatively small - from 2001 to 2007 they averaged around 1/10th of Obama's. From 2000 to 2008[, the debt held by the public went from 35.1% of GDP to 40.8% -- a 5.7% of GDP increase; certainly that's not good. But under the Presidents' plan, between 2008 and 2016, it is expected to reach 77.5% -- a 36.7% of GDP increase.

here, a pretty basic visual imaging of the budget differences in the context of the late budget debate:

Cutting taxes for the rich without cutting spending is what got us into this trouble to begin with.

i would like to see any evidence that you can provide that this fantastic claim is correct. up until 2009 (when we went into a keynsian-inspired recession), our tax revenues remained on their historical average as a % of GDP, and other threads in these forums have demonstrated how tax revenues in total went up after Reagan reformed the tax structure. Revenues have historically been fine - it's the spending that expands far beyond revenues' ability to keep up that is the problem.

It all began in 1981 under the Reagan Administration. Spending has to be cut before we reduce revenues or we just end up with more debt. We have 30 years of experience to show is this is true. When they decide to cut the spending for our optional wars and the rich start paying their fair share again,

:roll: actually, No Country Leans on Upper-Income Households as Much as U.S., and Over the past 30 years it has actually become more progressive as measured by revenues.

because people are rational actors and avoid high tax rates.

and it's the revenues that are important - not the rates. the rates only matter if - like the President - you care less about revenue and more about tearing down the rich because you think that's "fair" (a highly subjective value).

It did increase revenue when they were raised under Clinton. We went from a budget deficit to a budget surplus.

actually the tax hike under clinton came in significantly under predictions; it's open to question if we had even seen an increase at all that wasn't driven by coming out of the recession that had elected him. Now, Clinton DID see a dramatic increase in revenues when he cut capital gains tax rates.

I agree we need to eliminate tax loopholes, then we need to look at targeted tax cuts to those that actually produce jobs and not to continue to give money to someone just because they are rich.

we need to close the loopholes straight up - and again i would say that's with the exception of the child-credit. low income families with kids are unlikely to qualify for a serious amount of other deductions, but they deserve that break. but "giving tax breaks to those who produce jobs" is just creating a whole new series of loopholes. the only way i can think of to do this without just recreating the problem is to reduce the employers' side of the payroll tax.

OR we could start reducing job-killing regulation; and tell the EPA to shut up about Cap-and-Tax. that's another cost-free way that we could increase employment.

Most of that is due to health care costs. Eventually we will have to go to National health care like the rest of the first world nations to address that problem. We have the most expensive health care system in the world and it is completely unaffordable.

the problem with that solution is that it makes healthcare more unaffordable, less responsive, and requires the government to impose strict rationing in order to survive. we would be far better off if we go with the model that has already been demonstrated to reduce costs without reducing the quality of care.

SS is an easy fix. Just lock the funds and raise the Cap.

as i've told you before; locking the funds at this point is useless because we are already running a deficit in social security - money is flowing from the general fund to the trust fund, not other way 'round. and raising the cap doesn't bring in enough revenue to cover the shortfalls. not by a long shot.

our unfunded liability for the entitlement programs is larger than world GDP, there isnt' enough money in existance. we have written ourselves a series of bad checks, chargeable to the younger generation, and now those checks are about to start bouncing. we have three basic options:

1. reform the entitlement system in such a way as to cut future expenditures while doing the least harm to seniors

2. hyperinflate the money supply while holding benefits below the rate of inflation (which is really another version of #1; but comes along with world economic collapse)

3. do nothing and see an economic collapse within the decade as our creditors refuse to lend us any more money to feed into what is clearly a broken system. we are forced by our creditors to begin throwing the elderly off the entitlements whole-sale.

as a side note; currently the President, the Democrats in Congress, and progressives on this board are urging us to pursue option #3.

Last edited:

- Joined

- Dec 20, 2009

- Messages

- 75,621

- Reaction score

- 39,896

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

I'll go with the economist's assessment thanks.

:shrug: as will I. the fact is that economists disagree on this matter, the problem is that keynsians are stuck on a circular argument, which is why their position is 1. self-reinforcing and 2. non-falsifiable. but it's interesting you don't have anything to dispute the fact that recessions met with increases in government intervention tend to last longer, but those met with government tax cuts don't, and those met with government tax and spending cuts recover fastest of all.

Here: some light reading for you on the comparative "stimulus" of government spending v tax cuts.

...Some excellent work on this topic has come from Valerie Ramey of the University of California, San Diego. Ramey finds a government-spending multiplier of about 1.4 — a figure close to what the Obama administration assumed, but much smaller than the tax multiplier identified by the Romers. Similarly, in recent research, Andrew Mountford (of the University of London) and Harald Uhlig (of the University of Chicago) have used sophisticated statistical techniques that try to capture the complicated relationships among economic variables over time; they conclude that a "deficit-financed tax cut is the best fiscal policy to stimulate the economy." In particular, they report that tax cuts are about four times as potent as increases in government spending.

