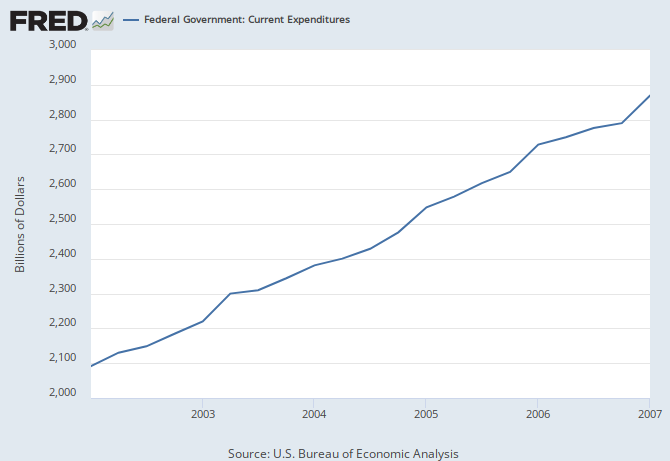

In 2009 dollars, adjusting for inflation, revenues in FY2002, GWB first full year, was $2,227B and by FY2007 rose to $2,663B. Despite tax cuts, revenues grew. On the spending side, spending increased from $2,417B to $2,829. Revenues as a % of GNP went up, from 15.7% to 17.9%. Don't see anything there to dispute the idea that tax cuts increase revenues.

Historical Federal Receipt and Outlay Summary

I don't like tax cuts, whether done by Bush or Obama. We need to bring debt down.

Saw a chart on the savings rate by various income groups. Forget where I found it. But it showed historic savings rates for the lower quintiles at 5% most of the time prior to 1980 when it went to zero and stayed there. The saving rates for the top echelon increased from 40% to 45%. About this same time, the income inequality grew. Since I believe firmly that the way to wealth (not Clinton wealth but healthy wealth) is savings and letting investments add income. The Fed rates tend to discourage savings by the very people who should save.