- Joined

- Jun 18, 2013

- Messages

- 46,124

- Reaction score

- 14,554

- Gender

- Undisclosed

- Political Leaning

- Conservative

I think a pretty accurate reflection of reality is people as a group behave rationally. .

Well.. I think there would be some disagreement about that. But lets say for argument sake you are right. So what? That doesn't have bearing on the discussion. The question is whether human behavior is controlled by mathematical absolutes.. or whether what people feel determines their behavior.

Case in point.

When supply drops below demand, prices rise, they don't EVER fall.

Wrong. In almost every school district.. for a student to participate in athletics they must have an athletic health physical for the year.. Most of the school year, demand for physicals is relatively steady and physicals cost between say 50 to 120 dollars a physical depending on area.

However, in the summer.. just before school starts the demand for sports physicals increases dramatically as parents want to get their child a physical for the start of the school year. Demand increases above supply. but prices DON"T RISE... in fact they fall as you see signs pop up in Clinics all over the country (Free Sport Physicals) or advertising cheap sport physicals. In fact.. clinics will even go in the schools themselves to give FREE or very reduced price sport physicals.

So the reality is that the best time to get a free or reduced price sport physical... is when demand has increased relative to supply.

.Well, OK, so people were concerned, some predicted hyperinflation - that's what ZeroHedge has been predicting for nearly a decade now - and what has come of this deep concern? Do you see hyperinflation? What are Treasury rates doing? 2.4%. That's off the record lows but still historically VERY low

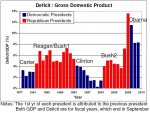

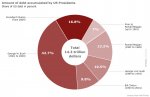

No.. you miss the point. The point isn't that people "were" concerned.. its that people are and have been concerned. Our country has operated since its beginning on the idea of being careful with debt. Its why we had a balanced budget back in the late 1990's. Its why Obama reduced the deficit in a time where it was tricky to reduce the deficit.

what has come of this deep concern? Do you see hyperinflation?

See.. this is the issue. Because of the way you look at this you say "see.. no hyperinflation"... which you think proves that hyperinflation can't or won't occur.

But what you fail to realize is that because we are concerned about debt and deficit.. we and through government have worked to control debt and deficit and thus reduce fears of hyperinflation.

So in answer to your question:

Obviously its " irrational fears by people". Its why Obama was compelled to reduce deficits and during a time when it was hard to reduce deficits.So what won out - irrational feelings by people whose fear of inflation has been ginned up by right wingers and inflation 'hawks'

the point is.. that the confidence fairy as you cause it is very very very.. real.The point is that concern over the confidence fairy stuff is nonsense.

I'll just end it by saying your theory is ultimately an empirical question,

and your anecdote about the public's concern about deficits and debt, in these circumstances, actually disproves your hypothesis. Despite all this supposed worry, inflation remained low, interest rates low, wage increases low.

Actually it supports my theory. Because of the publics concern about deficits and debt.. the government acts in ways to curb those fears. In fact, I would argue that its less that the government ACTUALLY lowers debt and deficit.. but merely that the people FEEL that debt and deficit are a concern and are being addressed by the government and our financial institutions.

And yes, economics is about "human behavior" but the field is premised on people/particpants/markets over the long term behaving rationally.

Which is likely why economists get it wrong so often. As our most recent bubble and collapse demonstrate.