No. That's a

savings account.

Then your retirement is a

savings account. Or a pension with a particularly ugly cap :shrug:

Which, again, is not a defining feature of "pensions".

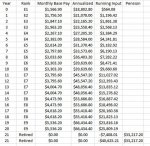

This, for example: is how rapidly "what is paid in" is paid out for an enlisted military pension:

View attachment 67203477

You will notice that it lasted less than a single year. And yet that pension benefit - and it is indeed a pension - will continue for the rest of the members' life, and then be inheritable by his survivors.

That is incorrect. SSDI transfers risk of individually unforeseeable events that are catastrophic in nature. OASI does not. OASI, instead, functions as a pension.

Actually in this case it is like a pension

But I like how you are desperately attempting now to shift, having been proven wrong, from your previous position that having a pay out that was determined by pay-in was a function of a

pension, rather than insurance :lol:

View attachment 67203478

You were wrong both about OASI and SSDI, as you claimed (see above) that being paid out according to what you had paid in was a function of pensions, as opposed to Social Security, which was insurance

Sure. And North Korea is called a Democratic Republic.

Function is controlling in deciding what something

actually is. Not the title. OASI functions as a crappy pension program. That's what it

is.