Glen Contrarian

DP Veteran

- Joined

- Jun 21, 2013

- Messages

- 17,688

- Reaction score

- 8,046

- Gender

- Male

- Political Leaning

- Progressive

Do you have any sources for your - "conservatives do have a habit of not listening to professionals" - or are you just partisan bashing?

I was hoping for less troll activity. Definitely not advancing the discussion.

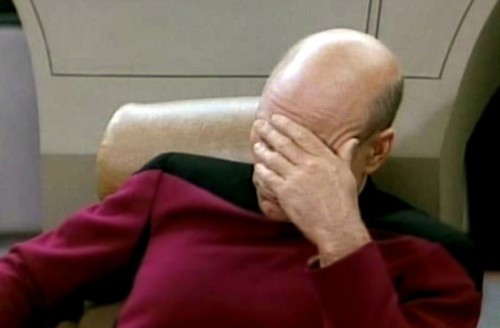

Sources providing examples of conservatives having a habit of not listening to professionals? You mean, like the FACT that every single national physical science organization of every developed nation on the planet agree that global warming is real and is mainly driven by human civilization, yet American conservatives (as opposed to most conservatives in most other nations) can't allow themselves to believe them? Do you really need a source to tell you that?

And in America, when someone says that the planet's only 6,000 years old (despite what the paleontologists - the real professionals - say), what's that person's probable political lean? I think you know, even if you won't admit it.

I could go into birtherism and Obama's-a-secret-Muslim-ism, but I think the point is already made: when a professional says something that goes against far-right conservative dogma, that professional MUST be wrong...no matter how qualified he is to make that statement.