- Joined

- Jan 2, 2006

- Messages

- 28,174

- Reaction score

- 14,270

- Location

- Boca

- Gender

- Male

- Political Leaning

- Independent

No, Kush.

This is getting old.

AIG paid back $205 billion. I don't even have to link it....

No, Kush.

This is getting old.

AIG paid back $205 billion. I don't even have to link it....

You do realize AIG paid no taxes so it could pay it back.

Actually the Fed bought some really toxic stuff early in the "crisis" to save banks. Fed ended up buying billions in crap* from Lehman, Bear Sterns and AIG. Fed specifically created Maiden Lane I, II and III LLC to run assets it bought. Over $100b in those three alone.

* crap being CDOs, Residential whole loans, a variety of CDS, the bulk is CMBX, AMBAC, MBIA, PMI, CDS (Commercial Real Estate), CDS on Munis, CDS on non-agency RMBS, CDS on Non-residential ABS, some treasuries, and just under $3 billion in Interest Rate Swaps (that's just for Maiden I). Maiden II and III are even worse. (ask if you want to know).

It's old news (2010).... Fed wasn't happy when it was forced to report it. Maiden Lane I, II, and III have cease to exist and Fed didn't "take" loss.

We won't know the full MBS break down for a few years (or when the Fed starts to unwind).

They are.. Fed actually spent $112 billion bailout for AIG. Treasury another $70b.

No, Kush. The purchase price for AIG assets was $112b. Not a $20b senior loan to BlackRock to run Maiden Lane II or the $25b for Maiden Lane III. AIG was fed $60b in one week (the same week the Maiden Lane products were bought). The Fed doesn't count the money it give in emergency lending hence why it had a "profit" on the senior loans.

I do realize you will squirm your way out of atoning for your misinformed comments.

The first comment:

Was shown to be inaccurate. [quote/]

You have shown no evidence what was in the Maiden Lane LLC (I,II,III) to refute my claim. They were crap, they were CDO and what I listed above. This has never been in dispute by the Fed, Treasury or Blackrock (who ran them). Maiden Lane LLC III contained Davis Square III.

Davis Square III had ratings depending on class (1-A) was rated A2, 1-B was given a Baa (Non-investment grade), 1-C was rated Caa1, 1-D Caa2 as well. Caa1 and 2 are junk bond status. Those were the ratings at the time they were bought by the Fed. ALL under review to get downgraded even further by December 2008.

Followed by:

Which is inaccurate.

Followed by:

Which again is inaccurate.

Then you try to shift the goalpost... again... with the tax response.

Same as the deflator post and the bank reserve post. When called out, you either ignore it or squirm. This expert act of yours is getting old.

I have differing opinion on those issue then you. Doesn't mean I am wrong or right.. We disagree. I find deflator to be manipulation as a way to hide inflation and bank reserves is again.. how you view your assets. Capital is part of Reserve requirement, you need X amount of cash on hand.

None of what I said is inaccurate. There was hearings in Congress over what the Fed did. Those hearings exposed that the Fed did two things.. 1) Maiden Lane LLCs were illegal (not in Fed's authority) and 2) Fed pushed the Maiden Lane losses onto the balance sheets of AIG and others to hide losses from the Maiden Lane holdings.

The Fed did account trickery and one of those was allowing (despite being illegal) AIG to claim tax relief due to losses in future years. Treasury Department Inspector General Neil Barofsky (TARP guy) reported these issues to Congress in Nov 2009. He accounted for $62b paid to counter-parties to AIG assets bought by the Fed (Maiden Lane II and III).

The Fed also encouraged AIG to lie to SEC over it.

So you wanna stick with Fed and Treasury was made whole?

I do realize you will squirm your way out of atoning for your misinformed comments.

The first comment:

Was shown to be inaccurate. [quote/]

You have shown no evidence what was in the Maiden Lane LLC (I,II,III) to refute my claim. They were crap, they were CDO and what I listed above. This has never been in dispute by the Fed, Treasury or Blackrock (who ran them). Maiden Lane LLC III contained Davis Square III.

