- Joined

- Oct 12, 2005

- Messages

- 281,619

- Reaction score

- 100,389

- Location

- Ohio

- Gender

- Male

- Political Leaning

- Libertarian - Right

:lamo :lamo :lamo

That's a great one!!!

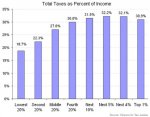

its almost as good as the constant litany that raising taxes on the rich will decrease government deficits, create more jobs and keep the jobs we have in this country.

in fact all that raising taxes on the rich does is slake the envy of those who are upset others are rich and provide a bogus argument for the dems to engage in even more vote buying spending