Thrilla

DP Veteran

- Joined

- Aug 13, 2011

- Messages

- 20,295

- Reaction score

- 9,801

- Location

- Texas, Vegas, Colombia

- Gender

- Male

- Political Leaning

- Other

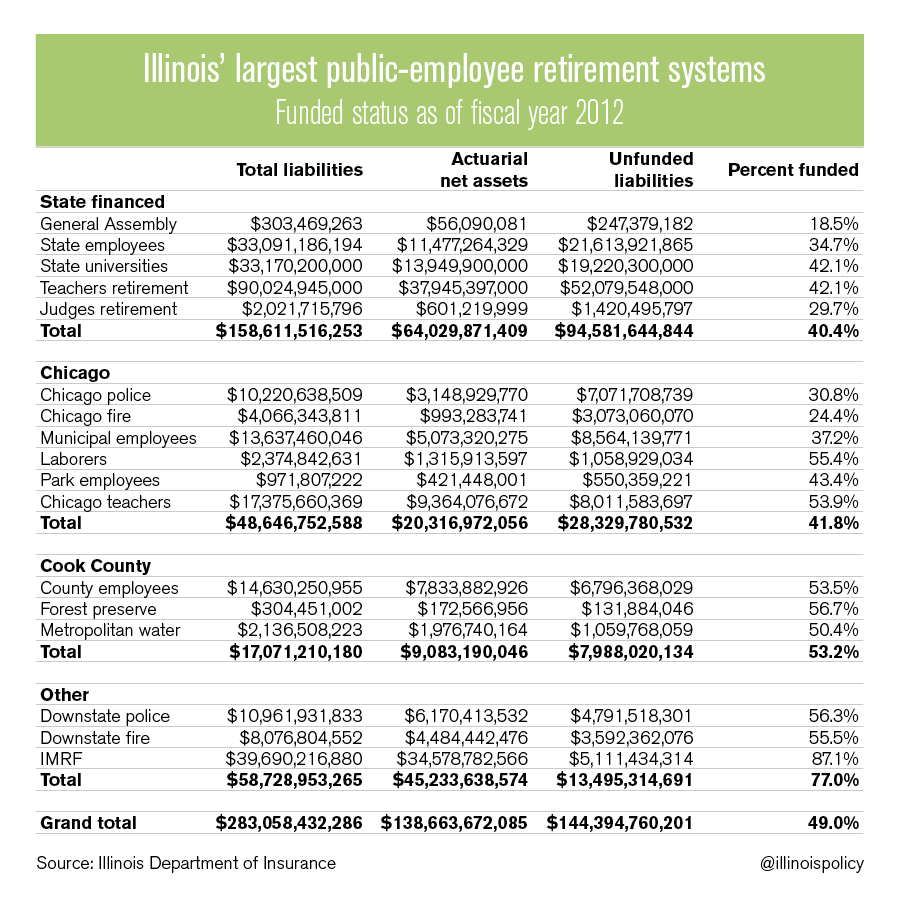

good luck Illinois...the court is basically tying the governments hands to increasing taxes

ya'll pay 3.75% in individual income taxes... surely you can afford much more..5%?.. 8%?....your state sales tax is 6.75... surely y'all can live with 8 or 9%

you have to pay for the government you elected... so .. open those wallets and get to paying your bills.

..and don't think about moving out of Illinois... stay there and clean up your own mess... you own it.

ya'll pay 3.75% in individual income taxes... surely you can afford much more..5%?.. 8%?....your state sales tax is 6.75... surely y'all can live with 8 or 9%

you have to pay for the government you elected... so .. open those wallets and get to paying your bills.

..and don't think about moving out of Illinois... stay there and clean up your own mess... you own it.