Davis Square III had ratings depending on class (1-A) was rated A2, 1-B was given a Baa (Non-investment grade), 1-C was rated Caa1, 1-D Caa2 as well. Caa1 and 2 are junk bond status. Those were the ratings at the time they were bought by the Fed. ALL under review to get downgraded even further by December 2008.

I have differing opinion on those issue then you. Doesn't mean I am wrong or right.. We disagree. I find deflator to be manipulation as a way to hide inflation and bank reserves is again.. how you view your assets. Capital is part of Reserve requirement, you need X amount of cash on hand.

None of what I said is inaccurate. There was hearings in Congress over what the Fed did. Those hearings exposed that the Fed did two things.. 1) Maiden Lane LLCs were illegal (not in Fed's authority) and 2) Fed pushed the Maiden Lane losses onto the balance sheets of AIG and others to hide losses from the Maiden Lane holdings.

The Fed did account trickery and one of those was allowing (despite being illegal) AIG to claim tax relief due to losses in future years. Treasury Department Inspector General Neil Barofsky (TARP guy) reported these issues to Congress in Nov 2009. He accounted for $62b paid to counter-parties to AIG assets bought by the Fed (Maiden Lane II and III).

The Fed also encouraged AIG to lie to SEC over it.

So you wanna stick with Fed and Treasury was made whole?

I don't understand why you're continuing with this.

What are you trying to prove ...?

You have shown no evidence...

I have differing opinion on those issue then you. Doesn't mean I am wrong or right.. We disagree. I find deflator to be manipulation as a way to hide inflation and bank reserves is again.. how you view your assets. Capital is part of Reserve requirement, you need X amount of cash on hand.

None of what I said is inaccurate. There was hearings in Congress over what the Fed did. Those hearings exposed that the Fed did two things.. 1) Maiden Lane LLCs were illegal (not in Fed's authority) and 2) Fed pushed the Maiden Lane losses onto the balance sheets of AIG and others to hide losses from the Maiden Lane holdings.

The Fed did account trickery and one of those was allowing (despite being illegal) AIG to claim tax relief due to losses in future years. Treasury Department Inspector General Neil Barofsky (TARP guy) reported these issues to Congress in Nov 2009. He accounted for $62b paid to counter-parties to AIG assets bought by the Fed (Maiden Lane II and III).

So you wanna stick with Fed and Treasury was made whole?

I don't understand why you're continuing with this.

What are you trying to prove ...?

I think too much is made of what the Fed has done since 2008. It was not a straightforward addition of dollars to the economy.

First, banks needed to recapitalize when their assets went down in value. So the Fed came in and bought up a bunch of weak assets at face value, exchanging dollars for MBSs and other such assets, a fairly even exchange of value. (In the Fed's hands, because they were able to hold them, those assets have been paying off.) Banks were then able to meet their capital requirements and keep on operating. It was an even exchange of value, but now the Fed held securities and the banks held dollars. Those transactions also increased the level of total reserves in the system; any net government spending increases total reserves.

As these securities mature, dollars flow back to the Fed, which not only takes dollars out of the economy, it also lowers total reserves. So some of this is already undoing itself. When the Fed sells those securities back in exchange for dollars, the same things happen; fewer dollars, and fewer reserves. If the Fed held all of these securities to maturity, all the dollars they spent (and a few more) would come back to them, extinguishing all of those liabilities. The net effect would be zero.

The increased deficit spending did put net dollars into the economy, and of course it increased reserves, too. But, you (hopefully) get increased economic activity, which means taxes (and reserves) are going to flow back to the government.

Any flow of dollars back to the government "unprints" money. Most of this is taxation, and some of it is coming from securities held by the Fed. Nothing is permanent, but it's hard to claw back dollars once they get saved. You can't really tax China and Japan to claw back all of the dollars (bonds) they hold. On the other hand, they aren't doing any harm, sitting around unspent.

