jonny5

DP Veteran

- Joined

- Mar 4, 2012

- Messages

- 27,581

- Reaction score

- 4,664

- Location

- Republic of Florida

- Gender

- Male

- Political Leaning

- Libertarian

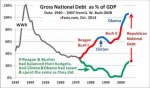

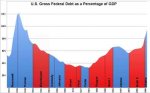

Not unless you wanted to reduce deficit or debt. I suppose once the debt is paid off, you could cut taxes. But even then, why? Wouldn't you want a rainy day fund in case of emergencies?

Up to what point?