Perhaps the most compelling research on this subject is a very recent study by my colleagues Alberto Alesina and Silvia Ardagna at Harvard. They used data from the Organization for Economic Cooperation and Development to identify every major fiscal stimulus adopted by the 30 OECD countries between 1970 and 2007. Alesina and Ardagna then separated those plans that were in fact followed by robust economic growth from those that were not, and compared their characteristics. They found that the stimulus packages that appeared to be successful had cut business and income taxes, while those that evidently did not succeed had increased government spending and transfer payments.

The data in the Alesina-Ardagna study are mostly European; only a small portion comes from the United States. But the evidence leads to conclusions that are very similar to those from Mountford and Uhlig's work using American data. These conclusions are also consistent with the work of Ramey and the Romers, which looked at the historical record to identify multipliers. There appears to be a growing body of evidence, then, suggesting that taxes may be a better tool for fiscal stimulus than conventional models have indicated....

The bygone middle-class golden era

“Dubbed ‘median wage stagnation’ by economists, the annual incomes of the bottom 90 per cent of US families have been essentially flat since 1973 – having risen by only 10 per cent in real terms over the past 37 years. [...]

:lol: these fools are measuring against CPI to produce "real" income instead of inflation.

SURPRISE! it costs more to buy a home computer in 2010 than it did not to buy one in 1975!!! who could have guessed?

the middle class today lives in bigger, better houses; it drives more, better cars (CPI also doesn't account for increases in quality); it recieves more, higher quality healthcare; more of them attend college, own computers, about the only thing they have "suffered" on is that now they are taught in a comparatively weaker public school system (thanks, unions!) and they aren't saving like their forebears did.

why do we know that our children will be worse off? because we're going to make them pay for the massive amount of government spending we've loaded onto ourselves.

Have you noticed the what the thread topic happens to be?

yes. have you noticed yet that you completely tried to change the subject from the failures of FDR's "Stimulus"?

Thanks for your opinion.

it's not my opinion; it's basic fact. we lost jobs through that period, we certainly didn't gain 3 million. the only way you can get to that number is to ignore reality on the ground and just run "Dollars Spent" through "Desired Multiplier".

look; i can do it too: I just went and bought a six-pack; and paid too much because i bought it from my hotels' shoppette; i paid $9.

however, so long as we assume that the multiplier is higher than historical evidence suggests (if you will read the report above, for example, you will note that the multiplier that Obama's team ordered utilized - poor CBO, everyone abuses them - was '3', whereas most keynsians have stuck to around '1.4'), and is actually 1.55 trillion, then I have just doubled the GDP of the United States. however, GDP hasn't moved all that much in actual terms. hmm. well, we know that I spent the 9 dollars. and we know that our multiplier is 1.55 Trillion.

GASP!

i just saved the entire US economy!. because 14 trillion minus 14 trillion is zero... then that means that once you take out the effects of my purchasing that six pack, the economy doesn't exist... which means that my six pack purchase is directly responsible for over a hundred million jobs saved or created.

Please reference our responsibility to control the world through hegemony in the Constitution. There is no such thing. We are only charged with providing for the common defense.

you are correct - but the Founding Fathers don't say how forward leaning providing for the commond defense is. Is keeping our economy from crashing by protecting vital trade routes defense? is keeping near-peer competitors from rising to challenge the US by maintaining strong regional alliances with fellow democracies defense?

the Founding Fathers, it's worth noting, discussed the inevitable American Empire, which they saw as stretching from Canada to (in some cases) South America. their notion of "common defense" included the Monroe Doctrine, which extended our power over the entire hemisphere. they invaded lands in North Africa, and kept a forward-deployed naval fleet. when France seemed to be turning into a representative government, they leapt to form a lasting bond with her, held back only by those who feared (accurately) her rapid descent into terror and tyranny.

we are safer and wealthier because of the current world order; a system whose lynchpin is our own military and economic might. getting rid of either of those crashes the system, which endangers Americans.

- Joined

- Dec 20, 2009

- Messages

- 75,621

- Reaction score

- 39,896

- Location

- USofA

- Gender

- Male

- Political Leaning

- Conservative

I'll go with the economist's assessment thanks.

:shrug: as will I. the fact is that economists disagree on this matter, the problem is that keynsians are stuck on a circular argument, which is why their position is 1. self-reinforcing and 2. non-falsifiable. but it's interesting you don't have anything to dispute the fact that recessions met with increases in government intervention tend to last longer, but those met with government tax cuts don't, and those met with government tax and spending cuts recover fastest of all.