******************

We used to worry about the level of reserves in the system, drawing out the excess by exchanging reserves for interest-bearing bonds. QE showed that excess reserves weren't really a problem. They don't lead to more bank loans, so the money supply didn't "explode" like some economists worried about. MB grew a ton; M1 didn't follow. So really, not a heck of a lot happened. We bailed out the banks by moving some things around, we had some too-small stimulus spending, and that's it. Much of the "money printing" that everybody was worried about is sitting around as excess reserves, which are pretty harmless.

Excess reserves " weren't a problem " because monetary stimulus doesn't create demand for consumer credit.

There was no demand for that new liquidity so it never entered into the economy.

Call QE what it was, a Bank Bailout ( Fed buying GSE MBSs that were backed by assets in default ) and a way to make new sovereign debt cheap.

You are clearly confused. Lower interest rates increase the demand for credit, in an economy that see's profit and employment growth.

Do you really understand what liquidity (and it's demand) entail?

The Fed raised interest rates last month by 25 basis points, and yields on long duration debt have fallen by roughly the same amount.

Why?

http://www.cnbc.com/2015/08/18/st-louis-fed-official-no-evidence-qe-boosted-economy.html

You ever get tired of parroting unsubtsantiated talking points ?

I am wondering what MMTers here think about this article on removing money from the economy, and what it means for our previous notions of debt, and the role of government.

Can the Fed Unprint Money? - US News

The simplest answer in the present context is the obverse of what banks have done since the advent of the Great Recession.

Banks were incited to "enhance reserves" in order to perform more lending (and thus contribute to overcoming the recession by expanding consumer Demand). So, they sent most of their dysfunctional debt on their books to the Fed. This increased their capacity to borrow further from the Fed, since the dead-stuff was not officially on their books but on that of the Fed. Banks need "official reserves" as collateral for the lending they promote.

Most such lending is "securitized" and sold to debt-holders who seek real-estate debt-payments as a steady income. The realty asset sold thus comes back to them as ready money - which is how they run themselves.

Doing the opposite, the Fed requires banks to increase their reserves, thus diminishing their lending capacity.

Why should any bank be asked to do that in a recessionary environment ... ?

Am i to debate an article?

Can't have it both ways. At the early stages of the recovery, the narrative was QE will cause debasement and inflation. Now that years have passed and credit has rebounded considerably, rhetoric changes to QE didn't do anything. All while failing to consider the data....

