cpwill, let me see if I can help you with this.

What we are trying to say is the debt limit does not serve as a mechanism to handling our debt burden, by the time we have gotten ourselves close to the next debt limit it is because of approved spending over the course of the last time the debt limit was raised. Budgets are rarely evaluated on where we are in terms of the next debt limit, and rarely impact how spending bills end up through Congress and on the President's desk. They can when the timing is right, otherwise... spend, spend, and more spend.

Congress already knows, or should know, the conditions of our budget in terms of tax revenues and spending. Thus deficits, and additions to debt.

Your argument boils down to Congress arguing about the amount of debt we should carry *after* we approved all the spending getting us to that point of debt limit. It is nonsensical as it equates to arguing about a credit card limit after the bill shows up telling us we spent ourselves to the point of the existing credit limit.

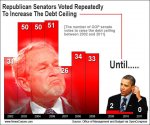

Because we tend to spend beyond means irregardless of the condition of the economy (influence on tax revenues) or the condition of our tax code (wildly out of control and way out of balance across income quintiles) it means the debt limit ends up raised. We know this is factual because we have raised the debt ceiling some 40+ times since just 1980. Republican President, Democratic President, no matter the disposition of Congress... it gets raised all the time.

That proves, beyond doubt, that the debt ceiling does not serve as a means of "fiscal responsibility" nor does it ever equate to proper evaluation of our "debt burden." Now that our Total Debt is well above 100% of our GDP it drives home the fact that debt ceilings are meaningless in every sense.

Do away with it, and focus on something that might impact fiscal restraint. Like spending caps as a percentage of GDP, accounting for spending bills by projected revenues, something... anything... along the lines of accounting or basic finance. Debt ceilings do not apply, and clearly do not help. At all.