Here: some light reading for you on the comparative "stimulus" of government spending v tax cuts.

...Some excellent work on this topic has come from Valerie Ramey of the University of California, San Diego. Ramey finds a government-spending multiplier of about 1.4 — a figure close to what the Obama administration assumed, but much smaller than the tax multiplier identified by the Romers. Similarly, in recent research, Andrew Mountford (of the University of London) and Harald Uhlig (of the University of Chicago) have used sophisticated statistical techniques that try to capture the complicated relationships among economic variables over time; they conclude that a "deficit-financed tax cut is the best fiscal policy to stimulate the economy." In particular, they report that tax cuts are about four times as potent as increases in government spending.

Perhaps the most compelling research on this subject is a very recent study by my colleagues Alberto Alesina and Silvia Ardagna at Harvard. They used data from the Organization for Economic Cooperation and Development to identify every major fiscal stimulus adopted by the 30 OECD countries between 1970 and 2007. Alesina and Ardagna then separated those plans that were in fact followed by robust economic growth from those that were not, and compared their characteristics. They found that the stimulus packages that appeared to be successful had cut business and income taxes, while those that evidently did not succeed had increased government spending and transfer payments.

The data in the Alesina-Ardagna study are mostly European; only a small portion comes from the United States. But the evidence leads to conclusions that are very similar to those from Mountford and Uhlig's work using American data. These conclusions are also consistent with the work of Ramey and the Romers, which looked at the historical record to identify multipliers. There appears to be a growing body of evidence, then, suggesting that taxes may be a better tool for fiscal stimulus than conventional models have indicated....

The bygone middle-class golden era

“Dubbed ‘median wage stagnation’ by economists, the annual incomes of the bottom 90 per cent of US families have been essentially flat since 1973 – having risen by only 10 per cent in real terms over the past 37 years. [...]

:lol: these fools are measuring against CPI to produce "real" income instead of inflation.

SURPRISE! it costs more to buy a home computer in 2010 than it did not to buy one in 1975!!! who could have guessed?

the middle class today lives in bigger, better houses; it drives more, better cars (CPI also doesn't account for increases in quality); it recieves more, higher quality healthcare; more of them attend college, own computers, about the only thing they have "suffered" on is that now they are taught in a comparatively weaker public school system (thanks, unions!) and they aren't saving like their forebears did.

why do we know that our children will be worse off? because we're going to make them pay for the massive amount of government spending we've loaded onto ourselves.

Have you noticed the what the thread topic happens to be?

yes. have you noticed yet that you completely tried to change the subject from the failures of FDR's "Stimulus"?

Thanks for your opinion.

it's not my opinion; it's basic fact. we lost jobs through that period, we certainly didn't gain 3 million. the only way you can get to that number is to ignore reality on the ground and just run "Dollars Spent" through "Desired Multiplier".

look; i can do it too: I just went and bought a six-pack; and paid too much because i bought it from my hotels' shoppette; i paid $9.

however, so long as we assume that the multiplier is higher than historical evidence suggests (if you will read the report above, for example, you will note that the multiplier that Obama's team ordered utilized - poor CBO, everyone abuses them - was '3', whereas most keynsians have stuck to around '1.4'), and is actually 1.55 trillion, then I have just doubled the GDP of the United States. however, GDP hasn't moved all that much in actual terms. hmm. well, we know that I spent the 9 dollars. and we know that our multiplier is 1.55 Trillion.

GASP!

i just saved the entire US economy!. because 14 trillion minus 14 trillion is zero... then that means that once you take out the effects of my purchasing that six pack, the economy doesn't exist... which means that my six pack purchase is directly responsible for over a hundred million jobs saved or created.

Please reference our responsibility to control the world through hegemony in the Constitution. There is no such thing. We are only charged with providing for the common defense.

you are correct - but the Founding Fathers don't say how forward leaning providing for the commond defense is. Is keeping our economy from crashing by protecting vital trade routes defense? is keeping near-peer competitors from rising to challenge the US by maintaining strong regional alliances with fellow democracies defense?

the Founding Fathers, it's worth noting, discussed the inevitable American Empire, which they saw as stretching from Canada to (in some cases) South America. their notion of "common defense" included the Monroe Doctrine, which extended our power over the entire hemisphere. they invaded lands in North Africa, and kept a forward-deployed naval fleet. when France seemed to be turning into a representative government, they leapt to form a lasting bond with her, held back only by those who feared (accurately) her rapid descent into terror and tyranny.

we are safer and wealthier because of the current world order; a system whose lynchpin is our own military and economic might. getting rid of either of those crashes the system, which endangers Americans.