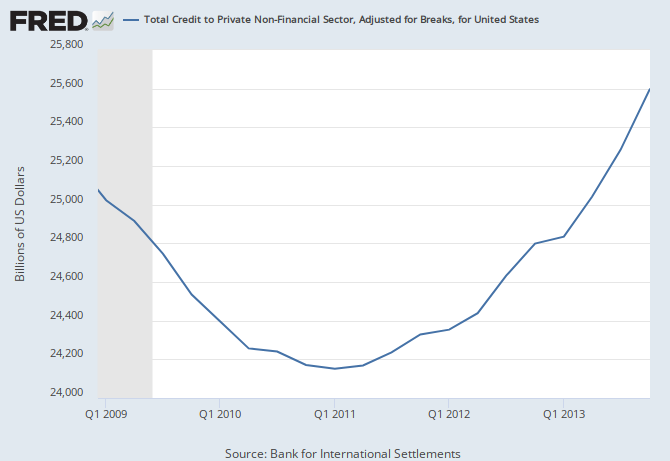

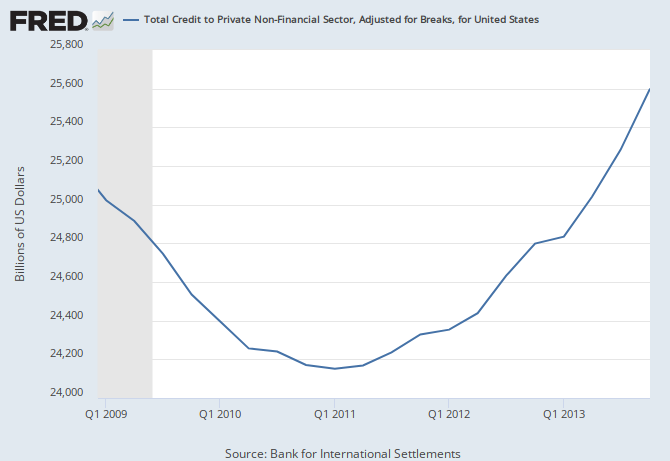

In case you are having difficulty: Total private credit fell by roughly a trillion dollars between 2009 and 2011, and increased by another $1.4 trillion by 2013. Private credit has increased by more than $3 trillion since 2011.

Banks didn't " send "their dysfunction debt over to the FED, the FED purchased Agency backed MBSs as part of their QE initaive

Now that years have passed and credit has rebounded considerably, rhetoric changes to QE didn't do anything.

this has nothing to do with what he was responding to.You are clearly confused. Lower interest rates increase the demand for credit, in an economy that see's profit and employment growth.

Do you understand what he is talking about is the bigger question.Do you really understand what liquidity (and it's demand) entail?

The Fed raised interest rates last month by 25 basis points, and yields on long duration debt have fallen by roughly the same amount.

Why?

DIVINE INTERVENTION

Let's forget the rhetoric, shall we? And let's concentrate on the facts.

This is my history of events (wholly man-made):

Well I never said it didn't do anything, just that it was largely ineffective at its accomplishing its stated goal

U.S. Homeownership Rate Hits 48-Year Low - Real Time Economics - WSJ

the QE reserves that the fed did never entered the market therefore there technically wasn't an excessive reserve of US dollars.

The fed's used QE to buy bad securities from banks. it was basically a dollar for dollar swap.

Do you understand what he is talking about is the bigger question.

which has nothing to do with what QE was about.

Same damn thing. They off-loaded the dud-loans (that they'd kept on their books) onto the Fed, thus expanding their lending reserve-capacity and start lending again. (And securitizing the loans, such that they could recycle yet again their money-load.)

Of course, those responsible for instigating and amassing the dud-loans in the first-place simply got a slap on the wrist.

The banksters were fined, but nobody perp-walked to jail ...

PS: Don't forget, the securitization process in the American banking industry can be done "in-house". All they need to do is shift the securitized loans (with its appropriate Triple-A rating from friends over at the rating-agencies), into another in-house finance entity that is reselling those packages to all and sundry (as mortgage investment vehicles with good returns). Where this process went wrong in the first-place was the fact that the Rating Agencies were not performing due-diligence by inspecting the fundamental nature of the mortgages that were being "securitized".

The goal of credit easing was to bring homeownership up to its previous high?

You are a liar.

GSE backed MBSs were given a " AAA " rating because US Treasuries had a " AAA " rating.

It was not the rating agencies fault the US Govt co-opted the GSEs into purchasing a increasing amount subprime debt starting in 1995

"Credit rating agencies (CRAs) — firms which rate debt instruments/securities according to the debtor's ability to pay lenders back — played a significant role at various stages in the American subprime mortgage crisis of 2007-2008 that led to the Great Recession of 2008-2009. The new, complex securities of "structured finance" used to finance subprime mortgages could not have been sold without ratings by the "Big Three" rating agencies — Moody's Investors Service, Standard & Poor's, and Fitch Ratings. A large section of the debt securities market — many money markets and pension funds — were restricted in their bylaws to holding only the safest securities — i.e securities the rating agencies designated "triple-A".

The pools of debt the agencies gave their highest ratings to included over three trillion dollars of loans to homebuyers with bad credit and undocumented incomes through 2007. Hundreds of billions of dollars' worth of these triple-A securities were downgraded to "junk" status by 2010, and the writedowns and losses came to over half a trillion dollars. This led "to the collapse or disappearance" in 2008-9 of three major investment banks (Bear Stearns, Lehman Brothers, and Merrill Lynch), and the federal governments buying of $700 billion of bad debt from distressed financial institutions."